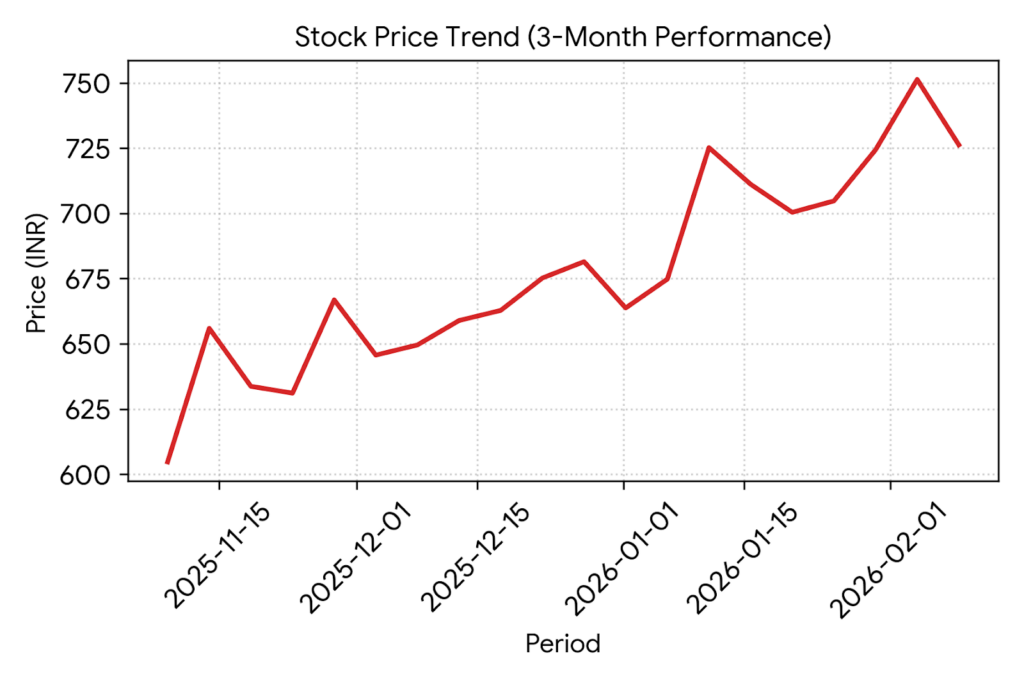

Tinna Rubber and Infrastructure Limited (NSE: TINNARUBR; BSE: 530475) shares closed 5.93% higher on Monday. The stock ended the trading session at ₹747.00 on the National Stock Exchange, following the release of the company’s financial results for the quarter ended December 31, 2025.

Market Capitalization

The company’s market capitalization stood at ₹1,338.39 crores (approximately $161 million) at the close of market hours on February 9, 2026.

