ABB India Limited is a leading integrated power equipment manufacturer, delivering a comprehensive suite of products, services, and solutions across automation and power technology for industries, utilities, and infrastructure. With a longstanding presence and technological leadership, ABB India supports digital and sustainable transformation of the country’s critical sectors.

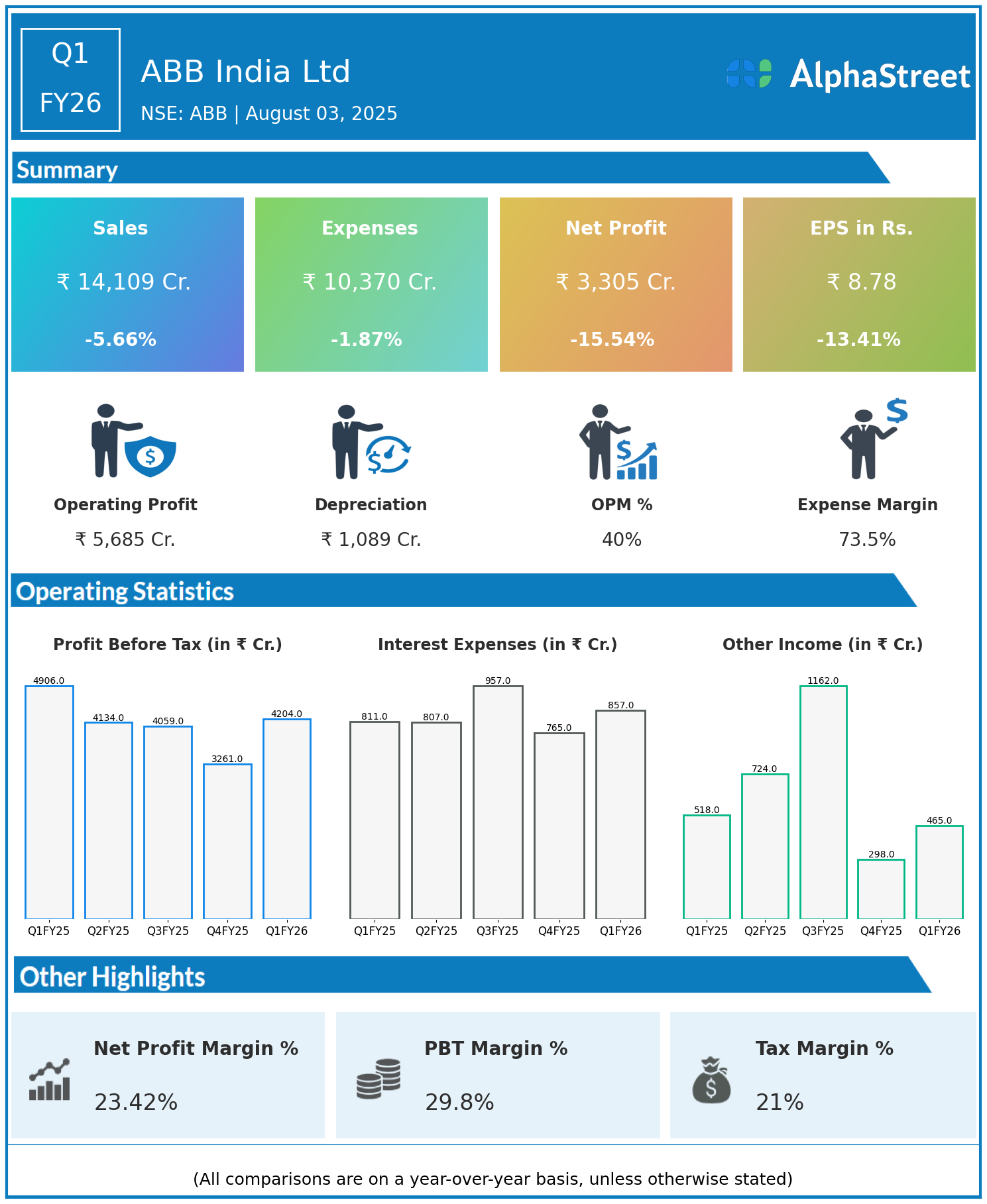

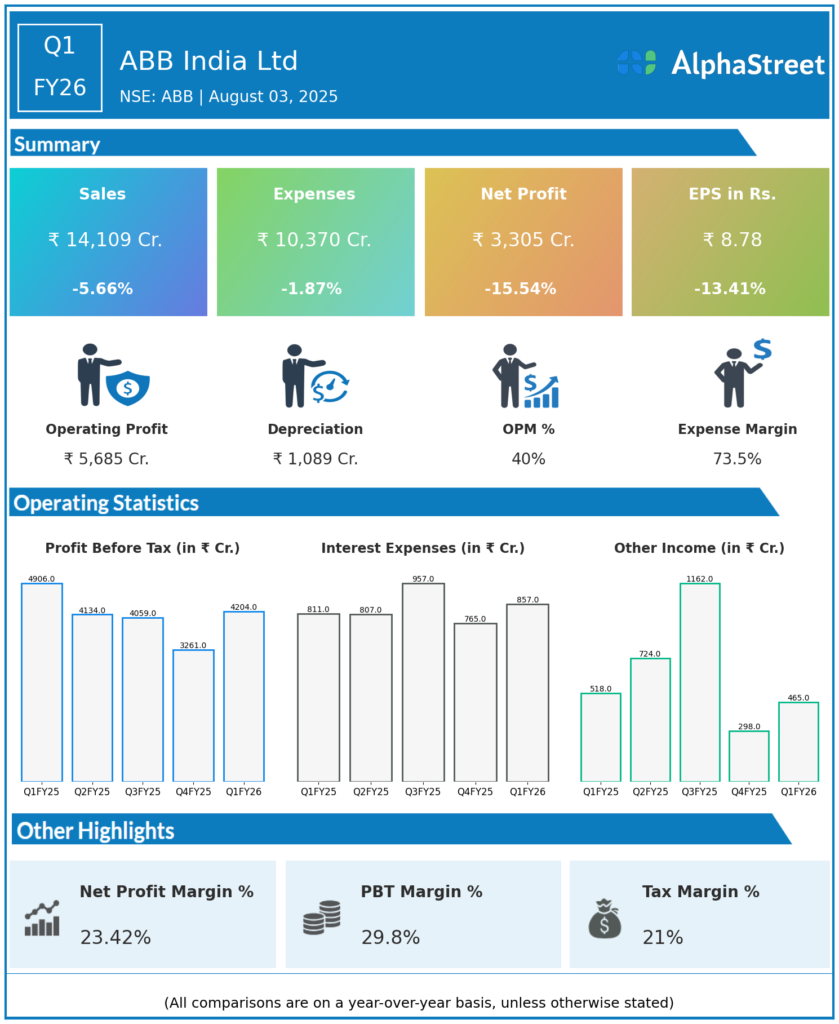

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹14,109 crore, down 5.66% year-on-year (YoY) from ₹14,956 crore in Q1 FY25.

- Total Expenses: ₹10,370 crore, down 1.87% YoY from ₹10,568 crore.

- Consolidated Net Profit (PAT): ₹3,305 crore, down 15.54% from ₹3,913 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹8.78, down 13.41% from ₹10.14 YoY.

Operational & Strategic Update

- Revenue Performance: The revenue decline reflects softer market demand, project phasing, and possible delays in customer capex, affecting both automation and power technology orders.

- Expense Management: Total expenses fell in line with the slowdown, but the reduction was lower than the dip in revenues, reflecting ongoing operating and fixed costs for manufacturing, personnel, and R&D.

- Profitability Trends: Net profit and EPS contracted more sharply than revenue, signaling margin compression and a less favorable mix of higher-margin project executions or service orders this quarter.

- Segment Highlights: ABB India’s diversified solutions in automation, electrification, robotics, and industrial digitalization provide a strong foundation, but cyclical market movements influence short-term performance.

- Operational Focus: The company remains committed to operational excellence, cost optimization, and scaling up next-gen solutions such as automation, renewables integration, and smart industry services.

- Strategic Direction: Continued investments in digitalization, sustainable manufacturing, and localization are expected to enhance long-term competitive advantage and resilience.

Corporate Developments

Q1 FY26 posed a challenging environment for ABB India, with revenue and profit declines reflecting market volatility and cost dynamics. Nevertheless, the technological depth, diversified business model, and customer centricity remain key strengths as industries and utilities modernize and upgrade for future-ready operations.

Looking Ahead

ABB India Ltd is positioned to benefit from increased automation, smart grid investments, industrial digitalization, and government push towards sustainable infrastructure. The company is expected to focus on margin recovery, innovation acceleration, and deepening customer partnerships to drive growth and value creation through FY26 and beyond.