About Company:

Established in 1984, Aarti Industries is a leading Indian manufacturer of Speciality Chemicals and Pharmaceuticals with a global footprint. Chemicals manufactured by Aarti are used in the downstream manufacture of pharmaceuticals, agrochemicals, polymers, additives, surfactants, pigments, dyes, etc. The company operates under two business verticals namely:

Specialty Chemicals:

Under this segment, the company has integrated operations across the Benzene, Sulphur, and Toluene product chains, and is ranked among the top three players globally for the manufacture of Nitro Chloro Benzene (NCB) and Di-chloro Benzenes (DCB). The company is also the only manufacturer of Nitro fluoro aromatics using the Halex process and the only manufacturer of Phenylenediamines (PDA) value chain in India. Most of its speciality chemical products are primarily along the benzene-based value chain. Other chemicals such as sulphuric acid and its derivatives, single super phosphate, Toluene-based derivatives, calcium chloride granules, fuel additives, and phthalates are also part of its manufacturing portfolio.

Pharmaceuticals Segment:

The company uses its world-class expertise and modern manufacturing infrastructure to develop APIs, Intermediates, and Xanthine derivatives for the pharmaceutical and food/beverages industry. It also has its own backward integrated intermediaries for most of the APIs that are manufactured. APIs accounted for 35% of revenues of the Pharma division, Intermediates for 29% & and the Xanthine derivatives accounted for the rest 36% of revenues of the segment for FY22. Remarkably, the company stands amongst the top 4 manufacturers for 75% of its product portfolio.

Global Presence:

The company has a global presence with exports around the world. The Domestic (Indian) market accounts for 59% of total revenues, followed by North America (11%), Europe (11%), China (5%), Japan (3%) and the rest of the world accounts for the remaining 11% of revenues.

Client Base:

The company has a client base of 700+ domestic clients and 400+ global clients. Its clients belong to many industries viz. Pigments & Paints, Polymers, Agro intermediaries, Pharmaceuticals, and others. The company’s client list includes Clariant, Sunchemical, Huntsman, Sudarshan, BASF, Toray, Bayer, UPL, Coromandel, Cipla, Sun Pharma, Lupin, Zydus, Dr. Reddy’s, 3M, Dabur & many more.

Limited Exposure:

With a total of 200+ products in production, the company has diversified exposure to many industries. It has a 60% exposure in agrochemicals, pharmaceuticals, and FMCG while 40% exposure is in Discretionary (Dyes, Pigments, Printing Inks, Polymer & Additives, Fuel Additives, etc).

Manufacturing Facilities:

The company has 15 manufacturing plants for its specialty chemicals division & 5 plants for its pharmaceuticals division. In total, it has 20 manufacturing facilities which are all located in western India with close proximity to ports for easy export. Its manufacturing units are located in the states of Gujarat and Maharashtra.

Out of 5 pharma plants, 2 plants are USFDA approved for manufacturing which makes it a preferred supplier of drugs. It also owns 5 co-gen power plants & a solar capacity of ~700 KW.

Research & Development Capabilities:

The company owns 4 R&D centers in India with a dedicated pool of 400+ engineers and scientists for developing customized products. It operationalized Aarti Research & Technology Centre, its new R&D facility in Navi Mumbai in FY20.

Competitive Advantage:

The company has a superior cost structure and competitive advantage as compared to its competitors due to its backward integration and scale. This is why China plus one strategy has helped the company throttle its top line. Further, the company also has 8 international patents and 39 USDMF. For FY22, the company got permission for 11 more patents of the 44 patents filed. Interestingly, Aarti Industries is a global player in benzene-based derivatives with integrated operations as it stands top 3 in chlorination and nitration globally and among the top 2 in hydrogenation globally.

The reason behind the company being a multi-bagger:

Aarti Industries is a speciality chemical manufacturer with B2B sales to major global companies for a variety of end-use — polymer, agrochemicals, dyes, and pigments. They have a very value-added production chain. Because of this business model and multi-customer relations, they have been able to grow their business sizably. In the last few years, the overall competitiveness of India against China has increased, which has expanded margins for the chemical industry and for the company as well. This is a major reason for both volume growth as well as bottom-line growth.

Share price Insights:

- With the current price of INR 752 as of October 18, 2022, Aarti Industries is hovering near the low of its 52-week range of INR 669 – INR 1168

- The stock price has generated a 5-year CAGR of 29% and returns of 240% during the same period.

- If you would have invested a sum of INR 1 Lacs during its IPO, it would have been more than 7 crores today.

