ACC Limited, incorporated in 1936 and part of the Adani Group, is a leading manufacturer and seller of cement and ready mix concrete in India. With a widespread manufacturing footprint across the country, ACC primarily serves the domestic construction and infrastructure sectors.

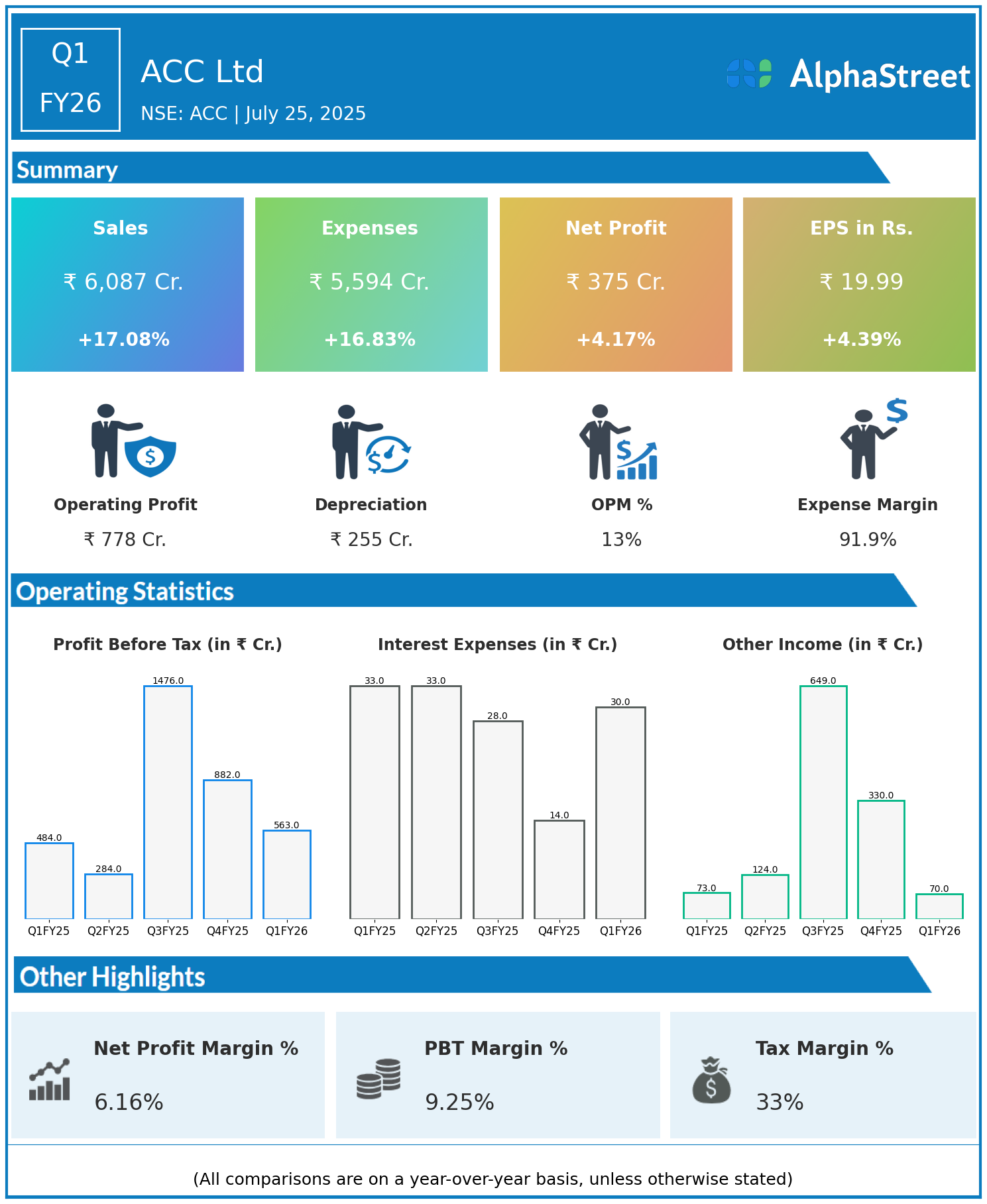

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Revenue: ₹6,087 crore, up 17.08% year-on-year (YoY) from ₹5,199 crore in Q1 FY25.

-

Total Expenses: ₹5,594 crore, up 16.83% YoY from ₹4,788 crore.

-

Consolidated Net Profit (PAT): ₹375 crore, up 4.17% from ₹360 crore in the same quarter last year.

-

Earnings Per Share (EPS): ₹19.99, up 4.39% from ₹19.15 YoY.

Operational & Strategic Update

-

Revenue Growth: Robust growth driven by healthy demand in urban and rural construction sectors along with infrastructure projects across India.

-

Cost Management: Expenses rose in line with higher raw material, fuel, and logistics costs, but efficient operating leverage helped contain margin pressure.

-

Profitability: Net profit growth, though modest, reflects steady margin management and cost discipline amid inflationary input costs.

-

Product & Market Focus: ACC continues to strengthen its leadership in cement and ready mix concrete markets, leveraging technological innovations and a strong distribution network.

-

Sustainability Commitment: Ongoing efforts to reduce carbon footprint through enhancement of eco-friendly product lines and usage of alternative fuels in manufacturing.

-

Expansion Plans: Strategic capacity expansions and focus on premium product offerings to capture high-growth market segments.

Corporate Developments

ACC Limited reported a solid Q1 FY26 performance with strong topline growth and a stable profit increase despite inflationary challenges. The company remains focused on operational efficiency, sustainability initiatives, and market expansion driven by rising infrastructure investments nationwide.

Looking Ahead

With increasing infrastructure and real estate developments in India, ACC is well-positioned to capitalize on demand growth. Continued investments in innovation, capacity enhancement, and green manufacturing practices provide a strong foundation for sustainable long-term growth and shareholder value creation.