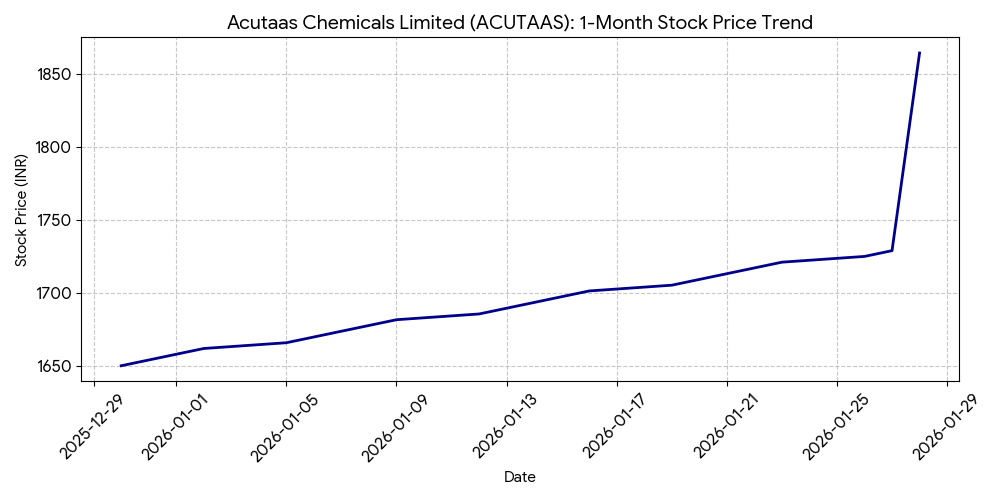

Shares of Acutaas Chemicals Ltd (NSE: ACUTAAS, BSE: 543349) ended Wednesday’s trading session at ₹1,864.45, an intraday increase of 7.84%. The stock opened at ₹1,748.00 and reached a high of ₹1,893.90 on the National Stock Exchange. Trading volume stood at 1,239,184 shares, significantly exceeding the 30-day average.

Market Capitalization

The company’s market capitalization was approximately ₹14,447 crore at the close of trading on January 28, 2026.

Latest Quarterly Results

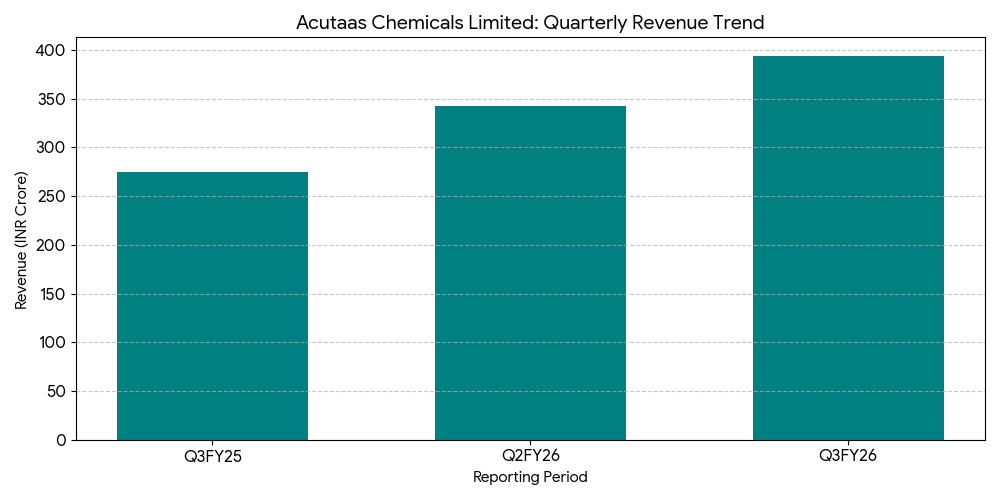

Acutaas Chemicals reported consolidated revenue from operations of ₹393.18 crore for the quarter ended December 31, 2025, a year-over-year increase of 42.98% from ₹275.00 crore. Consolidated net profit for the quarter rose to ₹107.96 crore, a 140.18% increase from ₹44.95 crore in the year-ago period.

Operating margins for the quarter expanded to 38.32%, up from 24.97% in Q3 FY25. The results were driven by growth in the Advanced Pharmaceutical Intermediates (API) segment and increased volumes in the Contract Development and Manufacturing Organization (CDMO) business.

Financial Trends

Full-Year Results Context

For the fiscal year ended March 31, 2025, Acutaas Chemicals reported annual revenue of ₹1,006.88 crore, compared to ₹717.00 crore in the prior fiscal year. Annual net profit for FY25 was ₹160.42 crore, up from ₹48.00 crore in FY24. Directional trends show consistent growth in both revenue and profitability over the last two fiscal years.

Business & Operations Update

The company announced that its Phase 1 manufacturing block at the Ankleshwar site is now at full operational capacity. Construction of the high-purity electrolyte additives project at the Jhagadia facility is on schedule for completion by the end of March 2026. Additionally, the company is advancing its joint venture for semiconductor-grade chemicals targeting international markets.

M&A or Strategic Moves

Acutaas Chemicals confirmed that CARE Ratings has reaffirmed its long-term credit rating at AA-. The company has also entered into a non-binding memorandum of understanding for a technical collaboration with a South Korean partner to develop specialty battery additives.

Equity Analyst Commentary

Institutional analysts noted that the third-quarter performance exceeded market expectations due to a shift in the revenue mix toward higher-margin CDMO projects. Analysts highlighted the expansion of operating margins to record levels as a key indicator of improved operational efficiency.

Guidance & Outlook

The company has updated its full-year revenue growth guidance for FY26 to approximately 30%. Management maintained an EBITDA margin guidance range of 32-35%. Industry factors to monitor include the regulatory certification process for new high-purity chemical lines and the stability of raw material costs in the specialty chemicals sector.

Performance Summary

Acutaas Chemicals shares gained 7.8% to close at ₹1,864.45 today. Quarterly net profit surged 140% to ₹108 crore on revenue of ₹393 crore. The company’s expansion into semiconductor and battery chemicals continues alongside revenue growth in core API segments.