BLS International Services Limited (NSE: BLS) closed at ₹292.40 on the day, moving 2.57% intraday after the company released third-quarter and nine-month results. Market capitalization: ₹12,027 crore at the latest close.

Latest Quarterly Results (Q3 FY26)

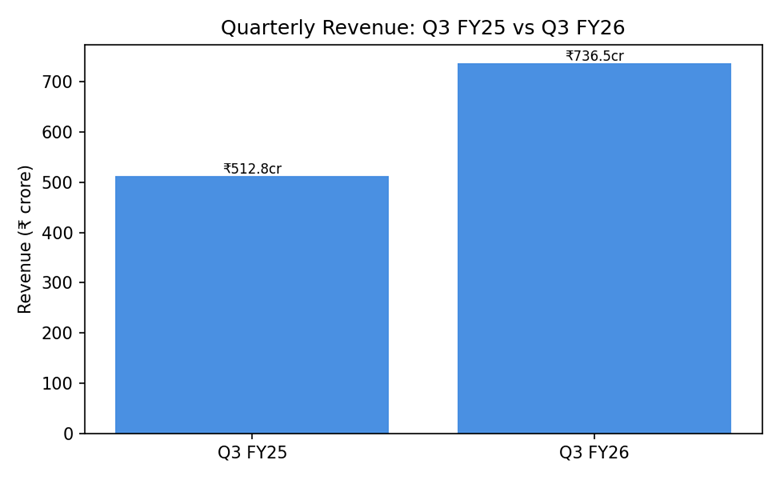

Consolidated revenue for the quarter ended Dec. 31, 2025, was ₹736.5 crore, up 43.6% year on year. EBITDA for the quarter was ₹198.0 crore, up 25.3% year on year, with EBITDA margin at 26.9%. Profit after tax for the quarter was ₹170.2 crore, up 33.1% year on year. Figures are consolidated and unaudited as announced by the company.

Financial Trends

Business & Operations Update

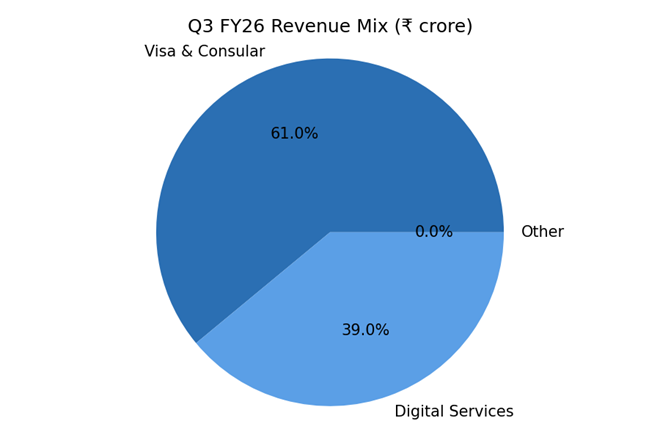

Management highlighted strong growth across Visa & Consular and Digital Services. Visa & Consular revenue was ₹449.3 crore in the quarter, while Digital Services revenue rose to ₹287.2 crore. The number of applications processed in the quarter was 10.7 lakh, and net revenue per application increased materially year on year.

M&A or Strategic Moves

The company continued integration of recent acquisitions and cited selective inorganic opportunities to broaden digital capabilities. No material divestitures were announced for the quarter.

Equity Analyst Commentary

Discussion during investor calls centered on application volumes, margin sustainability in the Visa business, growth in Digital Services, and the timing of contributions from recent acquisitions. No ratings or price targets are included here.

Guidance & Outlook — what to watch for

What to watch for: trends in application volumes, margin progression in the Visa business, contribution and margin trajectory from Digital Services, execution of Aadhaar and other government contracts, and any updates on contract wins or mobilization timing.

Performance Summary

Q3 revenue was ₹736.5 crore, and PAT was ₹170.2 crore. EBITDA margin remained in the mid‑20s for the quarter. Shares moved on volume following the results and corporate updates.