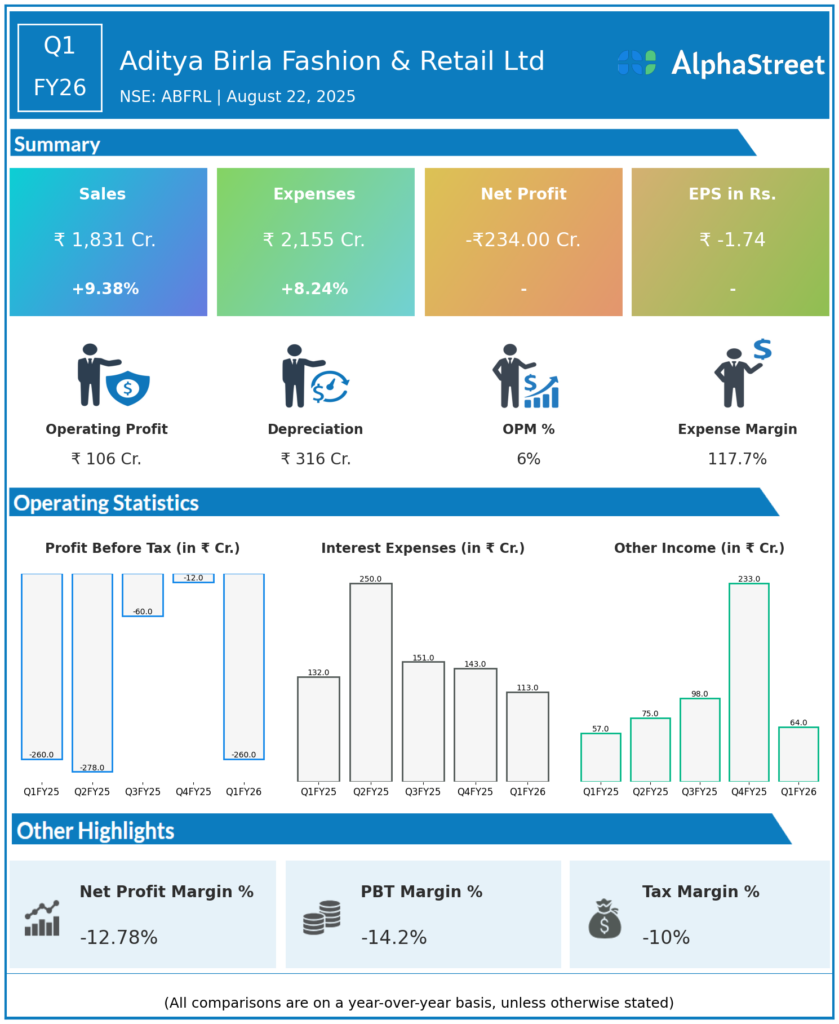

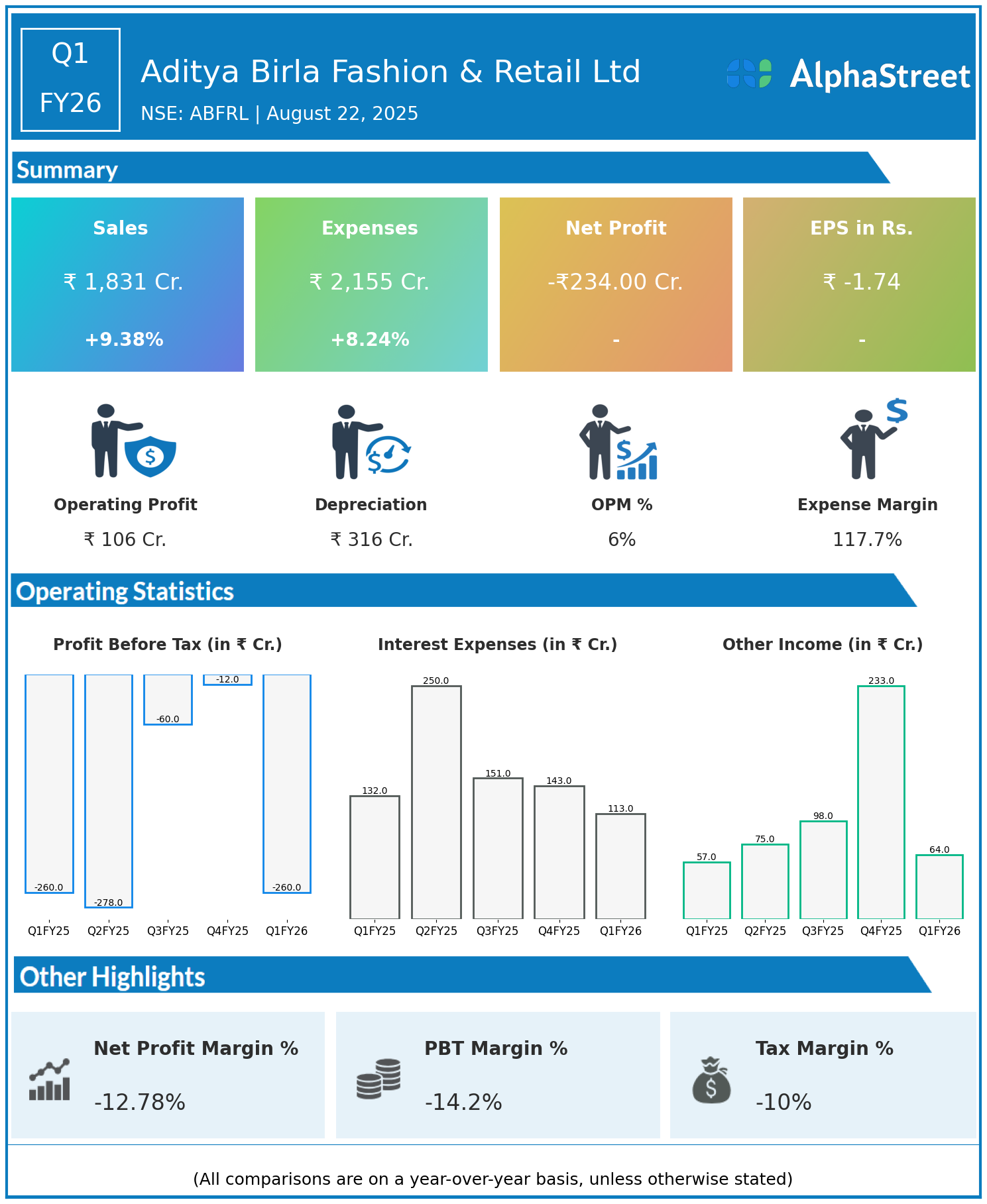

Aditya Birla Fashion & Retail Ltd. (ABFRL), a key player under the Aditya Birla Group, resulted from the consolidation of the group’s branded apparel businesses, including Madura Fashion, Pantaloons Fashion & Retail, and Madura Fashion & Lifestyle. ABFRL is part of a Fortune 500 global conglomerate with operations in 34 countries. Presenting below are its Q1 FY26 Earnings Results

Q1 FY26 Earnings Results

- Revenue: ₹1,831 crore, up 9.38% year-on-year (YoY) from ₹1,674 crore in Q1 FY25.

- Total Expenses: ₹2,155 crore, up 8.24% YoY from ₹1,991 crore.

- Consolidated Net Profit (PAT): Loss of ₹234 crore, compared to a loss of ₹215 crore in the same quarter last year.

- Earnings Per Share (EPS): -₹1.74, compared to -₹1.59 in Q1 FY25.

Operational & Strategic Update

- Revenue Growth: ABFRL posted strong revenue growth of over 9%, driven by positive momentum in branded apparel sales and increased retail activity.

- Controlled Expense Rise: Expenses grew by just over 8%, slightly lesser than revenue growth, indicating ongoing efforts in cost discipline.

- Sustained Net Loss: The consolidated net loss widened marginally year-on-year, as growth and operating leverage were offset by higher finance costs, competitive pressures, or strategic investments.

- Market Position: ABFRL remains a leading player in India’s branded apparel and retail sector, with a broad multi-brand portfolio and extensive retail and distribution network across the country.

- Strategic Focus: Focus continues on portfolio expansion, brand enhancement, omnichannel distribution, and operating efficiency to drive long-term growth and move towards profitability.

Corporate Developments in Q1 FY26 Earnings

Despite robust revenue growth in Q1 FY26, ABFRL faced continued earnings pressure, reflecting the challenges of balancing expansion with cost management in a highly competitive retail environment.

Looking Ahead

ABFRL is targeting profitability through further network expansion, new brand launches, and digital initiatives. Operational efficiency, strengthened customer engagement, and premiumization are expected to support margin improvement and value creation through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.