Aarti Industries Limited, the flagship company of the Aarti Group, is a leading manufacturer of organic and inorganic chemicals with extensive production facilities across Gujarat (Vapi, Jhagadia, Dahej, Kutch) and Maharashtra (Tarapur). Renowned for its strong market position in NCB-based specialty chemicals, the company supplies key intermediates for diverse industries including pharmaceuticals, agrochemicals, polymers, and specialty applications.

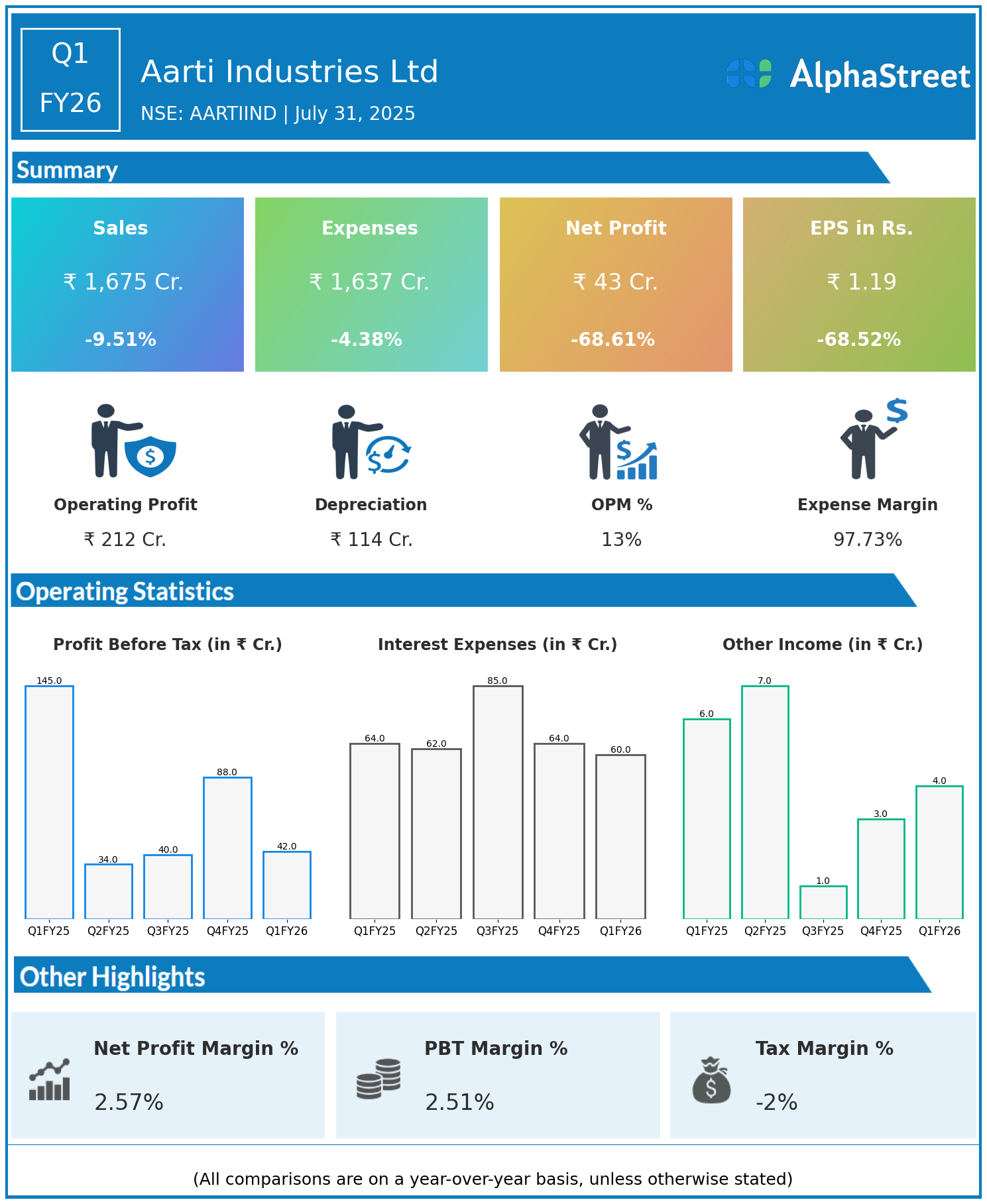

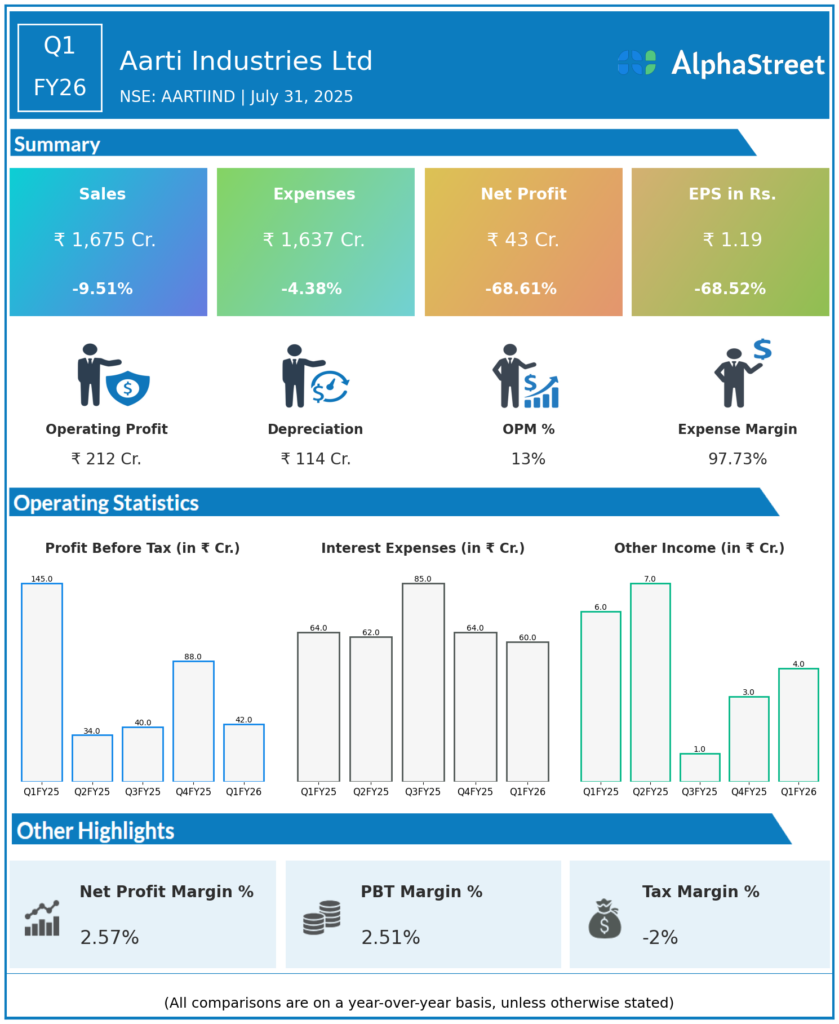

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹1,675 crore, down 9.51% year-on-year (YoY) from ₹1,851 crore in Q1 FY25

- Total Expenses: ₹1,637 crore, down 4.38% YoY from ₹1,712 crore

- Consolidated Net Profit (PAT): ₹43 crore, down 68.61% from ₹137 crore in the same quarter last year

- Earnings Per Share (EPS): ₹1.19, down 68.52% from ₹3.78 YoY

Operational & Strategic Update

- Revenue Decline: The significant dip in revenue was primarily driven by weaker demand and pricing pressure in key specialty chemical segments, reflecting broader challenges in export markets and supply chain disruptions.

- Cost Management: While total expenses were reduced, the fall was not sufficient to offset the decline in revenue, largely due to the persistence of fixed overheads and input inflation.

- Sharp Profitability Compression: The steep drop in net profit and EPS highlights a challenging operating environment marked by compressed margins and adverse production economics.

- Market Position & Product Focus: Despite current headwinds, Aarti maintains its technological edge and leadership position in the specialty chemicals space, particularly in NCBs, helping to stabilize core business.

- Operational Response: The company is likely focusing on further optimizing costs, improving product mix, and enhancing capacity utilization to support margin recovery going forward.

- Strategic Initiatives: Investments continue in process innovation, new product pipelines, and expansion into value-added and higher-margin specialty chemical segments to support long-term resilience.

Corporate Developments

Q1 FY26 reflects a demanding quarter for Aarti Industries Ltd, with profits under significant pressure despite ongoing efforts at cost control. The company’s strong manufacturing footprint, broad customer base, and commitment to innovation are expected to support recovery prospects once demand improves.

Looking Ahead

Aarti Industries Ltd is well-placed to navigate the current cyclical downturn by driving operational efficiencies, strategic product development, and disciplined cost management. With long-term demand for specialty chemicals expected to rise, the company is poised to regain growth momentum and shareholder value as market conditions normalize in FY26 and beyond.