Bharti Airtel Ltd reported consolidated financial results for Q3 FY26 ended 31 December 2025. Key figures show revenue growth offset by a sharp profit decline.

Executive Summary

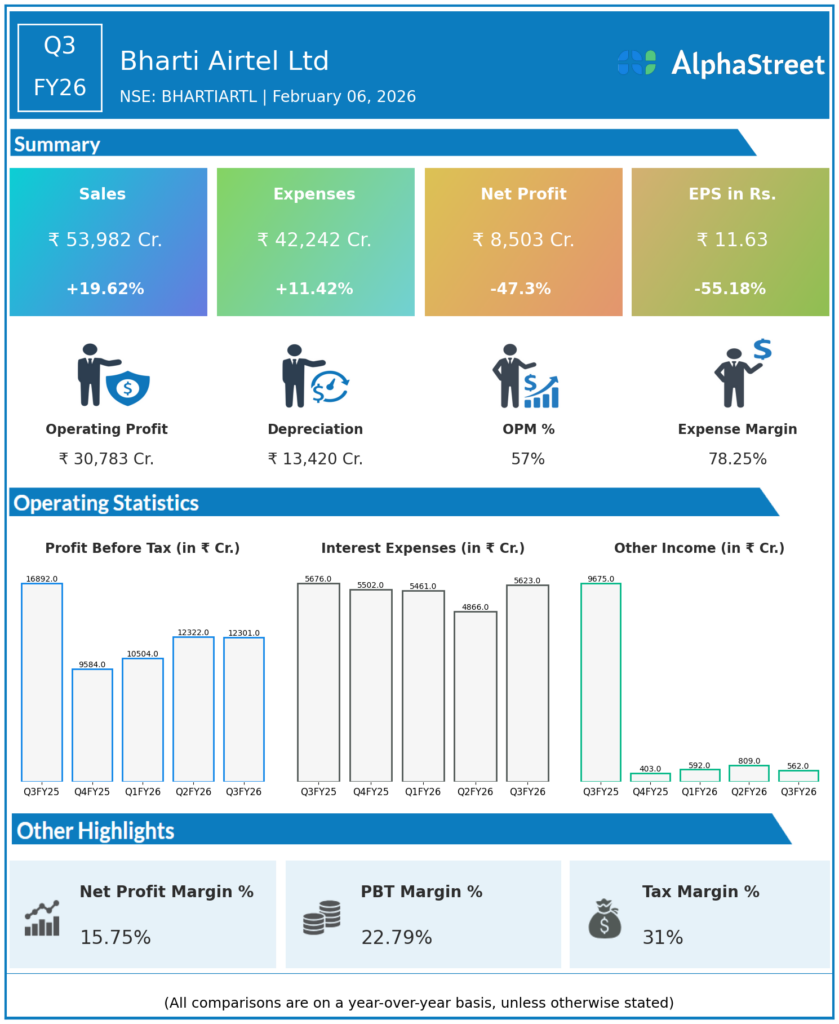

Bharti Airtel Ltd’s Q3 FY26 revenues reached ₹53,982 crore, up 19.62% YoY from ₹45,129 crore. Consolidated net profit fell 47.3% YoY to ₹8,503 crore from ₹16,135 crore, with EPS at ₹11.63, down 55.18% YoY from ₹25.95. EBITDA stood at ₹31,144 crore, reflecting operational strength amid higher expenses.

Revenue & Growth

Revenues grew 19.62% YoY to ₹53,982 crore from ₹45,129 crore. Total expenses rose 11.42% YoY to ₹42,242 crore from ₹37,913 crore. QoQ revenue increased approximately 3.5% from Q2 FY26’s ₹52,145 crore.

Profitability & Margins

Net profit declined 47.3% YoY to ₹8,503 crore. EBITDA rose to ₹31,144 crore, up around 25.2% YoY based on reports, yielding an EBITDA margin of 57.7%. Gross margin data unavailable; PAT margin approximated at 15.75%.

Balance-sheet Highlights

Net debt stood at ₹182,621 crore, down 7% YoY from prior year. Net debt to EBITDA ratio improved to 1.47x from 1.98x YoY. Current ratio details not disclosed in summaries.

Cash Flow / Liquidity

Operating free cash flow (EBITDA less capex) was ₹19,357 crore, down 3% YoY. Capex increased 29% YoY to ₹11,787 crore. Operating cash flow supports deleveraging efforts.