Acutaas Chemicals Ltd (formerly Ami Organics Limited) is a leading research and development-driven manufacturer of specialty chemicals, producing advanced pharmaceutical intermediates, active pharmaceutical ingredients (APIs) for new chemical entities, agrochemicals, and fine chemicals.

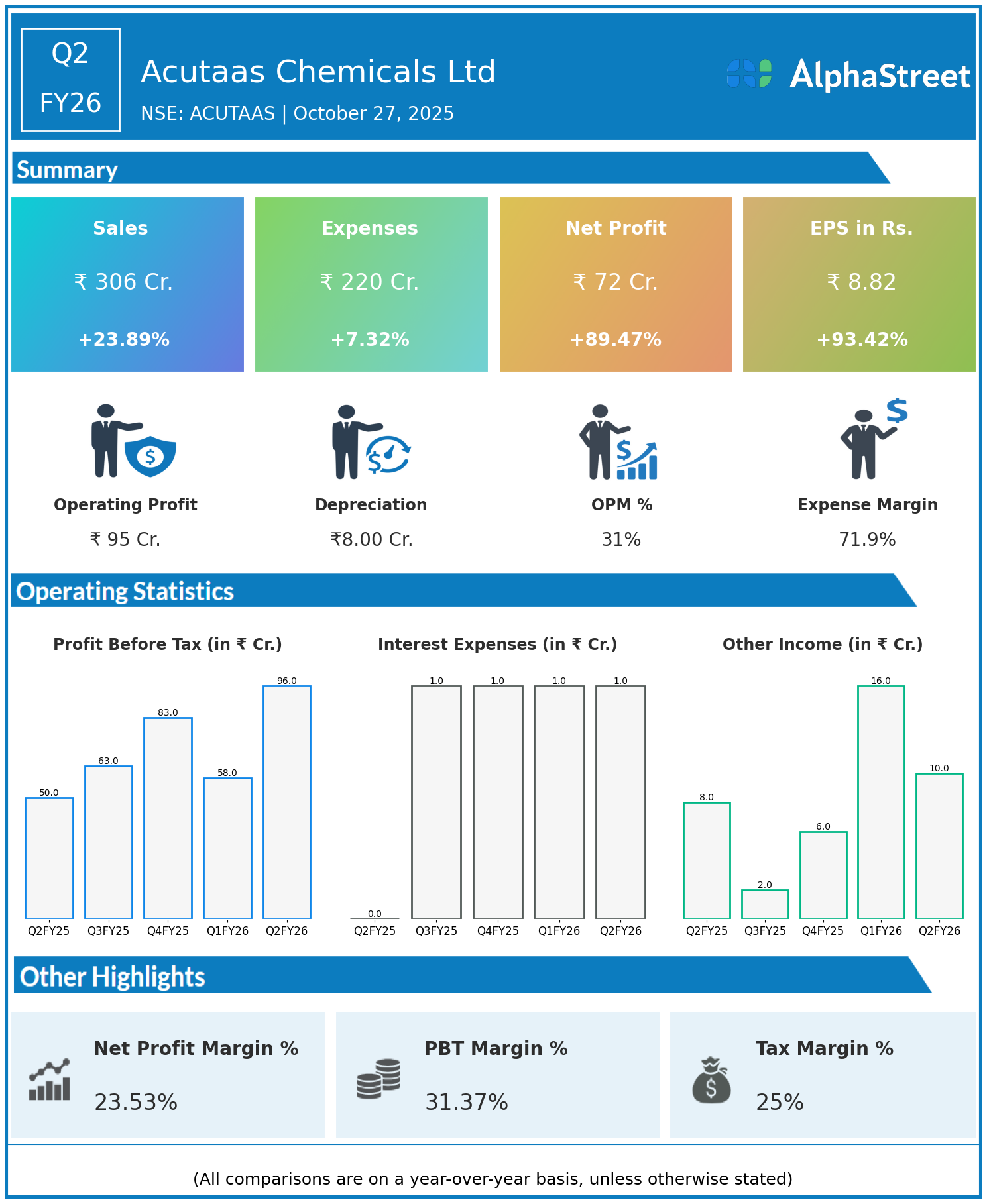

Q2 FY26 Earnings Summary

- Consolidated revenue rose 23.89% year on year to ₹306 crore from ₹247 crore.