Latest Quarterly Results

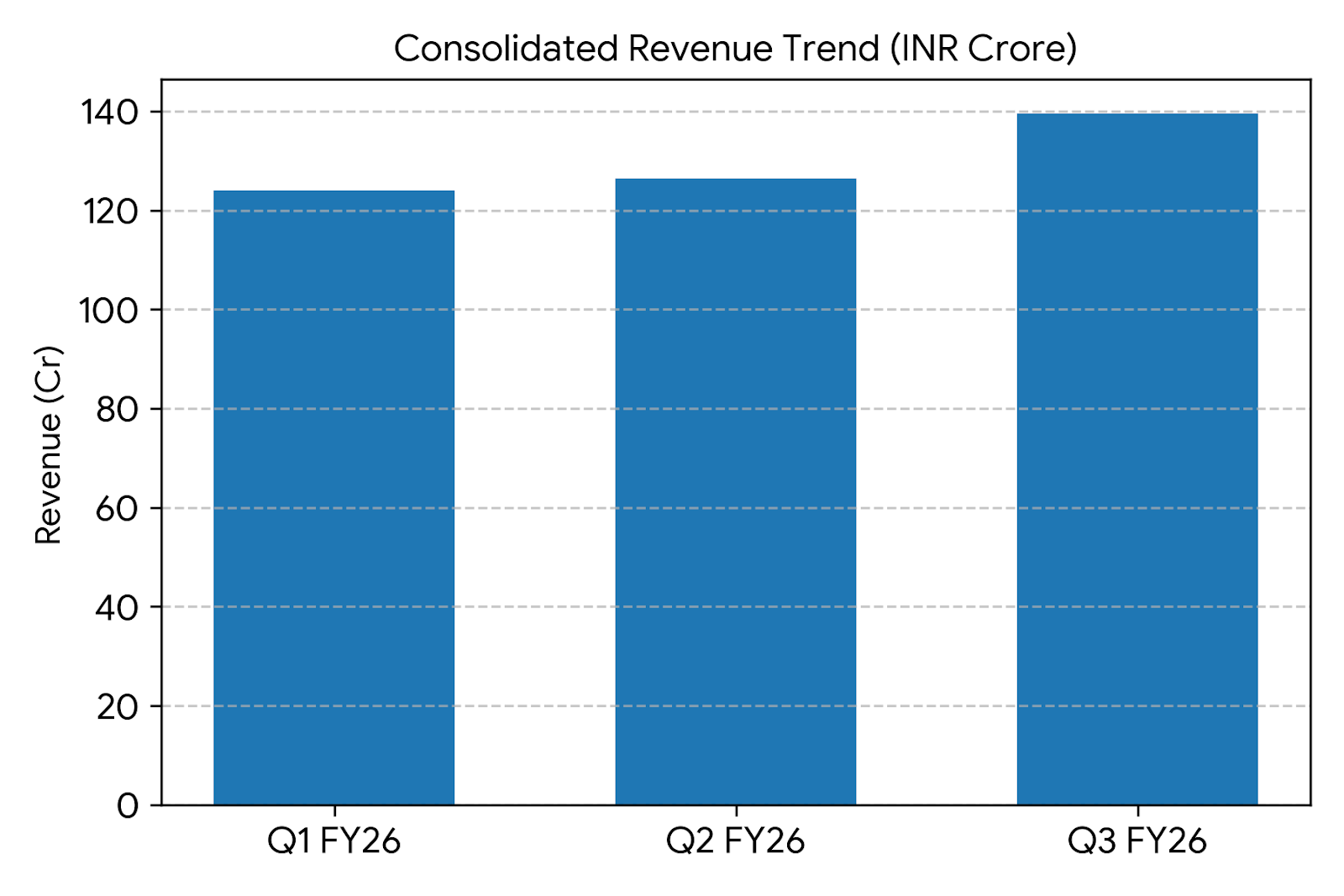

Tinna Rubber reported consolidated revenue from operations of ₹139.48 crores for the third quarter of fiscal year 2026, a 13% increase compared to ₹123.14 crores in the corresponding period of the previous year. Consolidated net profit for the quarter was ₹12.81 crores, representing a 63% increase from ₹7.86 crores in the same quarter last year.

Segment Performance Highlights:

- Infrastructure (Bitumen & Modifiers): CRM sales volume grew 75% year-on-year.

- Industrial (Recycled Rubber): MRP and Reclaimed Rubber volumes increased by 20% and 4%, respectively.

- Steel Scrap: Revenue increased by 6% year-on-year, supported by a 21% increase in sales volume.

- Consumer Goods: Revenue remained stable despite seasonal impacts from monsoon and market liquidity adjustments.

Financial Trends

Full Year Results Context

For the nine-month period ended December 31, 2025, consolidated revenue reached ₹389.87 crores, a 3% increase over the previous year. Consolidated profit after tax for the nine-month period was ₹36.31 crores, showing a 1% contraction compared to the same period in the prior fiscal year. The directional trend in profitability reflects stability despite start-up costs associated with international joint ventures.

Business & Operations Update

The company reported the completion of ₹79 crores in capital expenditure during the first nine months of the fiscal year. An additional ₹50 crores in investment is scheduled for the remainder of the 2026-2027 period. Operational developments include the commissioning of an integrated washing line unit at the Panipat plant. In January 2026, the company secured a work order valued at ₹75.79 crores from Indian Oil Corporation Limited (IOCL) for Crumb Rubber Modifier supply over a two-year period.

M&A or Strategic Moves

Tinna Rubber utilized ₹78.7 crores in proceeds from a Qualified Institutional Placement (QIP) for debt reduction (₹23 crores), solar power expansion (₹10.5 crores), and new projects in Pyrolysis and Recovered Carbon Black (₹22.42 crores). The South African joint venture, Mbodla Investments, is projected to reach break-even status by March 2026.

Equity Analyst Commentary

Institutional research highlights the focus on margin expansion through the reduction of low-margin commoditized products. Attribution is given to the improvement in the net debt-to-equity ratio following QIP deployment. Reports indicate domestic and Oman facility capacity utilization stood at 74% and 78%, respectively, during the reporting period.

Guidance & Outlook

The company’s “Vision 2028” targets a revenue milestone of ₹1,000 crores by the end of fiscal year 2028. Management has outlined a target to increase export volumes by 30% by the end of the fourth quarter of fiscal 2026. The commissioning of the Saudi Arabia facility is scheduled for mid-fiscal 2027.

Performance Summary

Tinna Rubber and Infrastructure shares ended the session up 5.93%. The company reported a 13% increase in quarterly revenue and a 63% rise in net profit. Infrastructure segment volumes showed growth while international start-up costs influenced the nine-month profit trend.