Financial Snapshot:

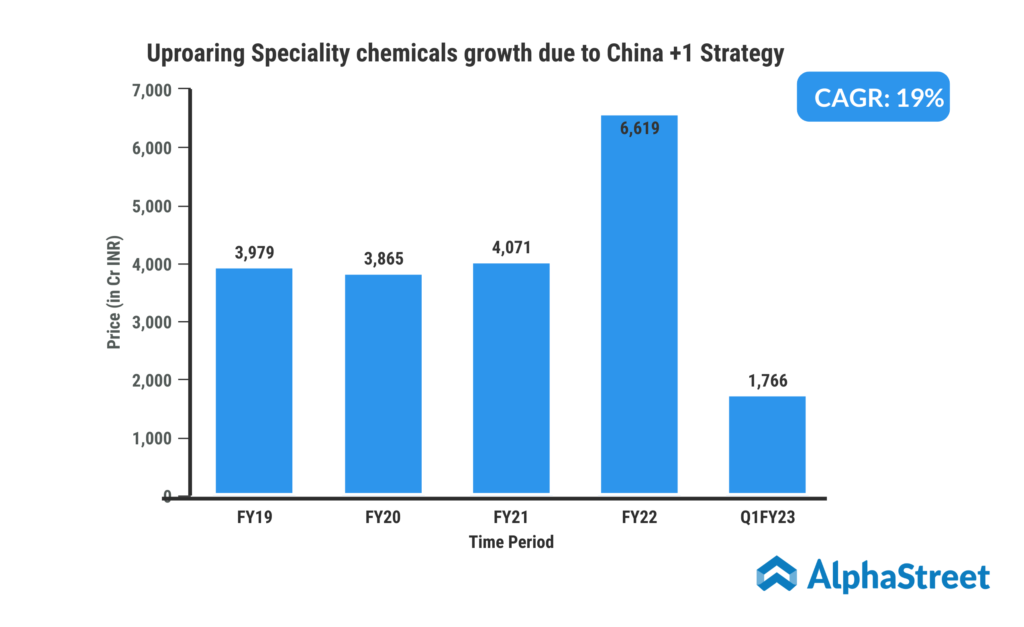

The company has delivered a soaring revenue CAGR of 19% over the period of the last 5 years. Consistent revenue momentum is a result of favorable demand scenarios and the company’s ability to pass on sharp increases in the prices of crude oil and other petrochemical intermediates. Meanwhile, China plus one strategy has bolstered the export momentum both in Specialty Chemicals and Pharma. The company continues to leverage strong relationships with global customers to elevate this trajectory.

The EBITDA growth has been a whopping CAGR of 29% over the period of the last 5 years. This has been supported by healthy growth in the topline and expense control.

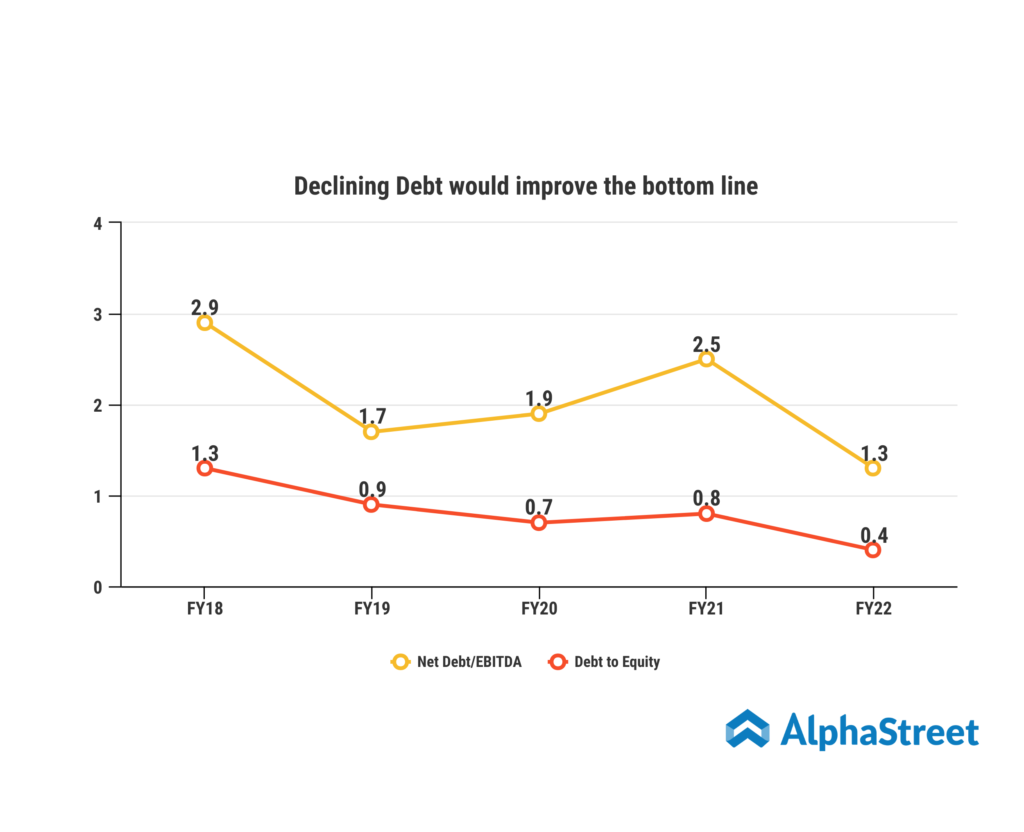

Meanwhile, due to an effective debt reduction, the bottom line has also delivered a robust CAGR of 41% over the period of the last 5 years. With further CAPEX and more unrest in the Chinese economy, orders are poised to go up in the future from other countries.

