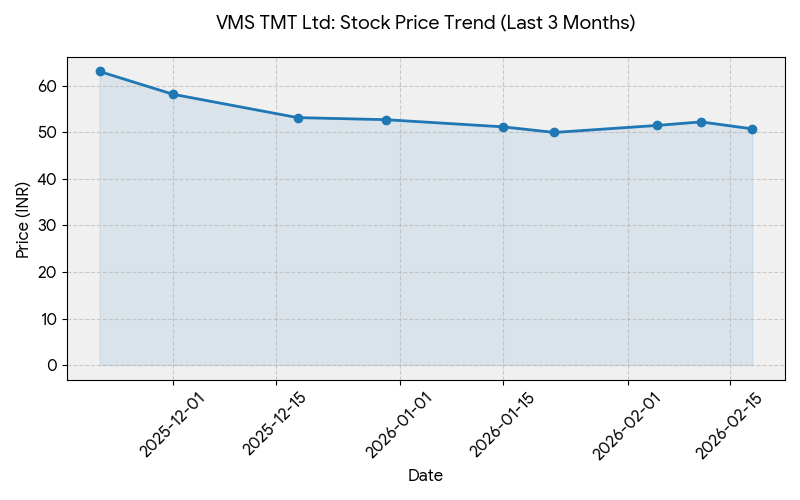

VMS TMT Ltd (NSE: VMSTMT; BSE: 544521) shares closed at 50.76 Indian rupees on Wednesday, representing an intraday decline of 0.78%. The stock fluctuated between a high of 51.31 rupees and a low of 50.50 rupees during the session.

Market Capitalization

The company’s market capitalization stood at 2.52 billion Indian rupees ($30.4 million) at the close of trading on February 18, 2026.

Latest Quarterly Results

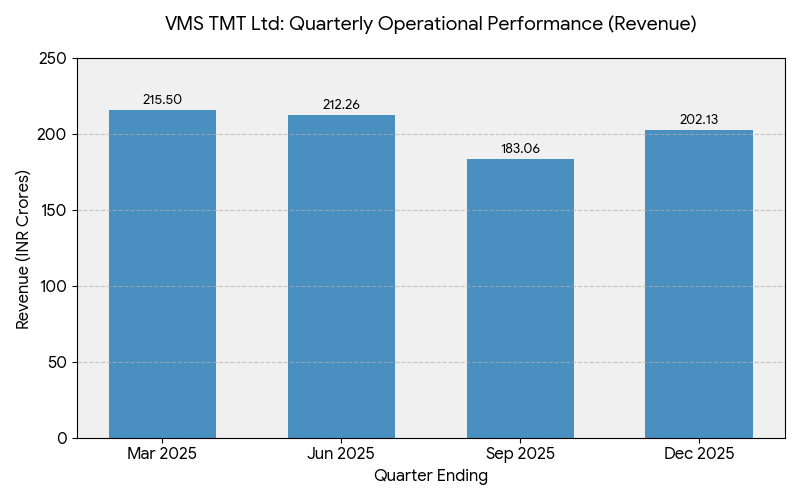

VMS TMT reported a consolidated revenue of 202.13 crore rupees for the third quarter ended December 31, 2025, a sequential increase of 10.42% from 183.06 crore rupees in the second quarter. Net profit for the period was 8.04 crore rupees, compared to 2.13 crore rupees in the preceding quarter. Year-on-year comparisons are unavailable as the company listed on the exchanges in September 2025.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) for the quarter was 17.15 crore rupees, with an EBITDA margin of 8.48%.

Segment Highlights

- TMT Bars: This core segment continues to represent approximately 96% of total revenue.

- Allied Products: Revenue from billets, binding wires, and scrap contributed the remaining share of the top line.

FINANCIAL TRENDS

Nine-Month Overview

For the nine-month period ended December 31, 2025, VMS TMT reported total revenue of 597.45 crore rupees. Cumulative net profit for the same period stood at 18.74 crore rupees. Directional trends indicate a sequential recovery in the third quarter following a contraction in the second quarter.

Business & Operations Update

The company confirmed the stabilization of its billet (CCM) facility, which has facilitated backward integration and cost control. VMS TMT operates a distribution network consisting of 227 dealers and three distributors primarily within Gujarat. Progress remains ongoing for the 15 MW captive solar power project intended to reduce long-term energy expenditures.

M&A or Strategic Moves

VMS TMT reported the full repayment of selected loans using 11 crore rupees from IPO proceeds. On February 4, 2026, the company received a no-dues certificate from SVC Bank.

Q&A Session Focal Points

During the earnings discussion, Varun Manojkumar Jain, Chairman and Managing Director, addressed several operational queries:

- IPO Fund Utilization: Management addressed a deviation of 2.81 crore rupees flagged by monitoring agencies. Response: The funds were temporarily placed in a cash credit account and have since been utilized for the intended loan closures as of February 2026.

- Capacity and Utilization: Questions regarding the Bhayla plant efficiency. Response: Automation and process optimization at the plant improved operating leverage during the third quarter.

- Market Expansion: Queries on geographic concentration. Response: The company maintains its focus on Gujarat via its retail license agreement for the “Kamdhenu NXT” brand.

Guidance & Outlook

Management identified infrastructure-driven demand and housing projects as primary drivers for the medium term. Factors to watch include the completion timeline of the solar power project and the impact of raw material price volatility on integrated margins.

Performance Summary

VMS TMT stock moved down 0.78% to 50.76 rupees. The company reported 202.13 crore rupees in revenue and 8.04 crore rupees in net profit for the third quarter. Recovery in the TMT segment and progress in captive power remain central to the operational update.