Stock Data:

| Ticker | NSE: AARTIIND |

| Exchange | NSE |

| Industry | Pharmaceutical & Chemicals |

Price Performance:

| Last 5 Days | +5.80 % |

| YTD | -19.82 % |

| Last 12 Months | -41.35% |

Company Description:

Aarti Industries is a global leader in specialty chemicals and pharmaceutical intermediates manufacturing. With decades of experience, the company offers a diverse portfolio serving pharmaceuticals, agrochemicals, petrochemicals, and dyes sectors. Through cutting-edge research and advanced processes, Aarti delivers high-quality solutions meeting international standards. Backed by state-of-the-art facilities and a customer-centric approach, the company remains agile in capturing opportunities and overcoming challenges. Aarti Industries’ commitment to innovation and sustainability cements its position as a reliable and ethical industry leader on the global stage.

Critical Success Factors:

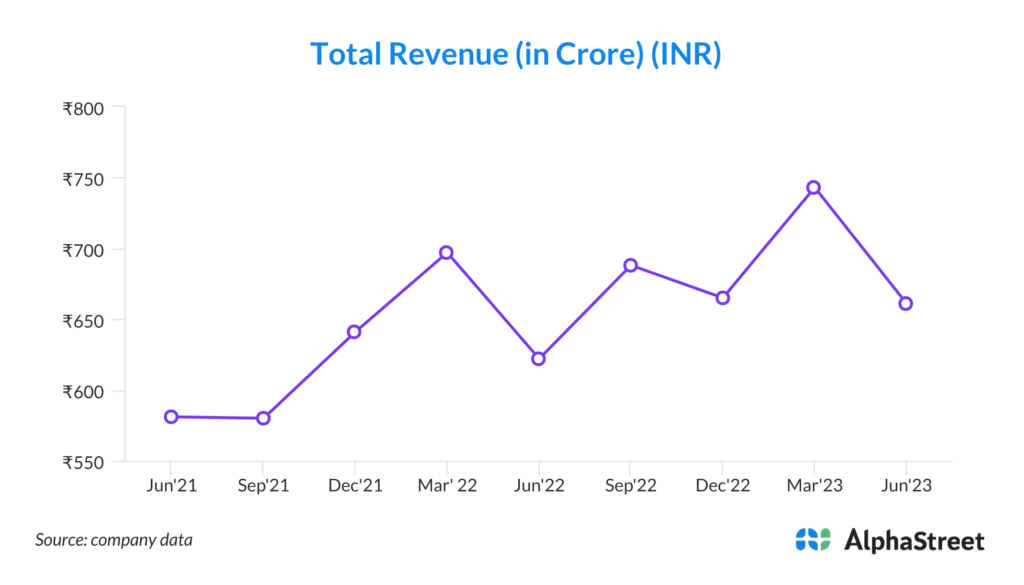

- Steady Revenue Growth: Aarti Drugs Ltd’s consistent revenue growth, with a commendable 6.3% year-on-year increase in Q1 FY ’24, underscores the company’s prowess in navigating dynamic market landscapes. This trajectory signifies not just short-term success, but a sustained ability to seize opportunities, backed by well-informed decision-making and market insights. This strength speaks volumes about the company’s adaptability to changing customer demands and industry trends, rendering it a reliable partner in the pharmaceutical arena. The consistent revenue uptick also reflects the company’s sound business strategies, enabling it to weather economic fluctuations and ensure financial stability.

