“Aarvi Encon’s future growth strategy includes increasing the wallet share of business from existing clients by supplying additional manpower and identifying cross-selling and up-selling opportunities. They plan to digitalize various processes for contactless operations management and provide manpower services to new clients in existing verticals. The company also aims to venture into new industry verticals such as Automobile, Marine, Airports, Ports, Defence, and Healthcare.”

– Management, Aarvi Encorn ltd.

Stock Data:

| Ticker | AARVI |

| Exchange | NSE |

| Industry | Special Consumer Services |

Price Performance:

| Last 5 Days | -1.21% |

| YTD | -37.80% |

| Last 12 Months | -7.88% |

Company Description:

Aarvi Encon is a technical staffing solutions company that was founded in 1987 in India. It specializes in engineering staffing solutions and provides services such as deputation of technical staffing, project management, construction supervision, inspection services, pre-commissioning & commissioning assistance, and O&M services. The company has over 6,000 engineers/technical personnel on payroll, and it has deployed over 30,000 personnel since its inception.

The company has a strong track record in India and has expanded its operations internationally, providing engineering services on various international projects, particularly in the UAE and the United Kingdom. The company’s clientele includes well-known names such as Larsen & Turbo Industries, Cairn, Reliance Industries Limited, Engineering India Limited, Indian Oil, and Technip.

Aarvi Encon offers staffing solutions for various stages of a project, from conceptualization to design, construction, pre-commissioning and commissioning, and operations and maintenance. They also provide large manpower for shutdown assignments ranging from 15 days to a few months. Aarvi Encon has a strong recruitment process, with a large in-house database of over 800,000 resumes and a robust referral program. Their recruiters are well-trained and can identify candidates that meet the client’s project requirements. The company targets various sectors such as oil & gas, power, LNG, PNG, refinery, petrochemical, pipeline, wind power, solar power, offshore, E&P, infrastructure, ports & terminals, telecom, fertilizers, cement, automobile, metro & monorail, railway, metals, and minerals, and information technology.

Critical Success Factors:

- Aarvi Encon’s revenue growth on a year-on-year basis has been consistent due to the addition of new clients. However, their EBITDA margins were impacted due to the completion of high margin contracts in the previous quarter. The increase in short-term working capital has also affected their bottom line, but the company expects to reduce it in the coming quarters. Additionally, Aarvi Encon has expanded its services to include social media marketing and SEO activities.

- Aarvi Encon’s future growth strategy includes increasing the wallet share of business from existing clients by supplying additional manpower and identifying cross-selling and up-selling opportunities. They plan to digitalize various processes for contactless operations management and provide manpower services to new clients in existing verticals. The company also aims to venture into new industry verticals such as Automobile, Marine, Airports, Ports, Defence, and Healthcare. They will have a dedicated international sales team focusing on international deputation of manpower to develop a stronger international presence.

- Aarvi Encon will focus on better talent acquisition to attract and retain talented professionals while meeting quality standards and compliance. The company plans to diversify expertise and service offerings across the engineering value chain and improve efficiencies by enhancing domain knowledge and achieving operational excellence.

- The flexi staffing segment is the largest in the staffing industry in India, with a market share of 75%. The industry has grown at a rate of 20-25% per year over the past five years, and is expected to continue growing. The segment provides a platform for recognized employment, work choice, reasonable compensation, annual benefits, and health benefits for the temporary workforce. Temporary or contract-based work is on the rise, and staffing firms are playing a pivotal role in easing the relationship between freelancers and their clients. According to a report from the Indian Staffing Federation, the industry is expected to grow by 9.2% with 1.53 million jobs in the next three years, and Andhra Pradesh, Telangana, Haryana, Gujarat, and Madhya Pradesh are high-growth potential states for flexi staffing.

