“The Business outlook remains positive, in spite of some short-term headwinds due to the macro conditions. We continue to see growth reaffirming the focus on the areas of business, clients and geographies that we have been pursuing.”

– Balaji Viswanathan, Chief Executive Officer

Stock data

| Ticker | EXPLEOSOL |

| Exchange | BSE and NSE |

| Industry | IT- Software |

Price Performance:

| Last 5 days | +0.51% |

| YTD | +28.92% |

| Last 1 year | +8.09% |

Company description:

Expleo Solutions Ltd is an India-based software service provider primarily delivering software validation and verification services to the BFSI industry worldwide. It is backed by the Expleo group, which is predominantly an ER&D service provider dominant in the European region.

Service Offerings:

The company offers various testing services for BFSI viz. test management, functional testing, non-function testing, product testing, compliance testing, UX/CX testing, mobile testing and managed testing services. It also offers big data technologies viz. big data development, big data testing and big data administration.

Revenue Breakup:

In FY23, the company earned ~76% revenues from time & material contracts and the rest ~24% from fixed bid contracts with clients.

Geographical Breakup:

In Q4 FY23, Europe accounted for 48% revenues, followed by India, Middle East and Australia (41%) and USA (11%).

Revenue from New Customers

During Q4 FY23, Expleo added over 25 new customers. In FY22, New client acquisition contributed 7% to revenue and the repeat business from existing clients is 93% of revenue. Revenue from Group clients was 20%.

Capex:

During FY22, the Company incurred capital expenditure of Rs. 37cr., which comprised 14 cr. on building & lease, 11 cr. on technology infrastructure, 12 cr. on physical infrastructure and the balance on intangible asset addition.

Takeover of Lucid Technologies:

On 25th March 2022, the company signed an agreement with Lucid Technologies and Solutions Private Limited and its subsidiary Lucid Technologies and Solutions LLC towards the purchase of Lucid’s specific assets, i.e. Intellectual Property and technical knowhow in India and Customer Contracts in the US.

Lucid is a leader in data governance, data protection and analytics. Its clients include Fortune 500 and unicorns across BFSI, healthcare, software hi-tech, retail and manufacturing.

Merger of Expleo Group Companies:

In FY22, Company initiated the process of merger of Expleo India Infosystems Private Limited (EIIPL), Expleo Technologies India Private Limited (ETIPL), Expleo Engineering India Private Limited (EEIPL) and Silver Software Development Centre Private Limited (SSDCPL) with Expleo Solutions Limited (ESL). Co. has filed with NCLT and expects to close this transaction in FY23.

This consolidation will strengthen the company’s position as end-to-end engineering, consulting and technology services provider across industries and a digital transformation partner.

Delivery And Training Centre:

The company is launching its sixth delivery and training centre in Coimbatore, Tamil Nadu. The new centre will contribute to growth and help support client’s transformation programmes across industries. It can host up to 400 employees who will be trained and upskilled to deliver innovation and improve performance in futuristic technologies such as Artificial Intelligence, Machine Learning IoT, Low Code & Automation.

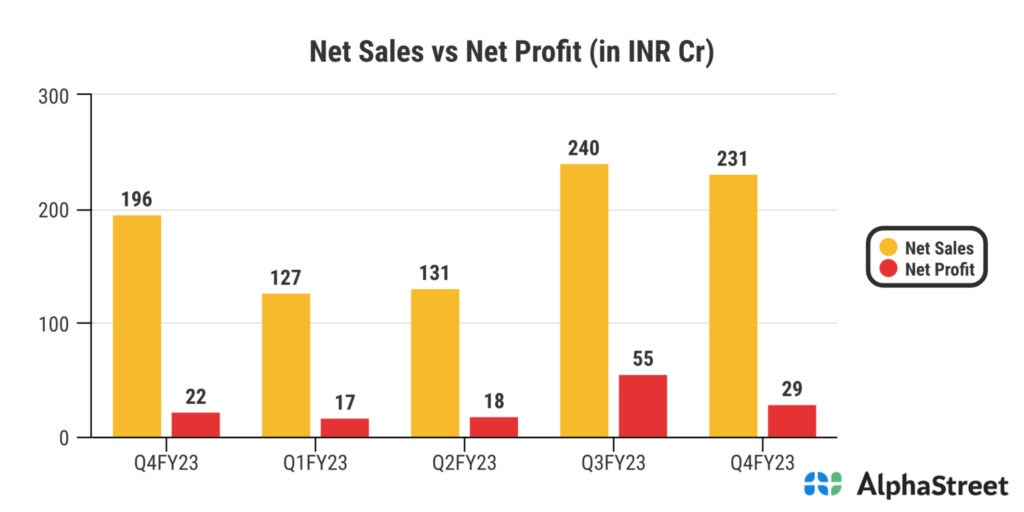

Financials:

What we like:

- Ambitious management team with years of experience:

The company is a part of the 1.1 billion Expleo Group which is present in over 25 countries, predominantly in the USA, UK, France, Germany and other European Countries. The change in leadership happened in 2020 at parent level with intention to grow the outsourcing. Currently, the management is firm that the demand environment is strong and traction is witnessed across geographies and the same is expected to continue in the medium term.

- The company has strong financials, sustainable margins and high return ratios:

As of March 2023, the company has ROCE of 43% and ROE of 34%. The EBITDA margin for y\the year was 22.2% while the PAT margin was 14.8% which by far are robust numbers for any IT company. The company also holds cash of Rs 156 crores on its sheet while the company being virtually debt free is an icing on the cake.

- Operational in niche space:

Unlike other big IT firms, expleo solutions operates in Quality analysis and testing and the company is well placed to capture the buoyancy in the QA space aided by increased outsourcing from parent + investments in capabilities and front end.

Factors to consider:

- The attrition of the company still remains high at 27-28% which affects the employee profitability of the company.

- Since the company’s major revenue earnings are from Europe, which already is heading towards a recession phase. Therefore, any slowdown in the European market can hamper the growth of the company.

- The company operates in an industry where the barrier to entry is very low. Also the competition is very intense. Hence it is very difficult to sustain a moat.