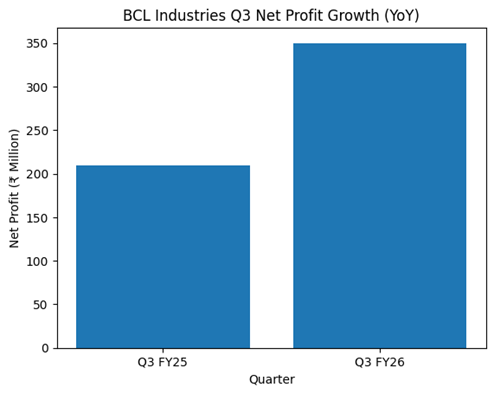

BCL Industries Limited (NSE: BCLIND) reported a consolidated net profit of 350 million rupees for the third quarter ended December 31, 2025, a 69% increase from 210 million rupees in the corresponding period of the previous year.

Total consolidated revenue for the quarter stood at 7.58 billion rupees, compared with 7.63 billion rupees a year earlier, representing a 1% decline.

Quarterly Segment Highlights

The company’s distillery segment reported revenue of 5.13 billion rupees for the quarter. Within this segment, ethanol contributed 62% of revenue, followed by Extra Neutral Alcohol (ENA) at 21%. Potable Maize Liquor (PML) and Dried Distillers Grains with Solubles (DDGS) accounted for 8% and 7%, respectively.

The maize oil extraction and refinery segment recorded revenue of 1.53 billion rupees. The newly separated oil trading vertical generated revenue of 840 million rupees with an EBITDA margin of 1%. Real estate revenue was reported at 18.4 million rupees.

Annual Performance Context

For the full year FY25, BCL Industries reported total revenue of 29.19 billion rupees, compared with 22.09 billion rupees in FY24. Net profit for the full year stood at 1.03 billion rupees, an increase from 960 million rupees in the prior fiscal year. Directional trends indicate revenue and profit growth over the annual period.

Business and Operational Developments

The company is currently executing a 150 kiloliters per day (KLPD) ethanol expansion project at its Bathinda facility. Commissioning for this unit is scheduled for the fourth quarter of FY26. Additionally, the company is preparing to commission a maize oil extraction unit at Svaksha Distillery in the same period.

Operational data shows the distillery units maintained capacity utilization levels near 100% during the third quarter. BCL also registered a 75 KLPD biodiesel plant with Oil Marketing Companies (OMCs) as an approved supplier.

Strategic Moves and Acquisitions

BCL Industries completed the acquisition of Goyal Distillery Pvt Ltd, located in Fatehabad, Haryana. This entity holds approvals for a 250 KLPD grain-based ethanol plant. Following this addition, the company’s total distillery capacity is expected to reach 1,150 KLPD from the current 750 KLPD.

The company also moved to acquire the remaining 25% stake in Svaksha Distillery Limited, which will make it a wholly owned subsidiary. The investment outlay for this transaction is approximately 550 million rupees.

Guidance and Outlook

Factors to watch include the revision of Food Corporation of India (FCI) rice ethanol prices to 60.32 rupees per liter for the 2025-26 supply year. Maize-based ethanol prices remain at 71.86 rupees per liter.

The company’s entry into the Indian Made Foreign Liquor (IMFL) segment is planned within the next two years, following the introduction of premium glass-bottled whiskey.

Performance Summary

Consolidated profit rose 69% year-over-year. Revenue stood at 7.58 billion rupees. Distillery operations maintained 100% capacity utilization. Expansion projects in Bathinda and Haryana are in progress. The company exited the packaged oil business while continuing soft oil refining.