Current Status Overview

Indo Count Industries Limited is a listed home textile manufacturer focused on bed linen and utility bedding products. The company operates manufacturing facilities in India and maintains distribution operations in the United States. The board approved unaudited financial results for the quarter and nine months ended 31 December 2025. Recent performance reflects demand moderation in key export markets. Operational focus remains on branded offerings and capacity utilization.

Share Price Performance

As of the latest trading session, the company’s shares traded at approximately ₹303.4. The stock has recorded a 52-week range between ₹213.5 and ₹355.5. Recent months show moderate volatility in line with broader mid-cap textile stocks. Trading volumes have remained within historical averages. Market capitalization remains reflective of mid-sized textile sector positioning.

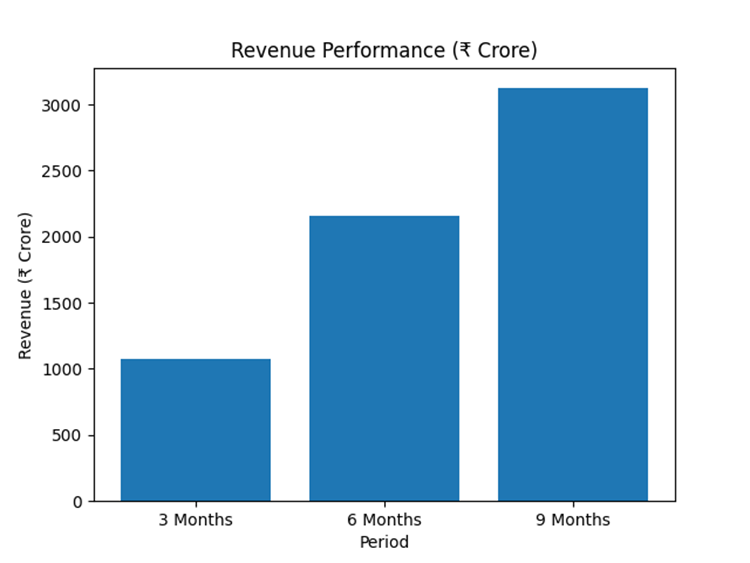

Revenue Performance

Revenue for the last three months (Q3 FY26) stood at ₹1,074.24 crore. Revenue for the last six months totaled ₹2,155.80 crore. Revenue for the nine months ended December 2025 reached ₹3,123.00 crore. The data indicates moderation compared to earlier periods. Sequential trends reflect ongoing global demand adjustments.

Revenue Chart

Market Analysis

The company operates within the global home textile and bedding industry. Export exposure to the United States remains significant. Industry conditions are influenced by tariff structures, raw material prices, and currency movements. Competition includes domestic manufacturers and international suppliers. Demand trends show cautious retail inventory management in key markets.

Analyst Commentary

Recent analyst commentary reflects downward revisions in revenue and earnings estimates following quarterly performance. Forecasts indicate moderated near-term growth expectations. Coverage remains limited to select brokerage firms. No major rating changes have been publicly reported in the latest cycle.

Mergers & Acquisitions

The company previously expanded through acquisitions in the United States to strengthen its utility bedding presence. No new mergers or acquisitions have been reported in the latest quarter.

Outlook

Management commentary indicates continued focus on cost controls and operational efficiency. Future performance remains linked to global retail demand recovery. Integration of prior acquisitions remains ongoing. Outlook remains cautious amid prevailing market conditions.