Snowman Logistics Limited (NSE: SNOWMAN) closed higher after releasing results for the third quarter and nine months ended Dec. 31, 2025. The company reported quarter-on-quarter revenue moderation but maintained margin expansion driven by warehousing and trading segments. The company’s market response reflected investor focus on capacity additions and recurring warehousing demand.

Latest Quarterly Results (Q3 FY26)

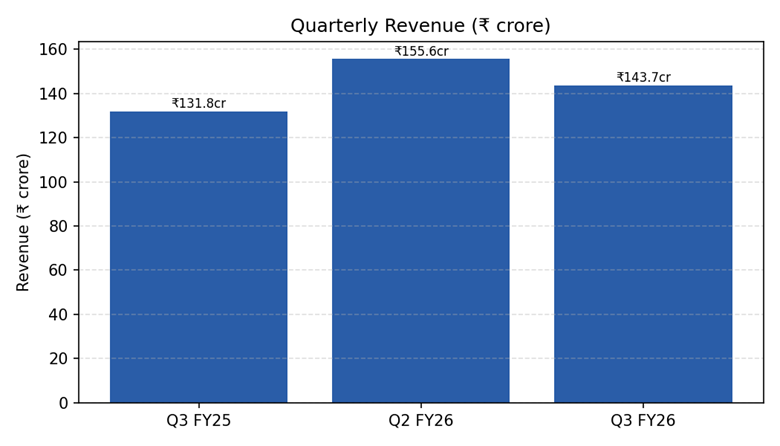

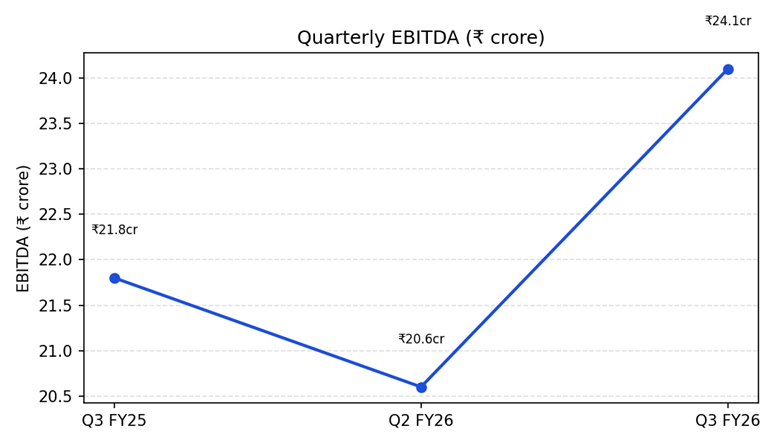

Revenue from operations for the quarter was ₹143.70 crore, up 9.0% year-on-year from ₹131.80 crore and down 7.7% sequentially from ₹155.60 crore. Total income, including other income, was ₹145.0 crore for the quarter. EBITDA for the quarter stood at ₹24.10 crore, delivering an EBITDA margin of 16.6%. Depreciation was reported at around ₹17.4 crore and finance cost at ₹7.1 crore. The company recorded an exceptional item of approximately ₹2.8 crore related to newly notified labor codes. Profit after tax for the quarter was a loss of about ₹1.9 crore after the exceptional item and tax adjustments.

Segment Highlights

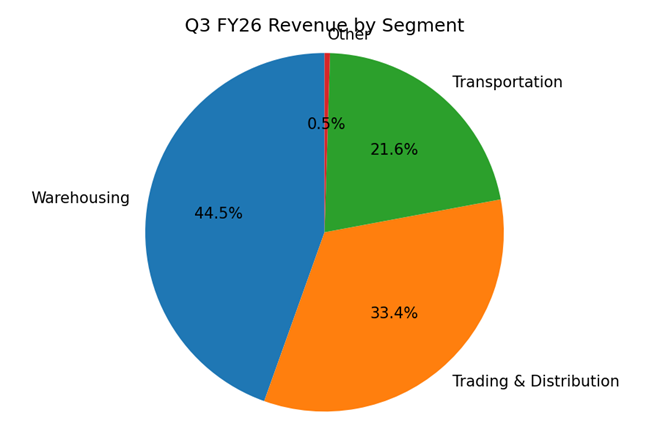

Warehousing services reported revenue of ₹64.00 crore, an 18.6% year‑on‑year increase. Trading and distribution revenue grew to ₹48.00 crore, while transportation revenue was ₹31.00 crore, reflecting a temporary customer‑mix shift in the transport division. Warehousing continued to show higher capacity utilization following recent additions to pallet capacity.

Financial Trends

For the nine months ended Dec. 31, 2025, total income was ₹462.1 crore, and EBITDA for the nine‑month period was ₹69.7 crore. Management highlighted capacity expansion during the quarter, adding a temperature‑controlled facility in Jaipur that increased pallet capacity by 1,440 positions and lifted total pallet capacity to 155,099 across 45 warehouses in 21 cities.

Chart 1 — Quarterly Revenue

Chart 2 — Quarterly EBITDA

Chart 3 — Q3 FY26 Revenue by Segment

Business & Operations Update

Snowman emphasized investments in technology, IoT‑enabled monitoring, and an expanded warehouse network to support cold‑chain growth. The company reported over 600 owned and leased vehicles and continued to scale its 5PL service offering. Management noted ongoing efforts to improve fleet optimization and reduce one‑time transportation volatility.

M&A or Strategic Moves

No material acquisitions were announced for the quarter. Management noted expansion under an asset‑light build‑to‑suit model in select markets, including plans to enter Pune and Patna, and reiterated a focus on selective capacity additions to meet organized‑sector demand.

Equity Analyst Commentary

Market participants queried drivers of margin expansion, the impact of the labor‑code charge, and the outlook for transportation recovery. Management provided detail on capacity utilization, customer mix, and the company’s strategy to shift revenue mix toward higher‑margin warehousing services.

Guidance & Outlook — what to watch for

What to watch for: sequential revenue progression, transportation segment recovery, utilization trends at new facilities, timing of contract wins under the 5PL model, and execution on margin improvement initiatives.

Performance Summary

Snowman reported Q3 revenue of ₹143.70 crore and EBITDA of ₹24.10 crore. The quarter combined revenue growth with targeted capacity additions and an emphasis on recurring warehousing demand.