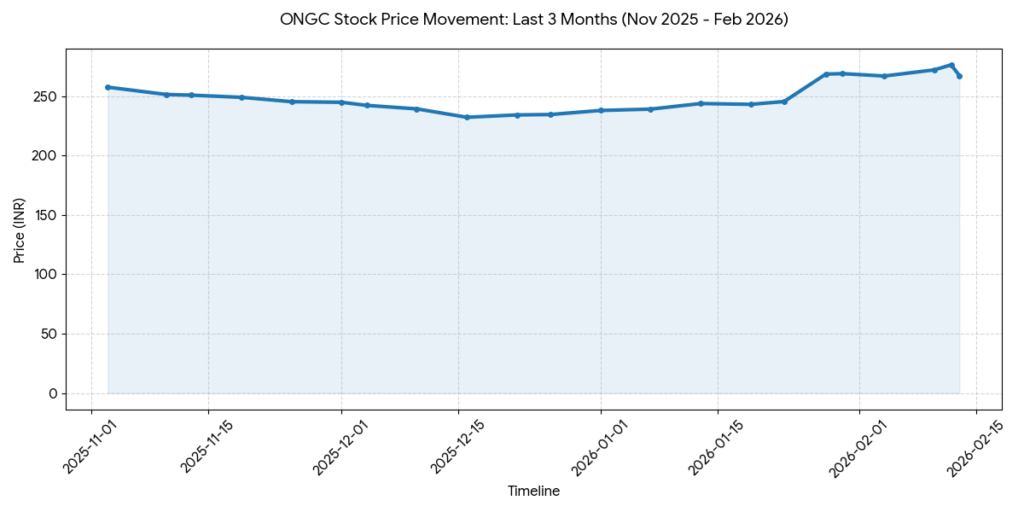

Oil and Natural Gas Corporation Limited (ONGC) shares ended lower on the National Stock Exchange (NSE) and BSE on Friday, following the announcement of its financial results for the quarter ended December 31, 2025. The stock closed at 267.35, representing an intraday decline of 3.26%.

Market Capitalization

As of February 13, 2026, the market capitalization of ONGC stands at INR 3.37 trillion (approximately USD 40.5 billion).

Latest Quarterly Results

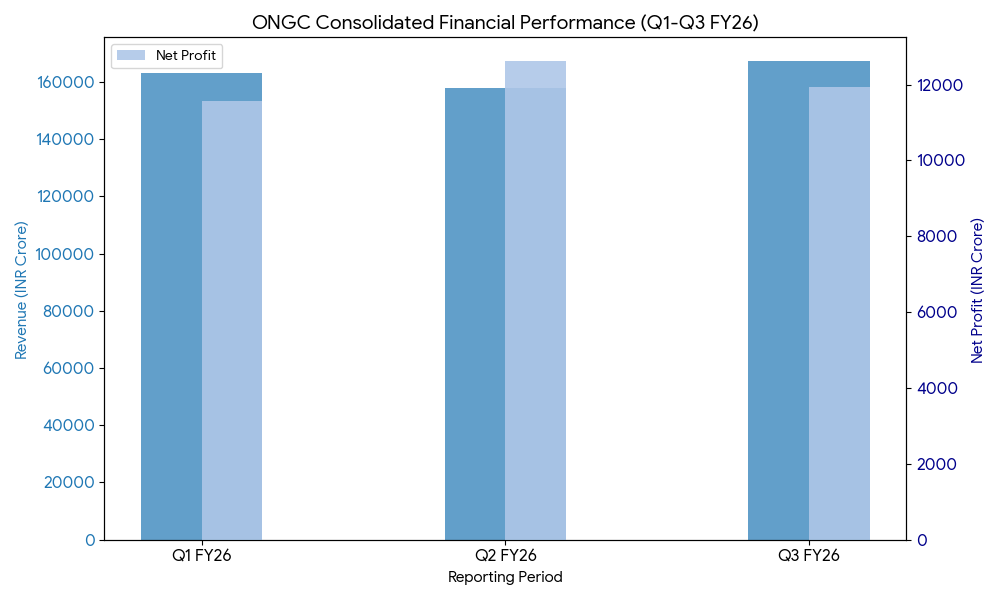

For the third quarter of fiscal year 2026 (Q3 FY26), ONGC reported a consolidated gross revenue of INR 167,213 crore, which remained flat compared to the same period in the previous year. The consolidated net profit for the quarter rose 23% year-over-year to INR 11,946.42 crore, compared to INR 9,746.54 crore in the year-ago quarter.

| Segment | Highlights |

| Oil & Gas | Nominated crude oil realization averaged $61.63 per barrel, down from $72.57. Natural gas sales price improved to $6.59 per mmBtu. |

| Refining (HPCL/MRPL) | Performance impacted by global margin volatility; specific throughput data maintained operational stability. |

| Petrochemicals (OPaL) | Strategic focus on domestic market following Dahej SEZ exit; long-term ethane supply agreement initiated. |

FINANCIAL TRENDS

Nine-Month Results Trend

For the first nine months of the 2026 fiscal year, cumulative revenue reached INR 488,442 crore. Crude oil production registered a marginal growth of 0.35%, while natural gas output remained constant compared to the previous year. Revenue from new well gas increased to INR 5,028 crore, contributing over 18% of total gas sales revenue. Financial data for the nine-month period indicates a directional trend of stability in production volumes and growth in net profitability.

Business & Operations Update

The company spudded its first stratigraphic well, AND-P-1, in the ultra-deepwater region of the Andaman Basin on January 27, 2026. Operationally, ONGC continues development projects at Mumbai High and the KG-DWN-98/2 block. In December 2025, the company signed a 15-year Ethane Unloading, Storage, and Handling (USH) agreement with Petronet LNG to secure feedstock for its subsidiary, OPaL.

M&A and Strategic Moves

In January 2026, ONGC signed a Memorandum of Understanding with Reliance Industries Limited for offshore infrastructure sharing in the Krishna Godavari Basin. Additionally, the company is in advanced negotiations with foreign partners for joint bidding in the tenth round of the Open Acreage Licensing Policy (OALP). The board also approved a second interim dividend of INR 6.25 per share.

Earnings Call Q&A Summary

During the investor conference call on February 13, management addressed the impact of lower crude oil realizations and the ramp-up of gas production at the KG Basin. Focal points included the timeline for reaching peak gas production of 10 mmscmd by mid-2026 and the status of stuck dividends from overseas operations in Venezuela. Discussions also covered capital expenditure plans of approximately INR 32,000 crore and the progress of the 10 GW renewable energy roadmap under ONGC Green Limited.

Guidance & Outlook

Management indicated that investors should monitor the production ramp-up in the KG-DWN-98/2 block and the potential impact of windfall tax adjustments based on global Brent prices. The company is also pursuing feasibility studies for a 1 MMTPA Green Ammonia project targeted for 2030 as part of its transition strategy.

Performance Summary

ONGC stock declined 3.26% today to close at 267.35. Despite the stock move, the company reported a 23% increase in Q3 consolidated net profit to INR 11,946.42 crore, supported by higher realizations from new gas wells. Segment performance showed stability in natural gas output amid a decline in international crude oil prices.