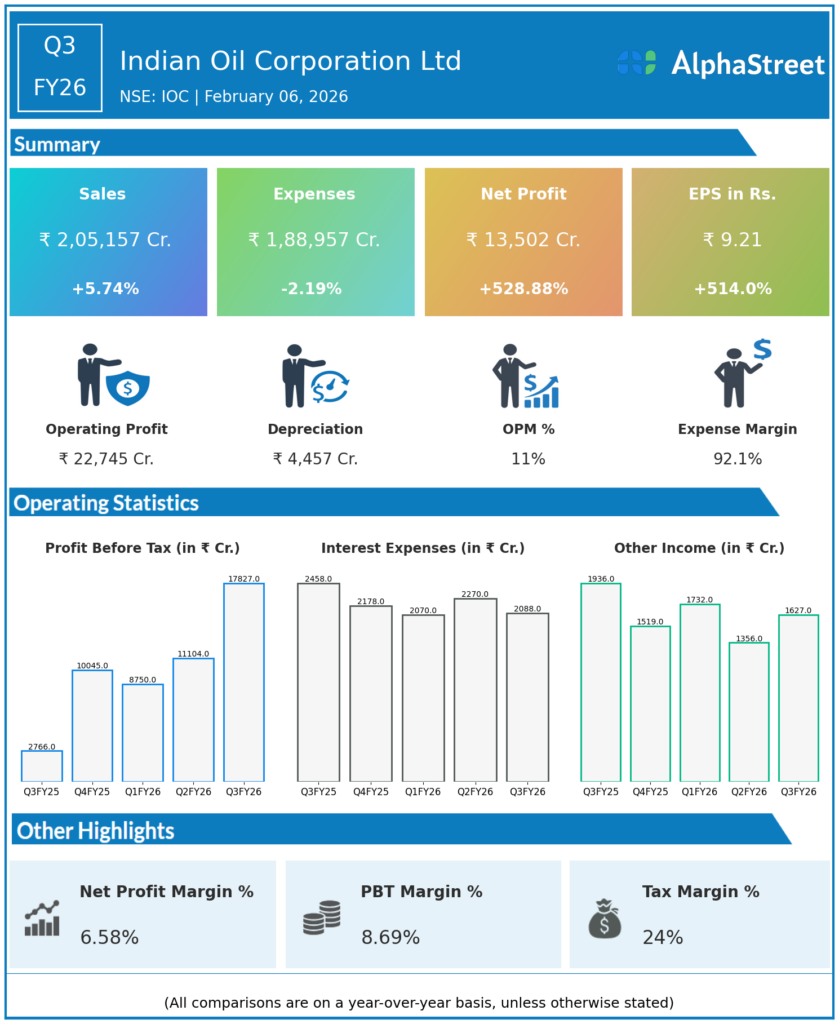

Indian Oil Corporation Ltd (IOC) posted stellar Q3 FY26 results with profits skyrocketing 529%. Revenues grew modestly amid controlled expenses.

Executive Summary

Indian Oil Corporation Ltd reported Q3 FY26 consolidated revenues of ₹2,05,157 crore, up 5.74% YoY from ₹1,94,014 crore. Net profit leaped 528.88% YoY to ₹13,502 crore from ₹2,147 crore, driving EPS to ₹9.21, a 514.00% YoY rise. Expense reduction fueled the dramatic turnaround.

Revenue & Growth

Revenues increased 5.74% YoY to ₹2,05,157 crore from ₹1,94,014 crore. Total expenses fell 2.19% YoY to ₹1,88,957 crore from ₹1,93,184 crore. QoQ data unavailable from provided figures.

Profitability & Margins

Consolidated net profit surged 528.88% YoY to ₹13,502 crore. EPS rose 514.00% YoY to ₹9.21 from ₹1.50. PAT margin expanded to 6.58% from 1.11% YoY; EBITDA and gross margin figures not detailed.

Balance-sheet Highlights

Balance sheet specifics like net debt or current assets not provided in dataset. Refining and marketing leadership supported profitability recovery. Net debt/EBITDA ratio unavailable.

Cash Flow / Liquidity

Cash flow statement details absent from inputs. Operating cash flow and free cash flow not reported. Liquidity metrics such as current ratio unavailable.