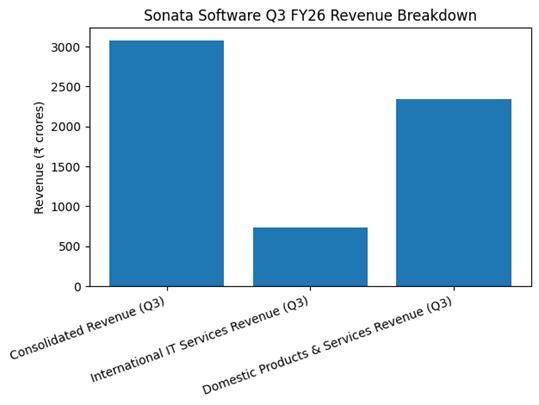

Sonata Software Limited (NSE: SONATSOFTW) reported consolidated revenue of ₹3,080.6 crores for the third quarter ended December 31, 2025. This figure represents a 45.4% increase from the previous quarter and an 8.4% increase compared to the same period last year. Consolidated profit after tax (PAT) before exceptional items reached ₹127.5 crores, reflecting a 6.1% growth quarter-on-quarter and a 21.4% increase year-over-year.

Quarterly Segment Highlights

International IT Services The segment recorded revenue of ₹738.6 crores ($82.3 million), representing a 1.1% increase in rupee terms and 0.4% in U.S. dollar terms from the preceding quarter. EBITDA before other income and forex for the quarter stood at 19.5%, showing a 220-basis point accretion sequentially. PAT before exceptional items for this segment was ₹80.4 crores. Geographically, the United States accounted for 73% of revenue, followed by Europe at 20% and the Rest of World at 7%. The segment added three new customers during the period.

Domestic Products & Services Revenue for the domestic business reached ₹2,345.9 crores, an increase of 68.6% compared to the previous quarter. Gross contribution was ₹76.1 crores, representing growth of 10.8% quarter-on-quarter. PAT before exceptional items for the segment stood at ₹47.1 crores, an 11.6% increase from the prior quarter.

Full-Year and Operational Context

For the nine months ended December 31, 2025, consolidated revenue totaled ₹8,165.1 crores, an 8.3% increase year-over-year. Consolidated PAT before exceptional items for the nine-month period was ₹357.0 crores, reflecting 12.6% growth over the same period in the prior year. The company recorded a one-time exceptional expense of ₹31.3 crores related to new labor codes, including ₹23.3 crores for gratuity and ₹8.0 crores for leave encashment.

Business and Strategic Developments

The company launched AgentBridge 5.5, an agentic artificial intelligence (AI) platform. Verifiable developments include a new partnership with IISc’s FSID to power AI-driven scientific research and a collaboration with the Wharton AI & Analytics Initiative. The firm also announced an alliance with adesso to deliver AI-powered modernization services.

In strategic moves, the business secured a large deal in the BFSI vertical with a Fortune 500 fintech client based in Milwaukee, Wisconsin. Other wins include an AI-led cloud modernization project for a U.S. mortgage servicer and an ERP platform support engagement for a UK-based quick-service restaurant operator.

Guidance and Outlook

Management identified a pipeline of 32 large deals currently in pursuit. On average, these transactions require four to six quarters to close. AI-related investments contributed approximately 14% to the overall order book for the quarter. The company has moved to a quarterly interim dividend policy, declaring a payout of ₹1.25 per share for the third quarter.

Performance Summary

Consolidated revenue grew 45.4% sequentially to ₹3,080.6 crores. Segment signals show International IT Services margins at 19.5% and Domestic Business revenue growth of 68.6%. Net profit before exceptional items increased 21.4% year-over-year. The company maintains a gross cash and equivalents balance of ₹564 crores.