“We have identified 10 growth states to focus, where we aim to do either be number one or number two in the segment. Increasing the share of B2B segments overall from current 21% to 25% by FY27. This segment is growing at a faster rate than the trade segment. Increase in share of premium products from current 22% to high 29%, 30%, and maintain the leadership in individual home buyer segment. These initiatives would enable us to move more than double our top line from around 31,000 crores to around 70,000 crores, while EBITDA will move up, will more than triple to 17,500 crores, with the expansion of EBITDA margin to 25% from the current average of 19% over the last three years.”

-Ajay Kapur, CEO

Stock Data

| Ticker | ACC |

| Industry | Cement |

| Exchange | NSE & BSE |

Share Price

| Last 1 Month | -3.2% |

| Last 6 Months | -24.5% |

| Last 12 Months | -17.7% |

Business Basics

ACC Limited, formerly known as The Associated Cement Companies Limited, is one of the leading cement manufacturers in India. The company operates in the cement and concrete sector, catering to both domestic and international markets. With a rich legacy of over eight decades, ACC has established itself as a trusted name in the construction industry. Adani Group has acquired the Ambuja Cements and ACC for a total consideration of $6.5 billion. The acquisition was carried out through Endeavour Trade and Investment. Adani will hold 63.15% of Ambuja Cements after the transaction and 56.69% of ACC (of which 50.05% is held through Ambuja Cements). With a 67.5 MTPA capacity as a result of this acquisition, Adani is now India’s second-largest cement producer.

ACC is known for its wide range of cement products, including Ordinary Portland Cement (OPC), Portland Pozzolana Cement (PPC), and Ready Mixed Concrete (RMC). The company’s cement plants are strategically located across India, ensuring efficient distribution and timely delivery of products. ACC’s cement manufacturing processes adhere to strict quality standards, resulting in high-quality cement that meets the requirements of various construction projects. In addition to cement, ACC offers a comprehensive range of concrete products through its Ready Mixed Concrete (RMC) business. The RMC segment provides ready-to-use concrete for a variety of construction applications, offering convenience and time-saving benefits to customers.

Q4 FY23 Financial Performance

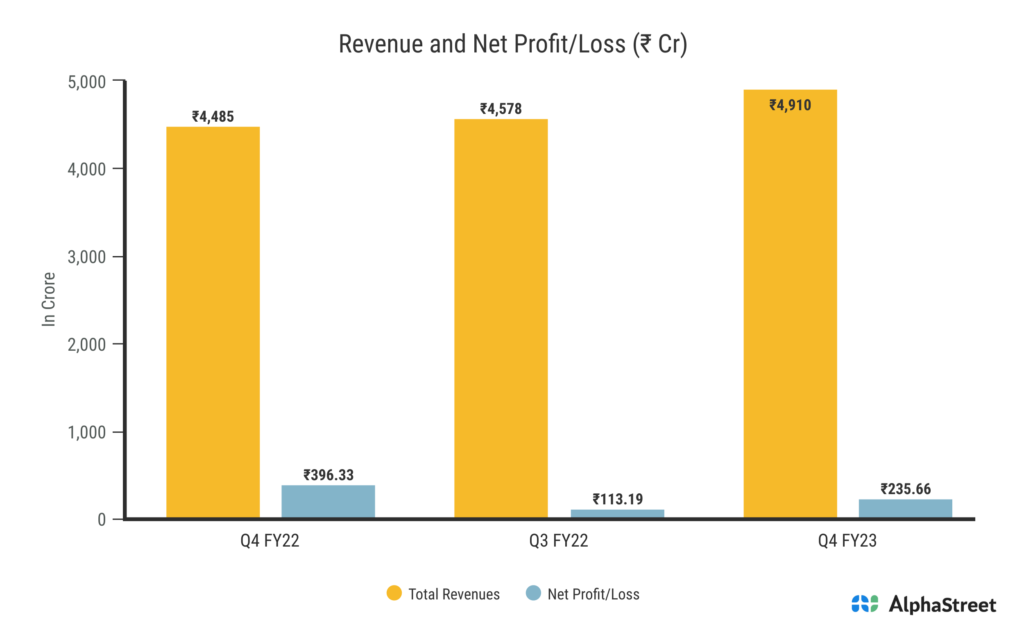

ACC Limited reported Total Income for Q4 FY23 of ₹4,910 Crore up from ₹4,485 Crore year on year, a growth of 9.5%. Consolidated Net Profit of ₹235.66 Crore, down 40.5% from ₹396.33 Crore in the same quarter of the previous year. The Earnings per Share is ₹12.51 for this quarter.