The return ratios have been improving over the period of the last 5 years. Not only this but the CAPEX done over the past few years has come to fruition as the company’s ROCE is also soaring higher. The company expects to manage the ratios within these lines.

Q1FY23 results:

With a YoY rise of 45%, the firm generated consolidated revenue of ₹2,173 Cr in Q1FY23 as opposed to ₹1,503 Cr in Q1FY22. On a consolidated basis, the firm recorded an EBITDA of ₹369 Cr in Q1FY23 compared to ₹314 Cr in Q1FY22, an increase of 18% YoY. The company’s overall income growth grew from 42.2% in Q1FY22 to 46.2% in Q1FY23. The company’s EBITDA margin decreased to 17.0% in Q1FY23 from 20.9% in Q1FY22. On a consolidated basis, the company’s EBIT climbed by 15.3% year over year in Q1FY23 to ₹283 Cr from ₹245 Cr in Q1FY22. The company’s EBIT margin dropped to 13.0% in Q1 FY23 from 16.3% in Q1 FY22. On a consolidated basis, the firm recorded a profit after tax (PAT) of ₹189 Cr in Q1FY23 as opposed to ₹165 Cr in Q1FY22, representing a YoY rise of 14.7%. The company’s PAT margin decreased to 8.7% in Q1FY23 from 11.0% in Q1FY22, while EPS increased by 10.4% YoY to ₹5.22 from ₹4.73 in the year-ago quarter.

Factors to consider:

- Higher-than-expected volatility in RMAT prices

- Upcoming Capex to lead the growing trend.

Recent Highlights:

- Demand Outlook: Although AIL has slightly outperformed in the current quarter, the company has maintained its topline guidance for FY23. It forecast 10% top-line growth & 8-9% EBITDA growth as management witnesses little turbulence in demand from Textile and FMCG (dyes & pigments segment) & raw material costs pressure from core products like benzene & higher utility prices.

- Production Volumes for Specialty Chemicals: For Q1FY23, volumes across product segments were:

- NCB – 20515 MT in

- Hydrogenation – 3295 tonnes/month

- Nitro Toluene – 5252 MT

- Specialty Chemicals top-line: Specialty chemicals grew 44% YoY, with about 75% share of the revenue from value-added products during the quarter. Growth came in from increased realizations from value-added products & the price hikes taken to pass on the increase in cost. The pass-on cost increase happens in a month in the domestic market, whereas in the export market, the lag is 2-3 months.

- Pharma Division: The segment reported 48% growth on a YoY basis & 5% growth on a QoQ basis. Robust growth in the topline was attributable to a positive demand landscape for key products. Higher uptake from Generic Pharma companies aiding top-line growth and strong revenue visibility. The expansion of capacity for the USDA-approved API facility is in the final stages and is expected to commercialize in Q1 FY23.

- New Capex and Expansion plans:

- The management has also guided for a Capex of Rs 3000 Cr for the next 2 years. Out of the projected Capex, the company has spent 200 Cr in the current quarter.

- The Capex will be majorly for adding more downstream products in the current benzene chain, the new Chloro Toluene chain, and debottlenecking of the existing products.

- All the capacities set up during FY22 should ramp up and clock utilization of ~70-90% by FY24-end. Incremental Capex would be mainly utilized for high-value products.

- 50% of the Capex will be for the existing products and contracts, while the remaining is for the new product development. A large part of the Capex would be towards chemical products 2500-3000 Cr, whereas for Pharma it would be in the range of 350-500 Cr. Site development work to commence on 100 + acre land at Jhagadia. AIL also acquired over 120 acres of land at Atali, Gujarat. Environmental Clearances obtained / in process. Construction from FY22 – FY24.

- The company will be coming up with a Concentrated Nitric Acid plant by FY24 to take care of Nitric Acid requirements. It is evaluating the feasibility of going for a Weak Nitric Acid integrated plant to be completely self-sufficient, while the management has a project cost of 150-200 cr for the CNA plant whereas a Capex of 500CR + for the WNA & CNA plant.

- Long-term Contracts:

- Capacity created for 1st long-term contract should ramp up utilization levels to the tune of 70-80% by the FY24- end.

