Adani Enterprises Limited, the flagship company of the Adani Group, is a diversified conglomerate with business interests across mining, integrated resource management (IRM), infrastructure (airports, roads, rail/metro, water), data centers, solar manufacturing, agribusiness, and defence. With its multi-sector presence, Adani Enterprises plays a key role in India’s infrastructure and industrial growth.

Q1 FY26 Earnings Summary (Apr–Jun 2025)

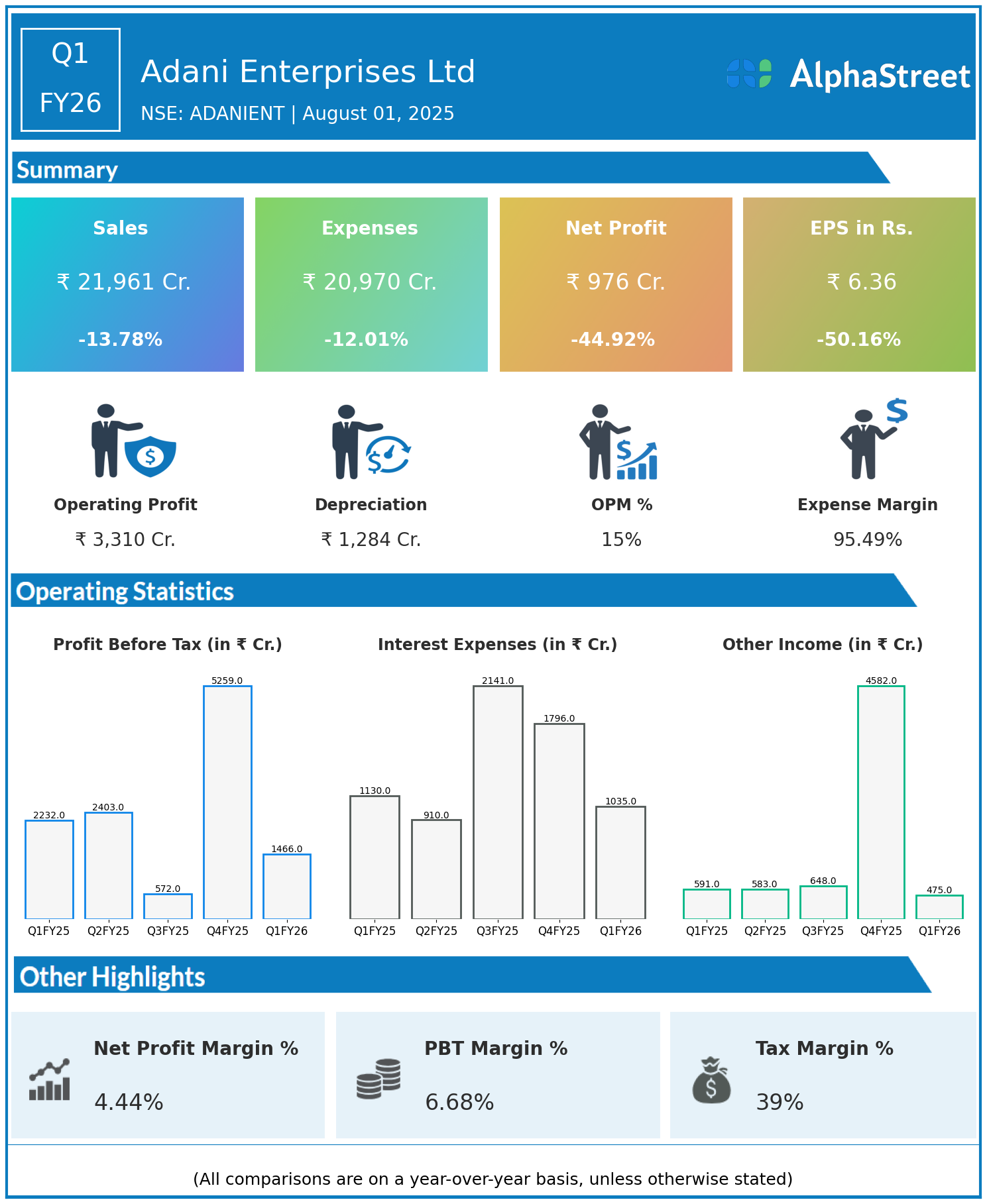

- Revenue: ₹21,961 crore, down 13.78% year-on-year (YoY) from ₹25,472 crore in Q1 FY25.

- Total Expenses: ₹20,970 crore, down 12.01% YoY from ₹23,831 crore.

