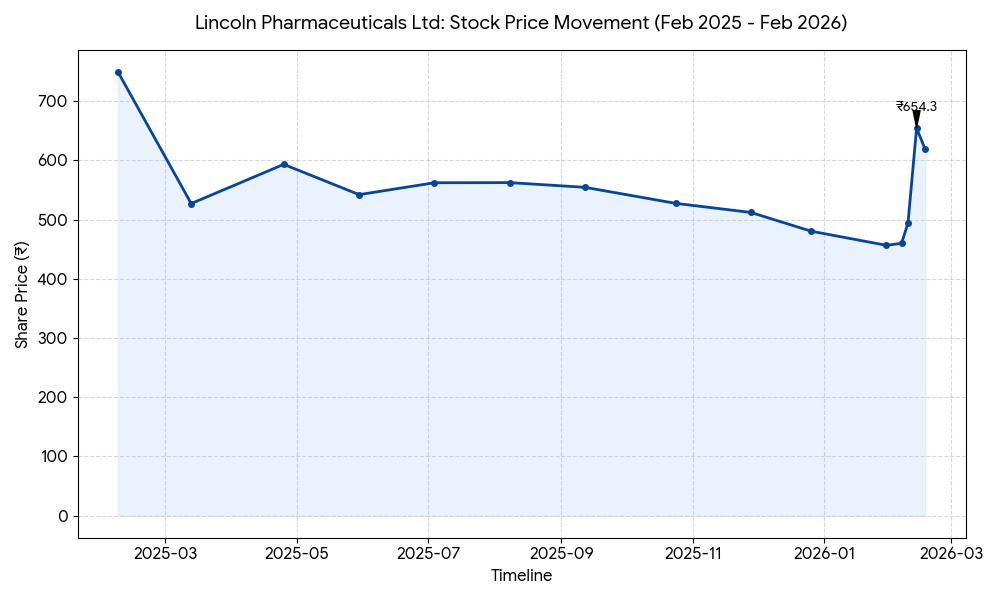

Lincoln Pharmaceuticals Ltd (LINCOLN:NSE, 531633:BSE) shares closed at ₹618.60 on Wednesday, representing a 1.26% decline from the previous session’s close. The pharmaceutical manufacturer’s equity performance follows the release of its financial results for the quarter ended December 31, 2025 (Q3 2026).

Market Capitalization

As of February 18, 2026, the market capitalization of Lincoln Pharmaceuticals stands at ₹1,239.09 crore ($149.6 million).

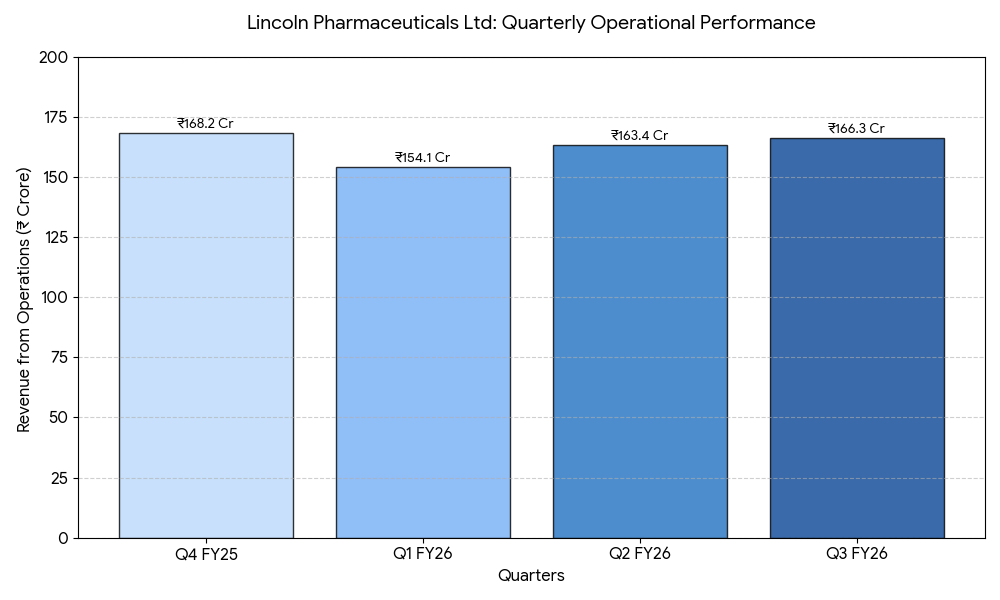

Latest Quarterly Results

Lincoln Pharmaceuticals reported consolidated revenue from operations of ₹166.32 crore for the third quarter of fiscal year 2026, a 13.49% increase compared to ₹146.55 crore in the same period last year. Consolidated net profit for the quarter rose 37.70% year-on-year to ₹28.60 crore, up from ₹20.77 crore.

Earnings before interest, tax, depreciation, and amortization (EBITDA) reached ₹38.74 crore, up 18.73% from ₹32.63 crore. The company does not report specific revenue under O2C, Digital, or Retail segments. Its operations are unified under the pharmaceutical formulations business, with a focus on chronic therapies and export markets.

FINANCIAL TRENDS

Nine-Month Overview

For the nine months ended December 31, 2025 (9M FY26), consolidated revenue from operations reached ₹483.75 crore, compared to ₹455.05 crore in 9M FY25. Net profit for the nine-month period stood at ₹76.26 crore, an increase from ₹70.77 crore in the previous year. Financial indicators for the nine-month period reflect a trend of growth in both revenue and profitability.

Business & Operations Update

The company maintained a portfolio of over 1,700 registered products across 15 therapeutic segments. Managing Director Mahendra Patel confirmed the company’s focus on the cardiac, diabetic, dermatology, and ENT segments. On January 9, 2026, CRISIL Limited reaffirmed the company’s long-term credit rating at CRISIL A/Stable and short-term rating at CRISIL A1.

Q&A Session Focal Points

During the discussions following the results announcement, management addressed several operational aspects:

- Revenue Targets: Management reiterated a target of reaching ₹1,000 crore in revenue within the next three years.

- Margin Sustainability: Director Munjal Patel noted that a better product mix and operating discipline supported the current quarter’s profit growth.

- Expansion Strategy: The company is focusing on increasing its presence in regulated markets and high-value product lines.

- Financial Risk: Management highlighted a debt-free balance sheet and a net worth of approximately ₹671 crore as of the last audited period.

Guidance & Outlook

Management indicated an objective of sustaining a 15-18% annual growth rate. Factors to watch include the expansion into new geographical markets and the development of over 700 products currently in the pipeline. The company’s performance remains subject to regulatory environments in both domestic and export markets.

Performance Summary

Lincoln Pharmaceuticals stock ended the day down 1.26% at ₹618.60. Third-quarter net profit increased by 37.70% to ₹28.60 crore on a 13.49% rise in revenue. The company maintains a debt-free status and is targeting continued expansion in chronic therapy segments.