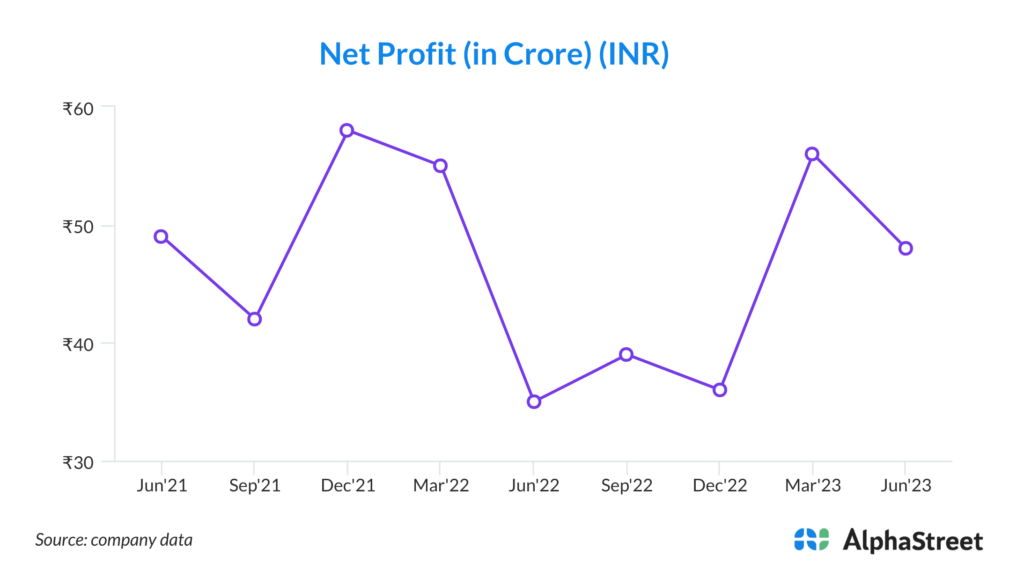

- Effective Cost Management: The impressive 26% surge in EBITDA showcases Aarti Drugs’ mastery in managing costs efficiently. This proficiency is indicative of a sophisticated internal control system, where the company leverages resources judiciously to maximize operational efficiency. The result is not just improved profitability but also enhanced competitive advantage, allowing the company to allocate resources towards innovation, expansion, and strategic initiatives. This financial acumen enables Aarti Drugs to stay agile in a sector characterized by cost fluctuations and market uncertainties, positioning it as a frontrunner in the pharmaceutical landscape.

- Strategic Diversification: Aarti Drugs’ strategic expansion into the dermatology product segment and backward integration demonstrates its forward-thinking approach. This diversification strategy showcases the company’s ability to identify evolving market trends and act on them to secure future revenue streams. By expanding its product portfolio and incorporating backward integration, Aarti Drugs sets itself up for increased control over supply chains and pricing, which in turn bolsters its competitive stance. This proactive approach to diversification minimizes risks associated with relying on a single revenue source, while maximizing the potential for sustained growth and profitability.

- Global Market Penetration: The company’s emphasis on regulatory filings and export capacity enhancement signifies a savvy approach to global market penetration. This strength lies in its ability to navigate complex international regulations and cultivate partnerships in foreign markets. The focus on regulatory compliance not only facilitates international expansion but also underscores Aarti Drugs’ commitment to delivering high-quality pharmaceutical products across borders. The export capacity enhancement further aligns with the growing global demand for pharmaceuticals, positioning the company to tap into diverse markets, diversify its customer base, and drive long-term growth on a global scale.

- Positive Market Outlook: Despite challenges in the specialty chemicals sector, Aarti Drugs maintains an unwaveringly positive market outlook, projecting robust growth across all segments. This optimism signifies the company’s confidence in its strategic initiatives, operational capabilities, and market positioning. Such positivity resonates with investors, stakeholders, and customers alike, fostering trust and reinforcing Aarti Drugs’ reputation as a resilient player in the pharmaceutical industry. This strength serves as a guiding light, encouraging the company to forge ahead despite market headwinds, capitalize on opportunities, and continue its upward trajectory.

- Capacity Expansion Impact: The successful completion of the Metformin expansion, coupled with a gradual expansion plan for Gliptins, underscores Aarti Drugs’ commitment to meeting rising market demands. This capacity expansion strategy not only showcases the company’s proactive approach but also its readiness to cater to evolving customer needs. The Metformin expansion, despite causing a temporary volume dip, sets the stage for sustained growth in sales and market presence. Additionally, the calculated expansion plan for Gliptins aligns with the company’s long-term vision of gradual leadership in this segment. Overall, these expansion endeavors position Aarti Drugs as an industry leader, poised to capture market opportunities with expanded capabilities and resources.

Key Challenges:

- Dependency on Raw Materials: A significant risk for Aarti Industries lies in its reliance on raw materials, such as chemicals and petrochemicals, to produce its diverse range of products. Fluctuations in raw material prices can impact production costs and profitability. Additionally, disruptions in the supply chain due to geopolitical tensions or unforeseen events can disrupt operations. The company must actively manage these risks through effective procurement strategies, supplier diversification, and hedging mechanisms to mitigate potential adverse effects on its financial performance.

- Regulatory Compliance and Environmental Concerns: Aarti Industries operates in a highly regulated sector, subject to strict environmental and safety regulations. Non-compliance with these regulations could lead to penalties, legal actions, and reputational damage. The company’s operations also involve handling hazardous chemicals, which poses potential environmental risks. Demonstrating consistent adherence to regulatory standards, implementing robust safety protocols, and investing in environmentally friendly practices are crucial to mitigate these concerns and maintain its social and environmental responsibilities.

- Global Economic Uncertainty: The company’s extensive export operations expose it to the volatility of global markets. Economic slowdowns, trade disputes, or currency fluctuations in key markets can impact demand for Aarti Industries’ products, potentially affecting revenue and profitability. To address this risk, the company should diversify its customer base across regions and continuously monitor economic indicators to adjust its strategies in response to market conditions.

- Competitive Landscape: Aarti Industries operates in a competitive industry where technological advancements and market innovations can quickly disrupt market dynamics. Rival firms might develop similar or more advanced products, posing a threat to the company’s market share and pricing power. Continuous investment in research and development, innovation, and maintaining strong customer relationships will be critical to staying ahead of competition and ensuring sustained growth.