- The engineering sector in India has witnessed significant growth in recent years, driven by increased investment in infrastructure and industrial production. The sector is expected to grow further, with the turnover of the capital goods industry in India expected to reach INR 8.05 lakh crore by 2025. The engineering sector also attracts interest from foreign players due to its comparative advantage in terms of manufacturing cost, technology, and innovation. India’s engineering R&D market is expected to increase from USD 36 billion in FY19 to USD 63 billion by FY25. The country needs INR 235 trillion worth of investments in infrastructure by 2029. Flexi staffing companies play an important role in meeting the requirements of the engineering sector by providing temporary/flexible workforce to clients.

- The engineering sector in India is attractive to foreign players due to its comparative advantage in terms of manufacturing costs, technology, and innovation. The sector is a growing market, with the export of engineering goods expected to reach USD 200 Billion by 2030. India needs significant investments in infrastructure development, with INR 31 trillion (USD 454.83 Billion) to be spent over the next five years, and the government targeting INR 25 Trillion (USD 376.53 Billion) investment in infrastructure over three years, including INR 8 trillion (USD 120.49 Billion) for developing 27 industrial clusters. The manufacturing sector in India has the potential to reach USD 1 trillion by 2025, account for 25-30% of the country’s GDP, and create up to 90 Million domestic jobs.

Key Challenges:

- Aarvi Encon faces several risks and concerns that could impact its business operations and financial performance. One of the main risks is the concentration of its revenue from the oil and gas sector, which exposes the company to fluctuations in oil prices and changes in government policies. If the demand for oil and gas decreases, Aarvi Encon’s revenue could suffer. Additionally, any regulatory or policy changes in the sector could have a negative impact on the company’s operations and profitability.

- Another key risk is the intense competition in the staffing industry. The industry is highly fragmented, and Aarvi Encon competes with several large and small players. This competition could result in a price war and lower margins for the company. The company also faces the risk of losing key clients to competitors, which could impact its revenue and profitability.

- Aarvi Encon’s financial performance is also subject to currency fluctuations, as the company generates a significant portion of its revenue from exports. Any volatility in the foreign exchange rates could affect the company’s financial results. Moreover, Aarvi Encon’s growth strategy through acquisitions involves integration risks, such as the challenges of integrating different cultures, processes, and systems of the acquired companies.

- The company’s ability to attract and retain skilled staff is another concern. Aarvi Encon’s business model is heavily dependent on its ability to provide quality and skilled workforce to its clients. Any shortage of skilled workers, coupled with higher employee turnover rates, could impact the company’s operations and profitability.

Financial Performance:

