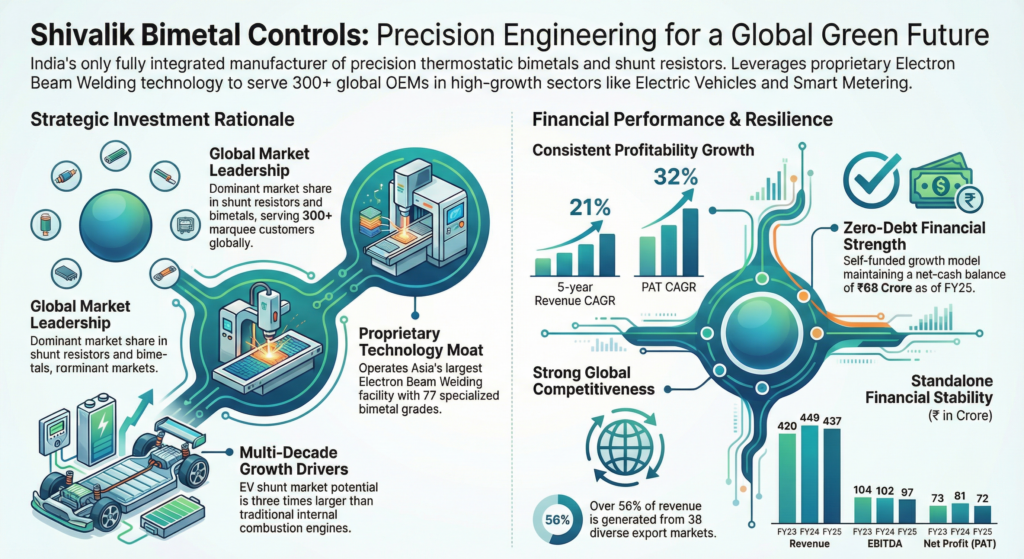

Shivalik Bimetal Controls Limited (SBCL.NSE), India’s only fully integrated manufacturer of precision thermostatic bimetals, low-ohmic shunt resistors and silver contacts, reported strong margin-led earnings growth for the third quarter and nine months ended December 31, 2025. The company serves more than 300 customers across 38 countries and has an estimated market capitalization of about ₹2,400 crore, positioning it firmly within India’s small-cap industrial and engineered components space.

Shares moved higher following the results, after having traded in a 52-week range of roughly ₹340 to ₹605. The stock had lagged in recent months amid broader weakness in metals and industrial small caps, before rebounding on improved profitability metrics.

Financial Performance Overview

Shivalik delivered resilient revenue growth alongside sharp margin expansion, driven by a richer product mix and higher contribution from value-added components supplied to global customers.

Consolidated Results (Q3 & 9M FY26)

For Q3 FY26, consolidated revenue rose 8.9% year over year to ₹134.23 crore. EBITDA increased 31.9% to ₹32.38 crore, while profit after tax climbed 22.4% to ₹22.33 crore.

Margins expanded materially during the quarter. EBITDA margin improved to 24.12% from 19.91%, and gross margin rose to 46.72%, reflecting operating leverage and improved realizations.

For the nine months ended December 2025, revenue grew 8.6% to ₹408.23 crore. EBITDA rose 27.3% to ₹95.40 crore, and PAT increased 25.1% to ₹69.71 crore. EBITDA margin for the period stood at 23.37%, up more than 340 basis points year over year.

Standalone Performance

On a standalone basis, Q3 FY26 revenue increased 3.7% to ₹110.13 crore, while PAT rose 11.1% to ₹19.47 crore. For the nine-month period, standalone revenue reached ₹345.24 crore, up 6.9%, with PAT of ₹61.32 crore, a 16.1% increase.

Standalone earnings per share improved to ₹3.38 in Q3 FY26 from ₹3.04 a year earlier, and to ₹10.65 for the nine-month period.

Business and Segment Trends

Shivalik operates in a single reporting segment, process and product engineering, with two key product verticals:

- Shunt resistors, now the largest contributor, account for about 50% of total revenue by value. Shunt revenue increased 7.5% year over year in Q3 FY26 to ₹55.01 crore, supported by demand from smart metering, EV and energy applications.

- Thermostatic bimetals, the company’s legacy business, generated ₹55.12 crore in Q3, remaining stable and continuing to support long-term growth.

Despite revenue growth, total volumes declined nearly 8% year over year in Q3, highlighting a deliberate shift toward higher value-added products rather than volume-led growth.

Geographic Performance

Regional trends were mixed during the quarter:

- Europe recorded strong traction, with shunt revenue rising nearly 99% year over year, and bimetal revenue up more than 40%.

- India saw shunt revenue grow 18.9%, supported by domestic infrastructure and smart metering demand.

- The Americas experienced temporary softness, with shunt revenue declining 22.3% year over year.

Balance Sheet and Financial Position

Shivalik maintained a strong balance sheet at the end of December 2025:

- Net worth: approximately ₹467 crore

- Cash and cash equivalents: ₹99 crore

- Net debt: effectively zero

Net working capital days increased to 265 days, mainly due to higher copper inventory levels as the company strengthened supply security amid raw material volatility.

Capital Allocation and Strategic Initiatives

The board declared an interim dividend of ₹2 per equity share for FY26.

The company is investing ₹200 million in a new manufacturing facility in Pune, Maharashtra, focused on automotive busbars, connectors and assemblies. The facility is targeted to commence production in April 2026, with initial capacity of 1 million busbars and 40,000 assemblies per month, funded entirely through internal accruals.

Shivalik also provided a ₹7 crore corporate guarantee to its wholly owned subsidiary to support bank credit facilities.

Regulatory and One-Time Items

During the quarter, the implementation of new labor codes resulted in a one-time exceptional charge of about ₹92 lakh, related to higher gratuity and compensated absence liabilities. Auditors issued an unmodified review report on both standalone and consolidated results.

Sector Context and Competitive Positioning

The engineered metals and components sector continues to face volatile input costs and uneven global industrial demand. While larger base metal producers have seen margin pressure, niche players focused on precision and value-added components have shown greater resilience.

Shivalik’s competitive positioning is supported by proprietary manufacturing capabilities, including electron beam welding and high-pressure diffusion bonding, which create cost advantages and high entry barriers relative to peers.

Outlook

Management highlighted structural growth drivers in electric vehicles, smart metering, energy storage and data centers. EV shunts command significantly higher value than conventional applications, while India’s large smart meter rollout provides localized demand visibility. The company did not issue formal earnings guidance but reiterated its focus on profitable growth, forward integration and technology-led differentiation heading into FY2027.