Embassy Office Parks REIT (NSE: EMBASSY; BSE: 542602), India’s first listed real estate investment trust and Asia’s largest office REIT by area, reported strong financial and operational performance for the third quarter and nine months ended December 31, 2025, supported by sustained leasing momentum and disciplined capital management.

The REIT owns and operates more than 50 million square feet of premium office space across Bengaluru, Mumbai, Pune, NCR and Chennai, serving roughly 280 global and domestic occupiers. Its current market capitalization was not disclosed in the earnings materials.

Financial & Operational Performance

- For Q3 FY2026:

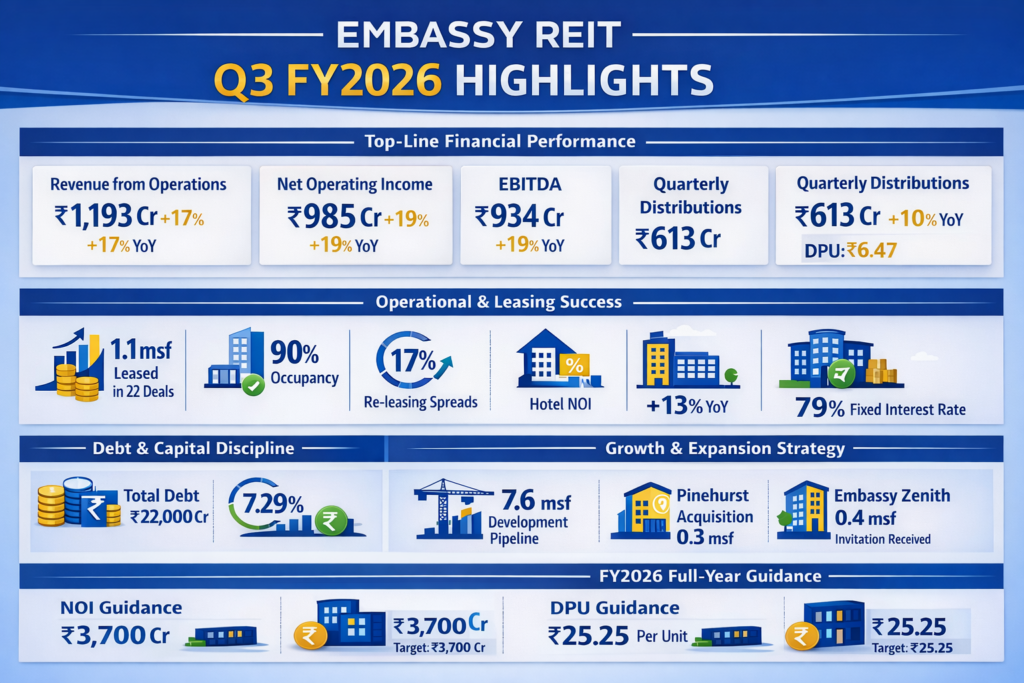

- Revenue from operations rose 17% year-on-year to ₹1,193 crore.

- Net operating income (NOI) increased 19% to ₹985 crore.

- Quarterly distributions climbed 10% YoY to ₹613 crore, or ₹6.47 per unit.

- For the nine-month period:

- Revenue grew 14% YoY to ₹3,378 crore.

- NOI rose 16% to ₹2,784 crore.

- Cumulative distributions reached ₹1,780 crore.

- Leasing activity remained robust, with 1.1 million square feet (msf) signed across 22 deals during the quarter, taking year-to-date leasing to 4.6 msf.

- Portfolio occupancy stood at about 90% by area and 94% by value, while new leases achieved 17% re-leasing spreads and were signed at an average 5% premium to market rents.

Business & Operational Highlights

- During the quarter, Embassy REIT delivered a fully leased 0.4 msf office block in Chennai and launched a 0.8 msf redevelopment at Embassy Manyata in Bengaluru with an estimated 23% yield on cost.

- The REIT also expanded its hospitality footprint with a proposed 116-key hotel in Pune and completed a ₹530-crore divestment to recycle capital.

- Strategic growth included a third-party acquisition of a 0.3 msf office building at Embassy GolfLinks and an invitation to acquire Embassy Zenith, a 0.4 msf prime office tower in Bengaluru.

Industry Context & Market Metrics

- India’s office market continues to benefit from global capability center (GCC) expansion, cost advantages and a large STEM talent pool.

- Portfolio market rents increased about 9% YoY, while hospitality segment NOI rose 13% amid improved hotel occupancy and room rates.

- Technology and co-working sectors together accounted for a large share of leasing demand, reflecting evolving workplace strategies and sustained global outsourcing trends.

Management Commentary & Strategy

- Chief Executive Officer Amit Shetty said the quarter was driven by strong leasing momentum and robust demand from multinational occupiers.

- Management highlighted disciplined financial execution, noting a reduction in average debt cost to 7.29% and a diversified ₹22,000-crore debt book with AAA/stable ratings.

Geographic Footprint, Customers & Investor Sentiment

- Bengaluru remained the REIT’s core market, contributing more than two-thirds of leasing activity, while Chennai saw rising traction from large global firms.

- The REIT hosts tenants across technology, co-working, consulting, engineering, healthcare and financial services.

- A diversified investor base and approximately 25% total returns in calendar 2025 reflect strong market sentiment and growing institutional participation.

Outlook & Guidance

- Management reaffirmed FY2026 guidance, targeting double-digit growth in NOI and distributions per unit, with occupancy expected to trend toward pre-pandemic mid-90% levels over time.

- 7.6 msf development pipeline and potential acquisitions are expected to drive long-term expansion.

Summary

Embassy Office Parks REIT delivered another quarter of steady growth supported by strong leasing demand, rising rents and strategic capital deployment. With a large development pipeline, disciplined acquisitions and favourable structural drivers in India’s office market, the REIT appears positioned for sustained income growth and stable distributions in the coming years.