Stock Data

Ticker: JINDALSTEL

Exchange : NSE

BSE: 532286

Industry: Steel and Energy

Price Performance

Last 7 days 3.01%

YTD 0.11%

Last 12 months -10.46%

The stock of JSPL has witnessed a 26% fall within a month. The main factors triggering this are Government’s Calibration of Customs Duty and Multiple Downgrades by Brokerage Firms.

Jindal Steel and Power Limited is an Indian steel company. The company has its corporate office in New Delhi, India. The company has its operations worldwide. The Founder of JSP is O P Jindal. It is one of the largest steel producers in India with a turnover of more than $7.6 billion. With unmatched quality and innovation the company has become a major player in the steel industry. It has a dominant presence in steel, power, mining and infrastructure sectors. The product portfolio includes rails, parallel flange beams and columns, Plates and coils, Angles and channels, Wide Rods, Round Bars, Speed floors, Jindal Panther TMT, Jindal Panther Cement, Fabricated Sections, Semi finished products.

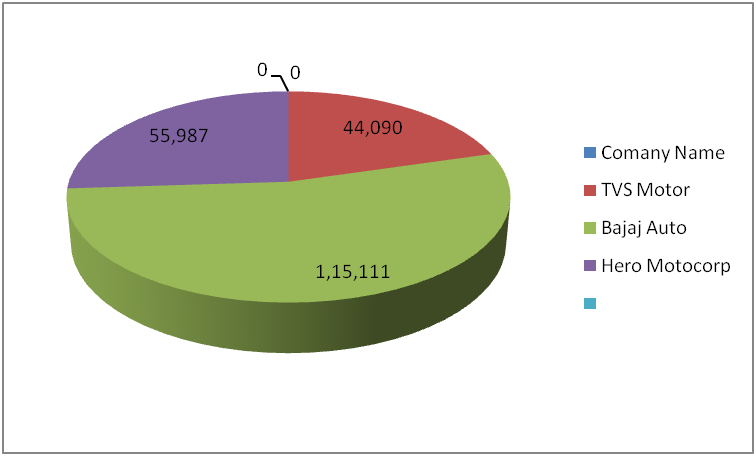

Shareholding Pattern in Percentage

The earnings snapshot is as follows: For Q1 FY23 production stood at 1.99mt. It declined 6% lower Q-o-Q and was marginally lower on a Y-o-Y basis. The company has reported sales of 1.74mt during the quarter, declined 16% Q-o-Q and improved (+8% Y-o-Y). Total export accounted for 26% of sales. Gross revenues stood at INR 14,541Crores, declined by 7% Q-o-Q and improved 27% Y-o-Y. Adjusted EBITDA stood at INR 2,993 Crores. It increased by 3% Q-o-Q but declined 32% Y-o-Y. Adjusted Profit after tax declined by 23% Y-o-Y , improved 5% Q-o-Q to INR 1,929 Crores.

The company aims to become Net Debt free by end of FY23. The company is targeting to support growth, increasing raw material security, and lower the cost of production. It is continuously working on its goal to enhance stakeholder value.

The India Operation is mainly expanded in Chattisgarh, Orissa and Jharkhand. The company has concentrated on infrastructure development. JSP has set up integrated Steel Plant in Angul, Pellet Plant in Barbil in Orissa. In Chhattisgarh & Jharkhand it has integrated steel plant in Raigarh, Integrated Steel Fabrication Plant in Punjipatra. It has also set up heavy machinery division in Raipur. Wrm & Brm has been set up in Patratu, Jharkhand.

The Global operation mainly expands in Australia and Africa. JSPML acquired a majority stake in Wollongong Coal Limited a company registered in Australia. At present JSP holds a 60.38% stake in WCL through its subsidiary, JSPML. In Q1 FY23 Russel Vale mine produced 138 KT ROM. The production increased 10% Q-o-Q. Dispatches also increased 8% Q-o-Q to 79KT. EBITDA stood at US$3mn for the quarter.

The operation expands in South Africa and Mozambique. The Mozambique: Chirodzi mine produced 0.93 MT ROM. The production declined 11% Q-o-Q, and 1% YoY. However, coking coal stood at 197 KT. It increased 25% Q-o-Q and 36% Y-o-Y. Kiepersol mine in South Africa reported production of 146 KT ROM. It increased 12% Q-o-Q, and declined 1% Y-o-Y. Reported EBITDA of US$11mn for the quarter.

JSPL has decided to expand the capacity of its Orissa steel plant to 25.2 MTPA at Angul by 2030. This would be the world’s largest and greenest steel plant in India. It has also decided to set up a multi-specialty hospital at Angul . The construction will start by June this year.

JSP has collaborated with GIFLO Steel – Hungary to install first Rail Wheelset manufacturing plant at Raigarh , Chhattisgarh. The MOU of this collaboration has been signed on 27 May 2022. The initial capacity will be 25,000 Wheelsets per year.

Peer Comparison

| Company | Market Cap | P/E ratio | P/B | Div Yield |

| Tata Steel Ltd | 1,31,436.63 | 3.27 | 1.12 | 4.74 |

| Jindal Steel And Power Ltd | 39,686.53 | 6.9 | 1.28 | 0.77 |

Based on the following parameters from the investor perspective Tata Steel Ltd is in a better position because the lower the P/E ratio, it is better for both the business and potential investors.

Our View

JSPL is constantly investing in new plants. This year it has won tenders for three out of five coal blocks auctioned by the central government. This was a lucrative deal for JSPL. But due to the prevailing factors metal stocks are falling and JSPL, is also a victim of the trend.