Cantabil Retail India Ltd. (NSE: CANTABIL) reported third-quarter fiscal 2026 results that showed higher revenue, improved margins, and continued store expansion. The quarter combined volume-led growth with operating leverage, supporting a rise in profitability across the retail network.

Latest Quarterly Results

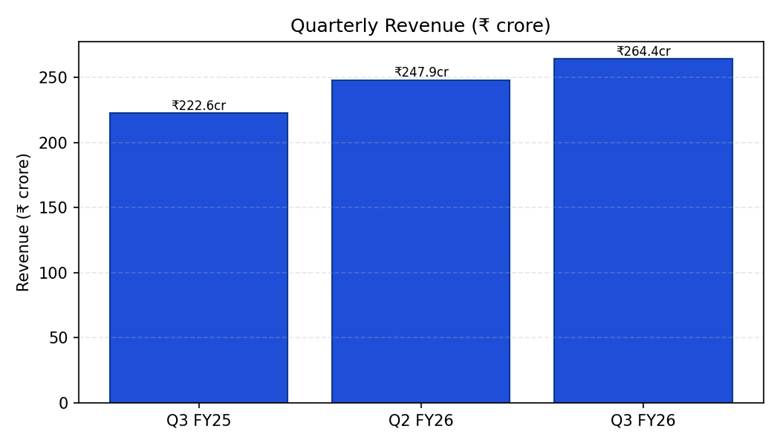

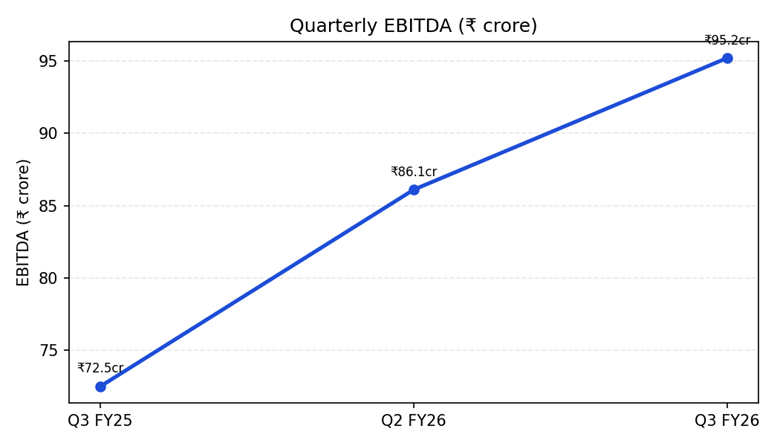

Revenue from operations for the quarter ended Dec. 31, 2025, rose to ₹264.4 crore, compared with ₹222.6 crore in the same period a year earlier. Sequentially, revenue increased from ₹247.9 crore in the prior quarter. Earnings before interest, tax, depreciation, and amortization for the quarter rose to ₹95.2 crore from ₹72.5 crore a year earlier. Profit after tax for the quarter increased to ₹45.1 crore, compared with ₹34.4 crore in the corresponding period of the prior year.

The company reported margin expansion driven by higher throughput across the store network, a better mix, and controlled operating costs. Management noted that private-label assortments and improved supplier terms contributed to gross-margin gains, while operating efficiencies supported a higher share of EBITDA.

Financial Trends

Chart 1 — Quarterly Revenue (bar chart)

Chart 2 — Quarterly EBITDA (line chart)

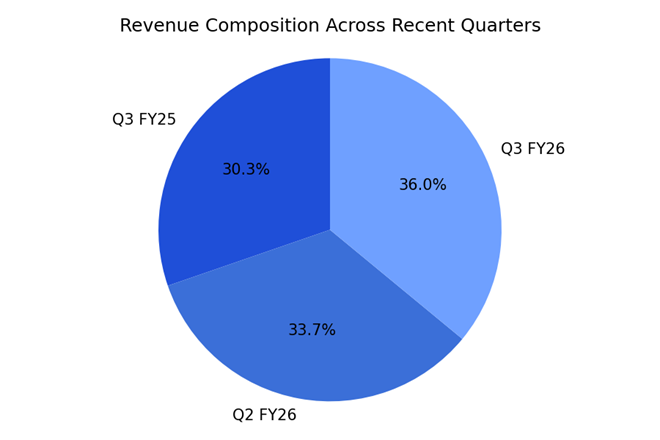

Chart 3 — Revenue Composition Across Recent Quarters (pie chart)

For the nine months ended Dec. 31, 2025, revenue from operations reached ₹599.1 crore. The nine-month performance reflected sustained same-store sales growth and added retail space. EBITDA for the nine-month period rose on a year-over-year basis, reflecting improved productivity and cost management.

Charts and infographics related to operating and market performance appear below the Financial Trends heading. The visuals show quarterly revenue progression, the trajectory of EBITDA across recent quarters, and a composition view of revenue across the reported quarters.

Business & Operations Update

During the quarter, Cantabil added 16 new stores, taking the total store count to 646. Total retail area increased to 8.82 lakh square feet compared with the prior-year period. Same-store sales growth for the quarter stood at 5.85%, while volume growth was 17.84% year over year. Management highlighted continued investment in merchandising, supply-chain planning, and digital initiatives to support omnichannel fulfillment and improve inventory turns.

The company emphasized disciplined expansion, favoring markets with demonstrable demand and efficient unit economics. Initiatives to strengthen private-label sourcing and promotional effectiveness were described as drivers of improved margin performance. Management also continued to focus on cash conversion and working-capital efficiency as the network scaled.

M&A or Strategic Moves

No material mergers or acquisitions were announced during the quarter. Management reiterated a priority on organic growth through selected store additions, category expansion, and initiatives to deepen customer engagement across digital and physical channels.

Equity Analyst Commentary

Participants in investor discussions focused on margin sustainability, the pace of new store productivity, and inventory management. Analysts examined the contribution from private label assortments and the company’s ability to sustain higher sales per square foot as the footprint expands.

Guidance & Outlook — what to watch for

What to watch for: execution of planned store rollouts, same-store sales trends, inventory turn improvement, and margin momentum. Management flagged priorities that include tighter inventory planning, enhanced supply chain visibility, and continued investment in store-level processes to drive conversion and retention.

Performance Summary

Cantabil reported higher third-quarter revenue and profit, supported by volume growth and margin expansion. Revenue was ₹264.4 crore, EBITDA ₹95.2 crore, and PAT ₹45.1 crore. The quarter underlines the company’s focus on scaling retail footprint while improving operating efficiency.