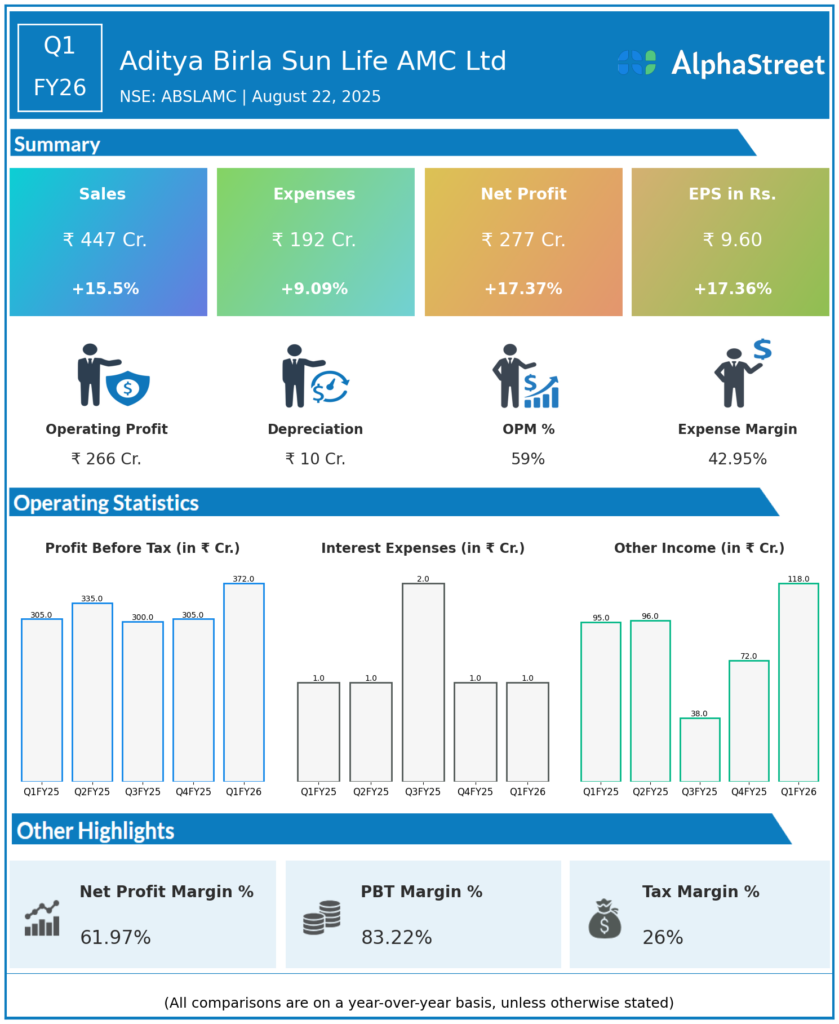

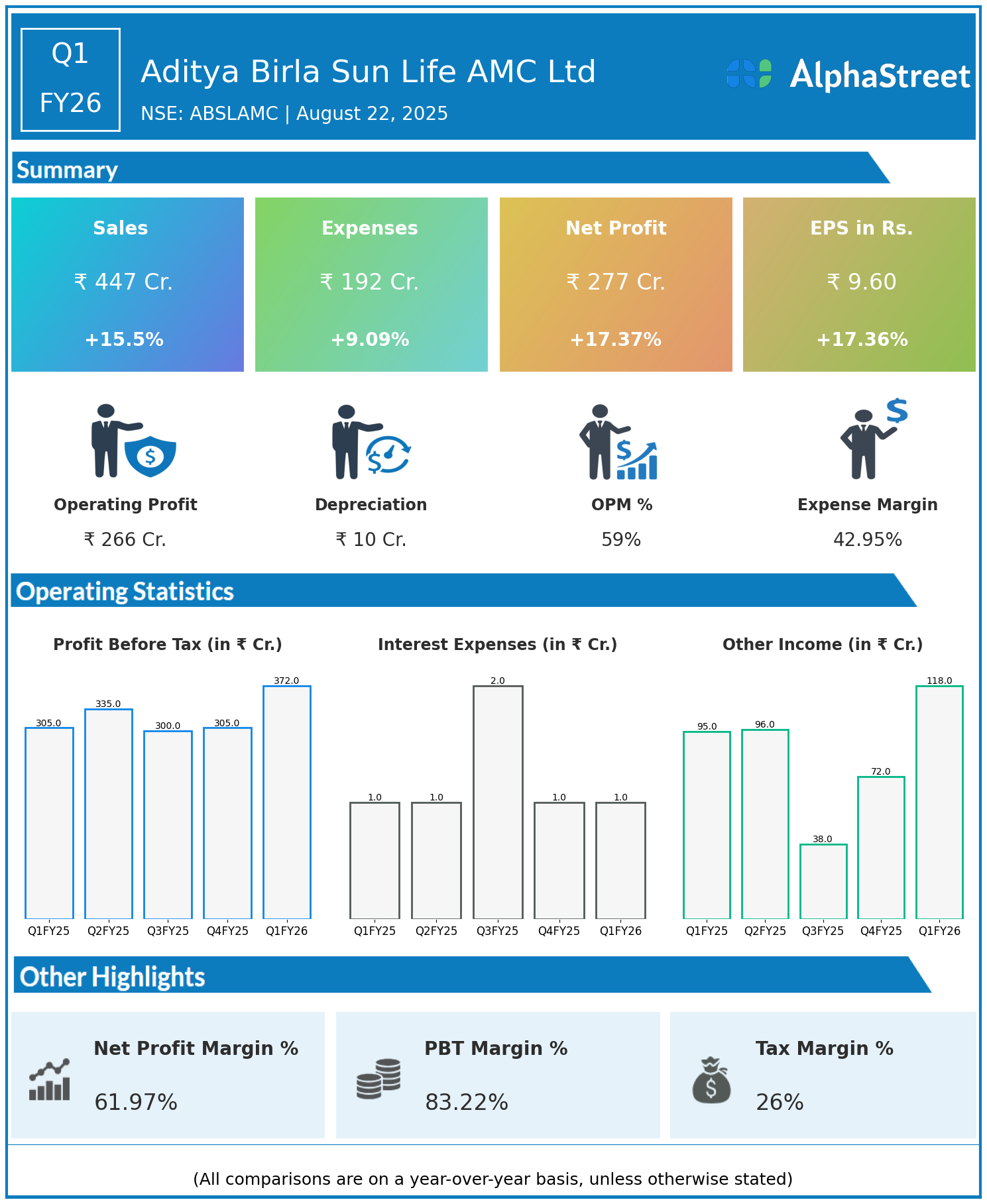

Aditya Birla Sun Life AMC Ltd, incorporated in 1994 as a joint venture between Aditya Birla Capital Ltd and Sun Life AMC, provides mutual fund services, portfolio management, as well as offshore and real estate investment offerings. Presenting below are its Q1 FY26 Earnings Results

Q1 FY26 Earnings Results

- Revenue: ₹447 crore, up 15.5% year-on-year (YoY) from ₹387 crore in Q1 FY25.

- Total Expenses: ₹192 crore, up 9.09% YoY from ₹176 crore.

- Consolidated Net Profit (PAT): ₹277 crore, up 17.37% from ₹236 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹9.60, up 17.36% from ₹8.18 YoY.

Operational & Strategic Update

- Solid Revenue Growth: Revenues rose by over 15%, driven by robust inflows into mutual fund and portfolio management schemes.

- Controlled Expense Growth: Expenses increased at a slower rate than revenues, reflecting effective cost management and operational efficiency.

- Strong Profitability Expansion: Net profit and EPS grew by over 17%, benefitting from income growth, efficiency gains, and a favorable product mix.

- Market Position: Aditya Birla Sun Life AMC remains one of India’s leading asset management companies, backed by a diverse product suite and a strong retail and institutional franchise.

- Strategic Focus: The company continues to prioritize digital initiatives, product innovation, and expansion across investment offerings to strengthen its market leadership.

Corporate Developments in Q1 FY26 Earnings

The Q1 FY26 results demonstrate Aditya Birla Sun Life AMC’s ongoing growth momentum, driven by improved asset mobilization and disciplined expense controls.

Looking Ahead

Aditya Birla Sun Life AMC Ltd plans to further enhance growth by investing in digital capabilities, launching new funds, and strengthening client relationships. Continued focus on innovation and operational excellence is expected to support long-term value creation through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.