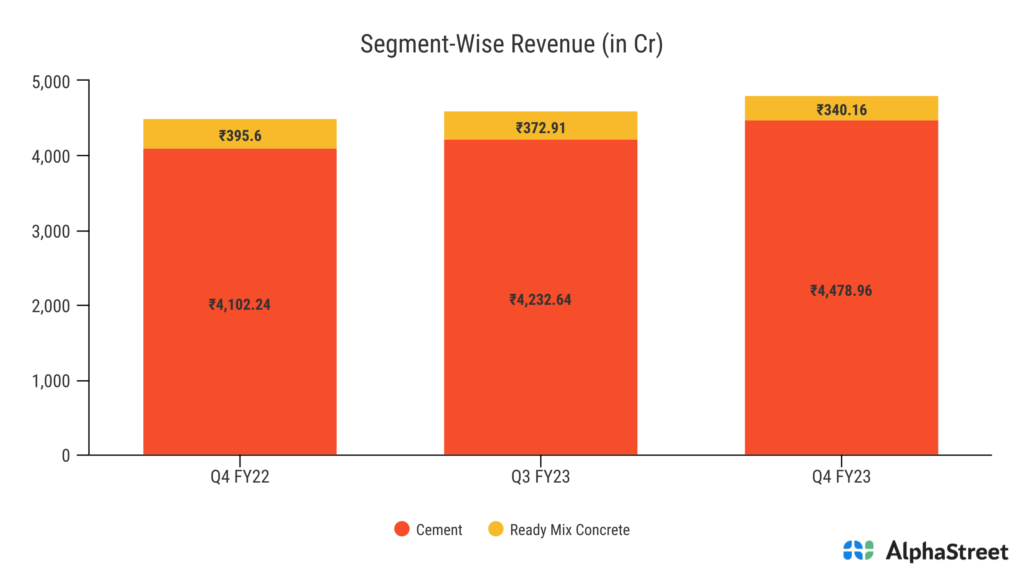

ACC Limited’s Segment Revenue

ACC Limited operates across two primary segments: Cement and Ready Mix Concrete (RMC). These segments represent the company’s core areas of business and contribute to its overall revenue generation. The Cement segment is the flagship business of ACC Limited. The company is known for its wide range of cement products, including Ordinary Portland Cement (OPC) and Portland Pozzolana Cement (PPC). ACC has a strong presence in the cement market, with its cement plants strategically located across India. The segment caters to various customer segments, including individual home builders, contractors, infrastructure developers, and government projects. ACC’s cement business is driven by a commitment to quality, technological innovation, and customer satisfaction.

The Ready Mix Concrete (RMC) segment is an important part of ACC’s business portfolio. ACC offers a comprehensive range of ready-to-use concrete products through its RMC plants. RMC provides several advantages to customers, including convenience, cost savings, and consistent quality. ACC’s RMC products are tailored to meet the specific requirements of each construction project, ensuring optimum performance and durability. The RMC segment caters to a wide range of customers, including commercial builders, infrastructure projects, and individual home builders. ACC’s success in these segments is driven by its strong manufacturing capabilities, distribution network, and focus on customer-centric solutions. The company’s cement plants are equipped with advanced technology and adhere to stringent quality standards to ensure the production of high-quality cement. ACC’s RMC plants are strategically located to provide efficient and timely delivery of concrete products.

India’s Cement & Ready Mix Concrete Industry

India is home to the second-largest cement industry in the world, after China. By FY22, 381 MT of cement is anticipated to be produced in India. High-quality lime deposits are spread throughout the nation, which would promote growth. South India accounts for nearly 32% of India’s cement production capacity, followed by North India (20%), Central (13%), West India (15%), and East India (20%). Between FY16 and FY22, India’s cement production is anticipated to rise at a CAGR of 5.65%, driven by demand from the construction of roads, urban infrastructure, and commercial real estate. With its significant contribution to employment generation, revenue generation, and the construction value chain, the cement industry remains a key driver of India’s economic development and infrastructure growth.

The ready-mix concrete industry in India has emerged as a crucial component of the construction sector, offering a convenient and efficient solution for concrete production. Ready-mix concrete (RMC) refers to concrete that is manufactured in a centralized batching plant and delivered to construction sites in a ready-to-use form. India’s ready-mix concrete industry has witnessed significant growth and adoption due to its advantages, including reduced on-site labor, improved quality control, faster construction timelines, and optimized material usage. However, the Indian ready-mix concrete market is consolidated in nature. Some of the key players in the market include UltraTech Cement, Adani Group, Prism Johnson Limited, and RDC Concrete (India), and India Cements.