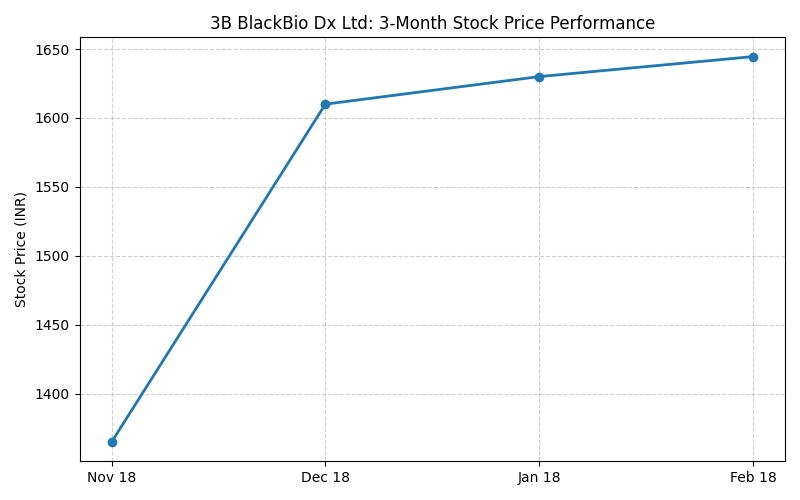

3B BlackBio Dx Ltd (BSE: 532067), formerly known as Kilpest India Limited (KILPEST), closed at 1,612.45 on February 18, 2026, marking an intraday increase of 0.87% on the Bombay Stock Exchange.

Market Capitalization

As of the market close on February 18, 2026, the company’s market capitalization stands at INR 1,384.20 crore.

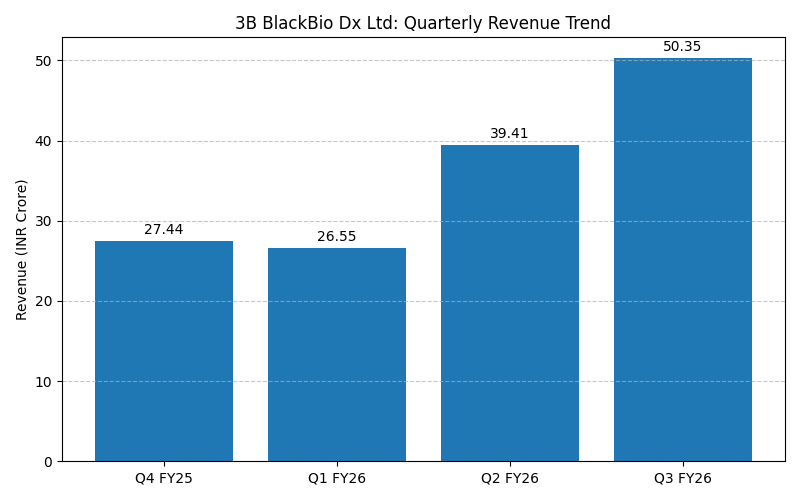

Latest Quarterly Results

3B BlackBio Dx reported consolidated revenue of INR 50.35 crore for the third quarter ended December 31, 2025 (Q3 2026), compared to INR 25.39 crore in the corresponding period of the previous year. Consolidated net profit for the period was INR 22.44 crore, representing a 66.30% year-over-year increase from INR 13.50 crore.

The company’s performance was categorized into the following segments:

- Molecular Diagnostic Kits: This segment generated revenue of INR 48.68 crore, compared to INR 23.28 crore in Q3 2025.

- Agrochemicals: Revenue for this segment was reported at INR 1.67 crore for the quarter.

- Coris Holding SRL (Acquired Subsidiary): The recently acquired Belgian subsidiary contributed INR 24.01 crore to consolidated sales and INR 7.00 crore to consolidated profit.

FINANCIAL TRENDS

Nine-Month Overview

For the nine months ended December 31, 2025, consolidated revenue reached INR 106.48 crore, reflecting a growth trend compared to INR 73.97 crore in the previous year. Net profit for the nine-month period stood at INR 50.13 crore, an increase from INR 39.66 crore reported in the prior-year period.

Q&A Session Focal Points

During the investor conference call, management addressed inquiries regarding the integration of the Coris acquisition and operational scale:

- Impact of Coris Acquisition: Managing Director Dhirendra Dubey stated that the integration of Coris Holding SRL has expanded the company’s diagnostic capabilities in international markets, contributing significantly to the quarter’s consolidated top line.

- Operating Margins: Management noted that while raw material costs increased to INR 13.67 crore, the diagnostic segment’s scale helped maintain operational stability.

- Agrochemical Strategy: The executive team clarified that the agrochemical business remains a seasonal component of the portfolio, with current focus directed toward high-growth molecular diagnostics.

Business & Operations Update

The company officially changed its name to 3B BlackBio Dx Limited to reflect its primary focus on the molecular diagnostics sector. In December 2025, a promoter, Mahesh Kumar Upadhyay, sold 400 equity shares through open market operations, though his total holding percentage remained effectively stable at 0.28%.

M&A or Strategic Moves

The consolidation of Coris Holding SRL, Belgium, which was completed in late August 2025, served as the primary driver for the expansion in consolidated revenue this quarter. The company incurred one-time M&A advisory fees of INR 1.39 crore over the nine-month period related to this transaction.

Guidance & Outlook

What to watch for:

- Integration of Belgian operations into the global supply chain.

- Regulatory approvals for new diagnostic kits under CE IVDR standards.

- Seasonality trends in the agrochemical segment during the upcoming monsoon cycle.

Performance Summary

3B BlackBio Dx stock closed up 0.87% today following the release of its Q3 2026 results. The company reported a 98.30% rise in consolidated revenue and a 66.30% increase in net profit, largely supported by the inclusion of Coris Holding SRL and growth in the molecular diagnostic kits segment.