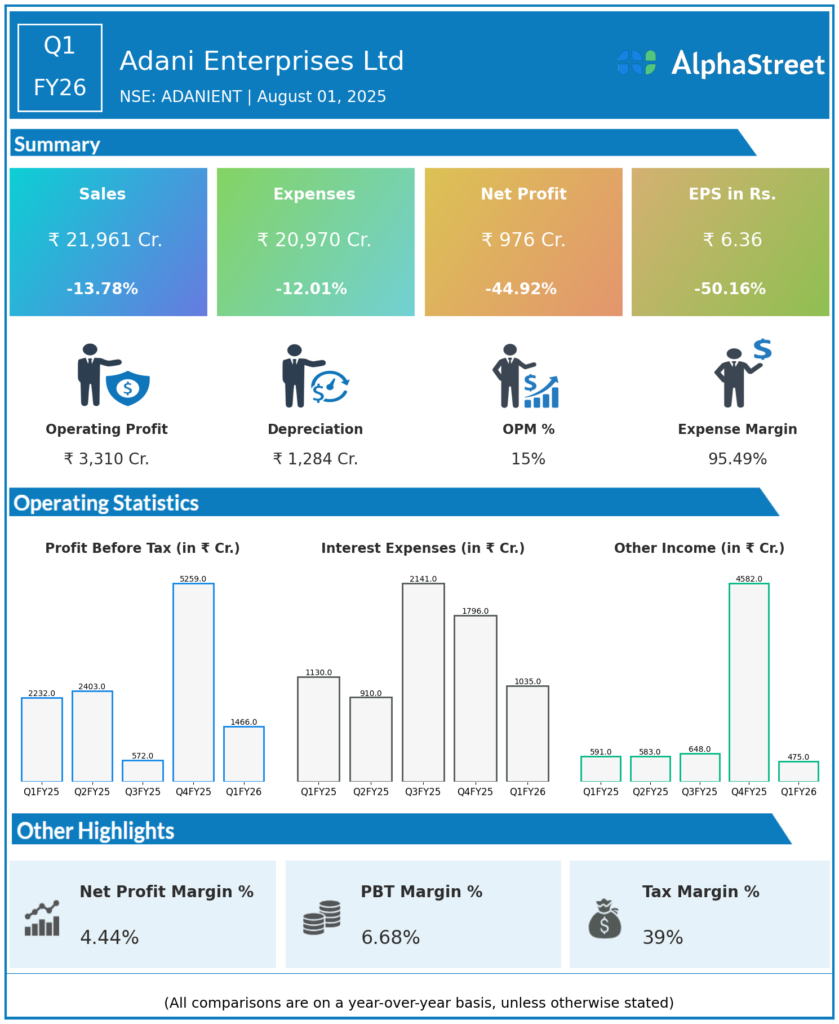

- Consolidated Net Profit (PAT): ₹976 crore, down 44.92% from ₹1,772 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹6.36, down 50.16% from ₹12.76 YoY.

Operational & Strategic Update

- Revenue Decline: The double-digit decrease in revenue reflects lower volumes or realizations in key segments such as IRM, mining, and infrastructure, potentially impacted by macroeconomic headwinds, project cycle timing, or softer commodity prices.

- Expense Reduction: While expenses also fell, the reduction lagged behind the revenue decline, resulting in margin contraction.

- Profitability Pressure: The sharp drop in net profit and EPS points to margin compression, possibly from higher fixed costs, lower project execution, reduced other income, or one-time impacts.

- Segment Performance: Adani continues to invest in high-growth areas—airports, green energy, data centers, and transport infrastructure—ensuring long-term growth avenues despite current headwinds.

- Portfolio Diversification: The company’s multiple business verticals offer resilience but can also lead to earnings volatility depending on the sectoral climate and project phasing.

- Strategic Developments: Adani Enterprises is focused on expanding its infrastructure footprint, driving digital and renewable initiatives, and reinforcing operational efficiencies across businesses amid evolving regulatory and market environments.

- Sustainability & Innovation: Continued emphasis on green technology, renewable energy adoption, and sustainable infrastructure supports the company’s long-term vision.

Corporate Developments

Q1 FY26 was a challenging quarter for Adani Enterprises Ltd, with significant revenue and profit declines attributable to sectoral softness and cost dynamics. Despite the near-term pressures, the company’s diversified pipeline and strategic initiatives position it well for potential recovery as individual segments regain momentum.

Looking Ahead

Adani Enterprises Ltd remains committed to leveraging opportunities across India’s infrastructure, digital, and energy landscapes. The company’s focus will be on margin recovery, efficient capital deployment, and scaling of its next-generation infrastructure projects to drive sustained value creation in FY26 and beyond.