- The company commissioned a second long-term contract during Q1FY23 and is expected to contribute to revenue starting from Q3FY23. The annual contracted sales for this contract are 500 Cr and shall be seen adding to the topline with a ramp-up in utilization over FY23.

- The 3rd contract should start by Q2 FY23 and ramp up over the next two years FY23 – 24.

- RM Availability: Nitric acid shortage continues to affect the production of a few linked products. Management is planning a Capex for Concentrated Nitric Acid to the tune of 150-200 Cr with a capacity of 60,000 MTPA. The plant will commission by the end of FY24 as a backup to reduce the company’s dependency on local players. In the near term, the company expects supply to resume from H2FY23 onwards as new capacity in India will be ready.

Outlook and key triggers:

Driven by rising domestic demand from end-user industries and strong exports, the Indian speciality chemical industry is likely to grow by around 12% annually over the next few years. Indian exports have also taken wings not least due to stricter environmental norms in China which have forced plant shutdowns on a no-small scale, thus prompting MNCs in Europe, Japan, and the US to look for alternate supplies.

Prospects of Aarti’s pharmaceutical business scarcely appear dim not least due to the huge export potential of APIs. By some estimates, the Indian pharmaceutical intermediate market is estimated to grow by a high single-digit over the next few years. Against this backdrop, Aarti would pull out all stops to launch new products (more than 50 planned) with a Capex of Rs 350-500 crs in three years from now. Volume expansion is expected to be driven by a pipeline of approvals in therapies, such as antihypertensive, cardiovascular, oncology, and corticosteroids.

After the commencement of commercial production of the second long-term contract in Q4 and USFDA approved API facility at Tarapur in Q2 of the current fiscal, Aarti is going full-on commissioning in phases the project related to the third long-term contract at Jhagadia, NCB expansion at Vapi, and acid unit revamp, besides others. After spending over Rs 1300 crs in fixed assets last year, Aarti plans to further release some Rs 1500 crs this fiscal for augmenting capacities to gain a cost advantage. The gradual ramp-up of assets related to the second long-term contract would take its capacity utilization past 70% next fiscal.

Aarti plans to derive much of its competitive advantage by aggressively expanding both existing and new products; foraying into new chemistries like photo chlorination, ammoxidation, and specialty fluorination; intensifying integration to gain cost advantage; tapping custom manufacturing opportunities.; and increasing focus on downstream products through processes like high-value chlorination, hydrogenation. Yet, the company has been affected by a slowdown in the global agrochemical industry, cost escalations, cancellation of a long-term supply contract, and delay in the commissioning of projects related to second and third long-term supply contracts.

Our View:

Robust growth guidance of 2x/4x increase in earnings by FY2024E/FY2027E over FY2021 reinforces confidence in terms of sustained long-term, high-growth potential for Aarti Industries. Therefore, we expect a strong revenue/EBITDA/PAT CAGR of 22%/25%/26% over FY2022-FY2024E, led by high Capex intensity over the next couple of years. We believe that Aarti Industries would benefit immensely from a strong growth outlook for the Indian specialty chemical sector supported by the China Plus One strategy of global companies, import substitution in domestic markets (identified opportunities of ~$1 billion), and rising domestic demand for specialty chemicals. The toluene segment in India is mainly untapped and catered to through imports; AIL will benefit in the long term by entering this segment. Moreover, favorable dynamics for the Indian specialty chemicals sector are likely to support the premium valuation.

Industry Analysis:

Crisil estimates that India’s share of the global specialty chemicals industry will double in five years to 6% by 2026 from 3 – 4% in FY21. Much of this growth, the agency contends, would be powered by demand recovery in domestic end-user segments and strong tailwinds in exports due to a shift in the global supply chain driven by the China+1 policy of vendors. To meet increased demand for products, Indian players would ramp up their capacity, and a sizable sum of this Capex will be channelized into backward integration, import substitution, and to meet increased demand for exports.

According to Fortune Business Insights, the global specialty chemicals industry is projected to grow by a CAGR of 4.7% during 2021-2028. This outcome would fructify on the backdrop of the slump in market growth induced by the COVID-19 pandemic outbreak. Most of the chemical companies during this period saw a sharp fall in revenues not least due to restrictions on transportation and travel activities. The report contends that mounting concerns over food security would benefit the global agrochemicals segment on account of skyrocketing demand for specialty chemicals in the agriculture segment to boost farm yield.

The report further states that concerns over food security in many parts of the world, driven by increasing population and depleting resources, may cause a global food shortage. Much of the growth in the global specialty industry would be driven by robust Chinese manufacturing power, which would take a leg up from the abundant availability of raw materials in the country and the existence of cheap labor. In forthcoming years, North America is well poised to establish a commanding hold on this market, not least due to it being one of the largest consumers of chemicals such as biocides, synthetic lubricants, and corrosion inhibitors.