- Total expenses increased 7.32% to ₹220 crore from ₹205 crore.

- Consolidated net profit surged 89.47% to ₹72 crore from ₹38 crore.

- Earnings per share (EPS) grew 93.42% to ₹8.82 from ₹4.56.

Operational Highlights

- The Advanced Pharmaceutical Intermediates segment recorded strong growth of over 27%, driven by expansion in Contract Development & Manufacturing Organization (CDMO) business.

- Specialty Chemicals segment also contributed with a revenue rise of over 7%.

- Robust performance was supported by operational efficiency, capacity expansion, process optimization, and ongoing investments in R&D.

- The company has a clear strategic direction targeting growth areas like battery chemicals and semiconductors, backed by global partnerships.

Financial Strength and Outlook

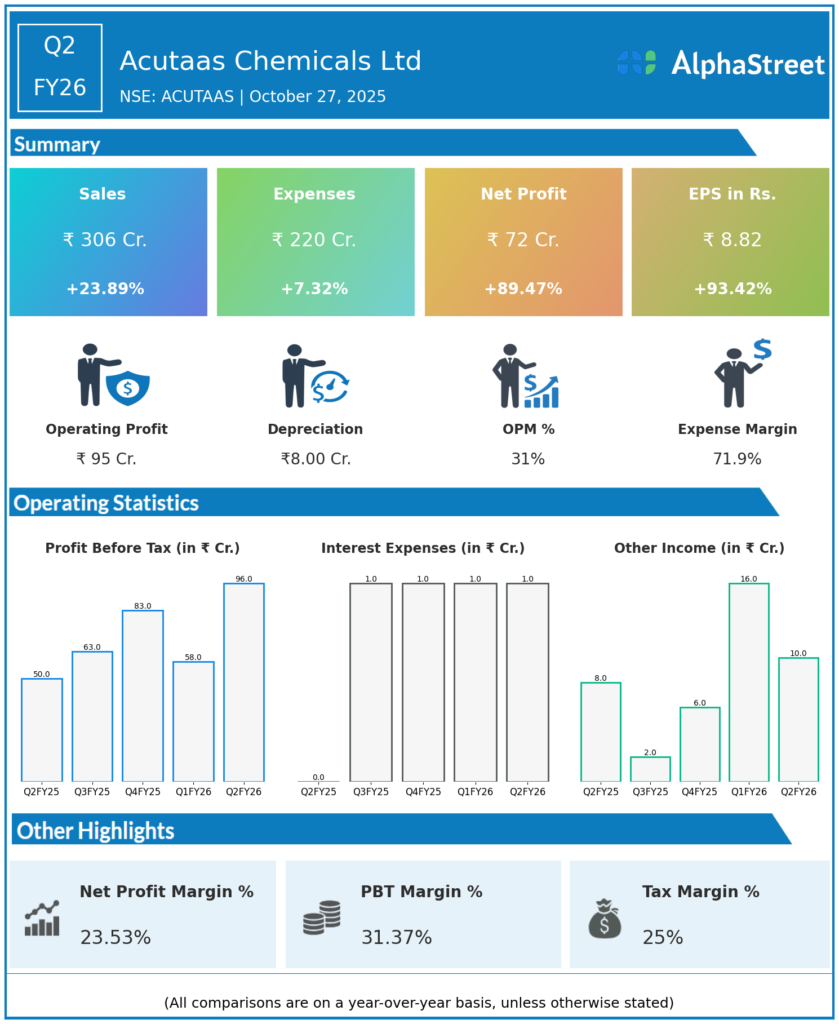

- EBITDA nearly doubled with a margin expansion to over 31%, reflecting strong profitability and cost control.

- Positive cash flow generation and disciplined capital allocation underpin long-term sustainability.

- Management expects around 25% revenue growth for FY26, based on a resilient business model and continued focus on innovation and market expansion.

Acutaas Chemicals Ltd continues to demonstrate robust growth and profitability in the specialty chemicals sector, positioning itself for sustained value creation and market leadership through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.