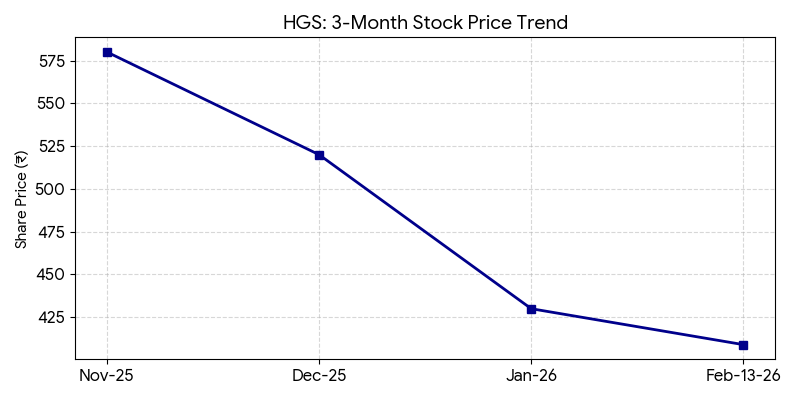

Hinduja Global Solutions Limited (NSE: HGS; BSE: 532859) shares closed 2.27% lower at ₹409.00 on Friday. The company reported a turnaround in its consolidated net profit for the third quarter ended December 31, 2025.

Market Capitalization

As of February 13, 2026, the company’s market capitalization is approximately ₹1,896 Cr.

Latest Quarterly Results

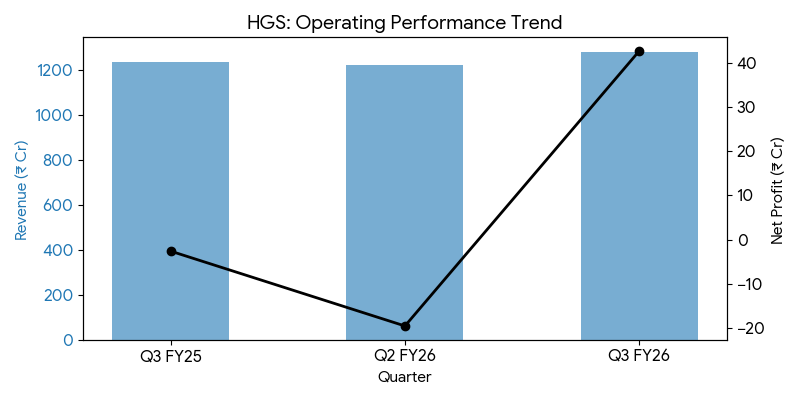

HGS reported consolidated revenue of ₹1,282.73 Cr for Q3 FY26, a 3.88% increase from ₹1,234.87 Cr in the same period last year. Net profit stood at ₹42.58 Cr, recovering from a loss of ₹2.64 Cr in Q3 FY25.

Segment Highlights:

- BPM Services: Core business process management saw a 4.89% sequential revenue growth.

- Standalone Operations: The standalone entity reported a net loss of ₹56.18 Cr.

Full Year Results Context

For the nine-month period ended December 31, 2025, total income reached ₹3,750.41 Cr, down from ₹4,036.46 Cr year-over-year. Net profit for the period dropped to ₹18.52 Cr from ₹102.41 Cr.

Financial Trends

Business & Operations Update

The company noted that operating margins excluding other income remained compressed at 1.58% during the quarter. Other income of ₹116.78 Cr significantly contributed to the consolidated bottom line.

M&A or Strategic Moves

No new mergers or acquisitions were announced during the reporting period.

Equity Analyst Commentary

Brokerages have highlighted the divergence between consolidated and standalone performance. MarketsMOJO noted the lowest operating margins in recent quarters.

Guidance & Outlook

Management is focusing on core BPM operational recovery. Investors are watching for improvement in standalone profitability and margin expansion.

Performance Summary

HGS shares closed at ₹409.00. Q3 revenue grew 3.88% to ₹1,282.73 Cr with a net profit of ₹42.58 Cr. Standalone stress remains a key monitoring point.