Pearl Global Industries Limited (NSE: PGIL), a global apparel manufacturing and sourcing company reported its unaudited financial results for the quarter and nine-month period ended December 31, 2025, highlighting a resilient performance despite a complex global macroeconomic environment.

PGIL posted strong nine-month revenue and EBITDA growth, driven by overseas manufacturing momentum and supportive trade dynamics. The company operates a large-scale, multi-geography apparel manufacturing and sourcing platform serving global brands.

Consolidated Q3 & 9M Financial Performance

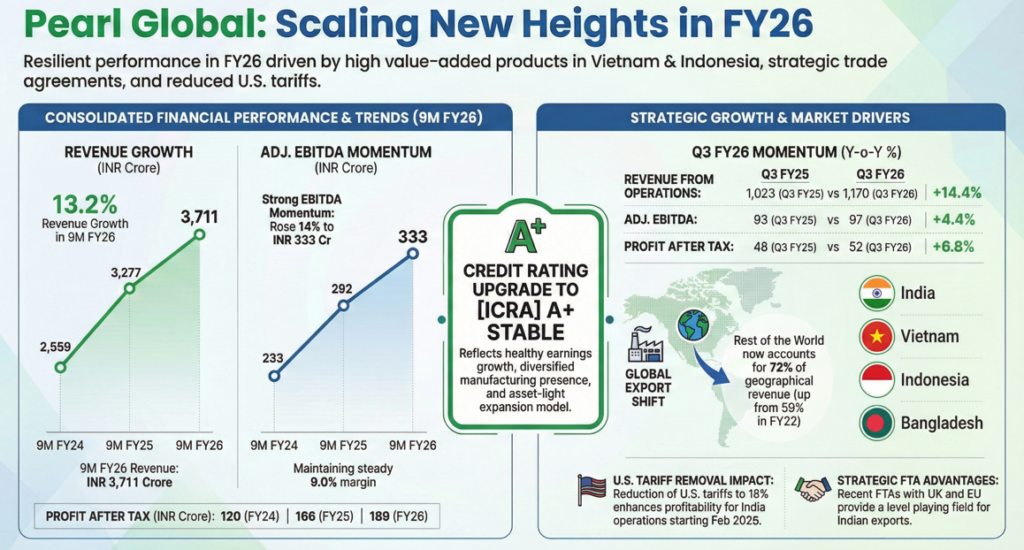

- 9M FY26, consolidated revenue rose to INR 3,711 crore, a 13.2% year-on-year growth.

- EBITDA reached INR 333 crore, up 14.0% from the previous year, with margins holding steady at 9.0%.

- EBITDA margin stood at a robust 10.1% on an adjusted basis, excluding reciprocal tariff impacts of approximately INR 31 crore and ramp-up costs for new operations.

- Q3 FY26 revenue grew 14.4% to INR 1,170 crore.

- PAT reached INR 52 crore, up from INR 48 crore in the corresponding quarter of the previous year.

Segment & Operations Update

- PGIL’s diversified manufacturing footprint proved critical to its performance.

- Operations in Vietnam and Indonesia demonstrated strong momentum, with factories operating at optimum utilization and driving growth through high value-added product sales.

- In Bangladesh, a major capacity expansion remains on track for completion by Q2 FY27, which is expected to further scale the company’s delivery capabilities.

- India’s standalone operations reported 9M revenue of INR 777 crore.

- Revenue saw a slight 2.7% year-on-year decline, the standalone EBITDA margin improved significantly from 3.3% to 5.5%, largely due to successful cost restructuring efforts.

Trade Agreements

- A primary catalyst for future growth is the reduction of U.S. tariffs to 18%, removing an additional 25% duty burden. Management expects this to directly boost profitability starting in February 2026, as the company will no longer need to extend discounts to U.S. clients to offset previous tariff costs.

- Furthermore, the India–EU Free Trade Agreement (FTA) and the UK FTA are expected to create a level playing field for Indian exporters, allowing Pearl Global to leverage its existing relationships in these markets.

Operational Efficiency

- Employee costs remained relatively stable at 18.8% of sales

- Other Expenses saw a slight improvement, dropping from 19.8% to 19.3% of sales in 9M FY26.

- Incurred INR 11 crore in incremental ramping-up costs for new operations during the nine-month period.

- Standalone finance costs as a percentage of sales increased from 2.7% to 3.3%.

- Operationally, shipped 56.1 million pieces in 9M FY26, compared to 53.8 million in 9M FY25.

- Product mix remained dominated by woven garments, which accounted for 72% of export value, while knits contributed 28%.

Internal Cash Management & Dividends

- Holding company (PGIL) received a total dividend of approximately INR 43 crore during 9M FY26 from its subsidiaries, NorpKnit Industries Limited (Bangladesh) and Pearl Global (HK) Limited. This is part of a consistent trend since FY22 and demonstrates the fungibility of cash across the group’s international entities.

Management Commentary & Investor Sentiment

- Mr. Pulkit Seth, Vice-Chairman & Non-Executive Director, stated that the company is well-positioned to capitalize on tariff reductions and new trade agreements to deliver “sustained revenue growth and profitability”.

- Investor sentiment was further bolstered by ICRA’s upgrade of the company’s long-term credit rating to [ICRA] A+ (Stable) and short-term rating to [ICRA] A1+. This upgrade reflects the company’s healthy earnings growth, diversified multinational presence, and the shift toward an asset-light expansion model.

Summary

PGIL’s Q3 and 9M FY 26 performance underscores the effectiveness of its diversified operating model. With strategic capacity expansions in Bangladesh and favorable trade deals with the U.S., UK, and EU, the company is moving toward a period of efficient scaling and enhanced stakeholder value creation.