| Metrics ( ₹ mn.) | FY20 | FY21 | FY22 | 9MFY23 |

| Operational Income | 2,181 | 2,018 | 2,885 | 3,302 |

| Total Expenses | 2,089 | 1,922 | 2,758 | 3,165 |

| EBITDA | 92 | 96 | 127 | 137 |

| EBITDA Margins (%) | 4.22% | 4.76% | 4.40% | 4.15% |

| PBT | 70 | 103 | 122 | 116 |

| Profit After tax | 72 | 105 | 121 | 111 |

| PAT Margins (%) | 3.30% | 5.20% | 4.19% | 3.36% |

| Diluted EPS (₹) | 4.86 | 7.08 | 8.16 | 7.48 |

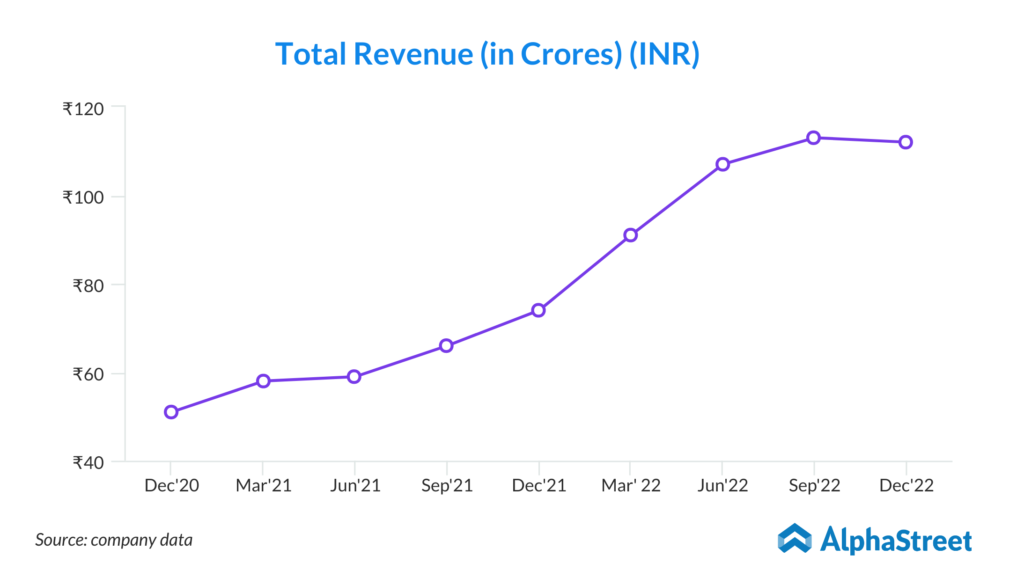

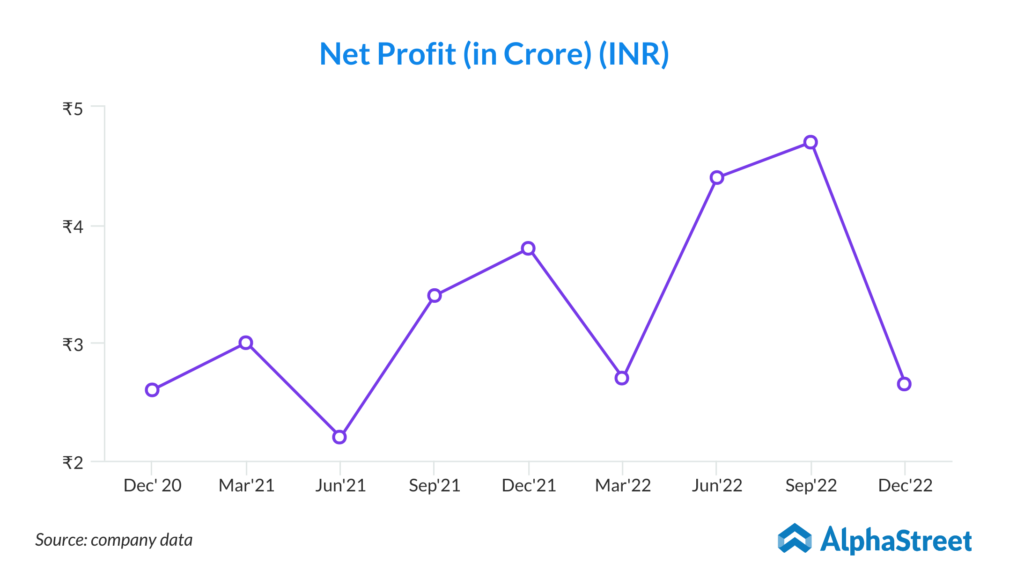

Aarvi Encon ltd operational income of the company increased from INR 2,181 crore to INR 3,302 crore over the period of four years. The total expenses also increased from INR 2,089 crore to INR 3,165 crore during the same period. The EBITDA of the company was INR 92 crore in FY20, which increased to INR 137 crore in the 9MFY23. The EBITDA margins ranged from 4.15% to 4.76%. The profit after tax (PAT) of the company increased from INR 72 crore in FY20 to INR 111 crore IN 9MFY23. The PAT margins ranged from 3.30% in FY20 to 3.36 % IN 9MFY23. The diluted earnings per share (EPS) of the company were INR 4.86, INR 7.08, INR 8.16, and INR 7.48 for FY20 to 9MFY23, respectively.

The healthy upwards trends in the Operational Income indicates that the company has observed higher sales consistently over the years. This has resulted in a higher amount of profits for the firm. The profitability margins seems to have remained stagnant due to the increase in input costs. As macroeconomic conditions return to normalcy, the margins should observe a recovery. Despite that, the relatively higher base of revenues have resulted in higher Earnings Per Share showcasing the rise in wealth for the firm’s shareholders.