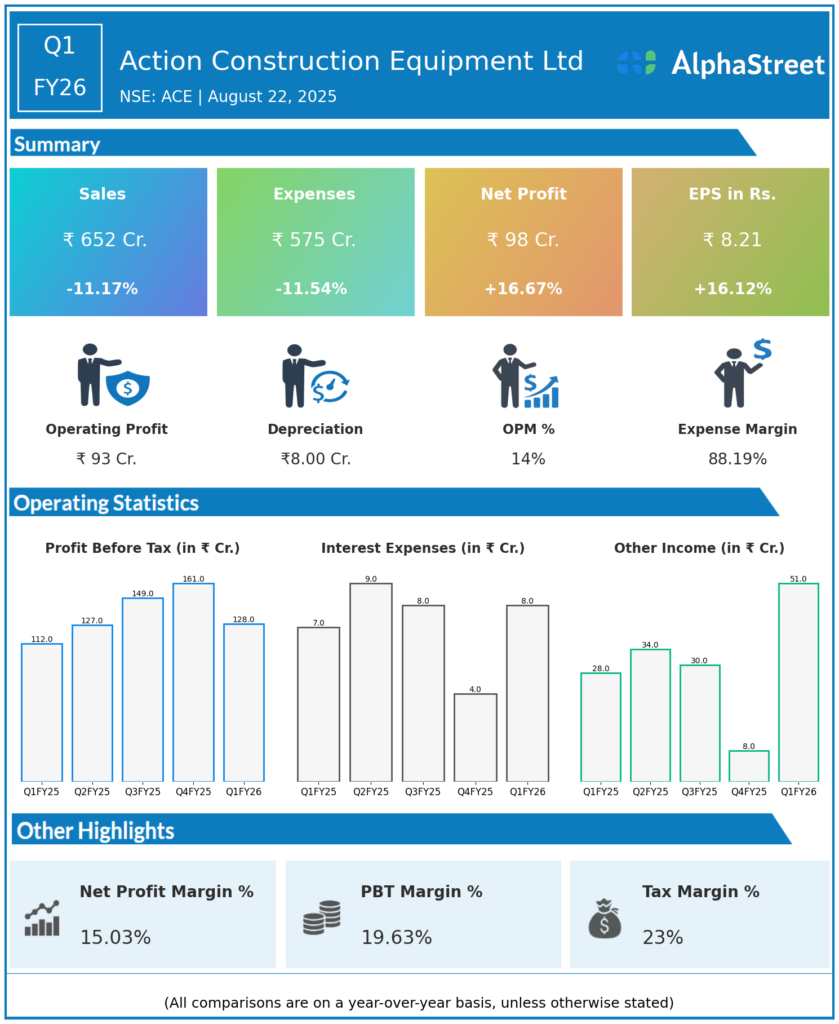

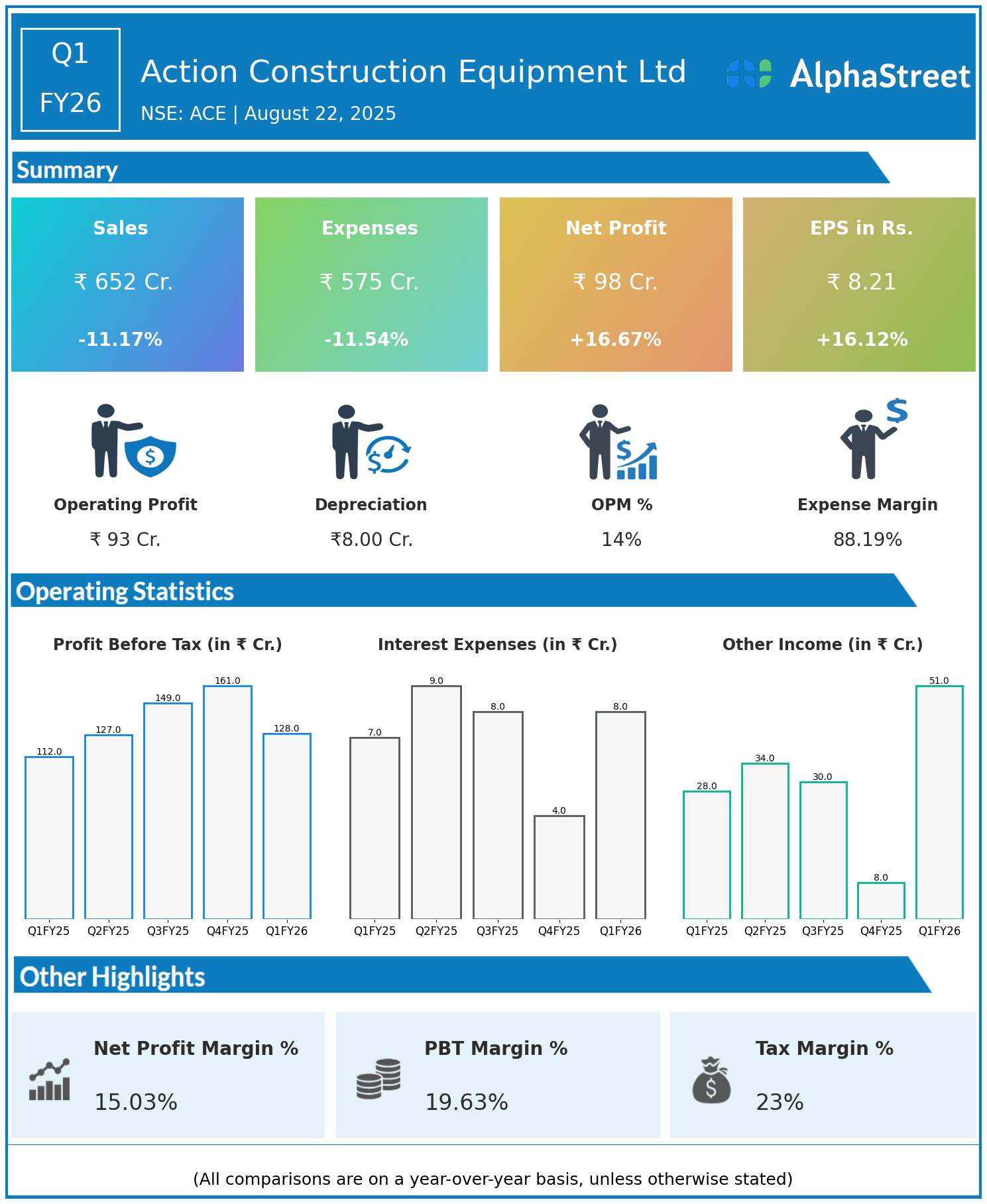

Action Construction Equipment Ltd is a leading manufacturer and marketer of hydraulic mobile cranes, mobile tower cranes, material handling equipment (like forklifts), road construction machinery (such as backhoe loaders, compactors, motor graders), and agriculture equipment (including tractors, harvesters, and rotavators). Presenting below are its Q1 FY26 Earnings Results

Q1 FY26 Earnings Results

- Revenue: ₹652 crore, down 11.17% year-on-year (YoY) from ₹734 crore in Q1 FY25.

- Total Expenses: ₹575 crore, down 11.54% YoY from ₹650 crore.

- Consolidated Net Profit (PAT): ₹98 crore, up 16.67% from ₹84 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹8.21, up 16.12% from ₹7.07 YoY.

Operational & Strategic Update

- Revenue Decline: Revenue contracted by over 11%, indicating softer demand or project delays in the core machinery and equipment markets.

- Expense Reduction: Total expenses dropped in tandem (down 11.54%), reflecting aggressive cost control and operational efficiency measures.

- Profitability Boost: Net profit and EPS rose by roughly 17% year-on-year, demonstrating strong margin improvement despite the top-line decline.

- Market Position: The company maintains a leading position across construction, material handling, and agriculture equipment segments through diversified offerings and a strong domestic footprint.

- Strategic Focus: Action Construction Equipment Ltd continues to emphasize product innovation, after-sales service, and operational agility to capture growth opportunities across infrastructure and agricultural sectors.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results highlight the company’s resilience and ability to enhance profitability by driving margins higher amid challenging demand conditions.

Looking Ahead

Action Construction Equipment Ltd is expected to focus on product upgrades, market expansion, and operational optimization to sustain margins and capitalize on recovery in infrastructure and agriculture outlays through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.