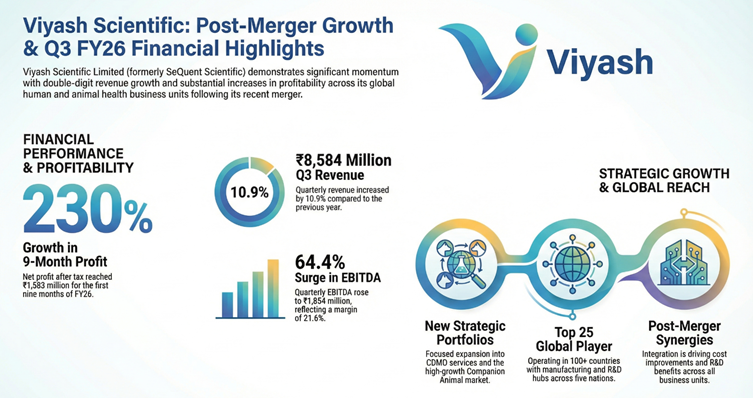

Sequent Scientific Limited (now Viyash Scientific Limited) (BSE: 512529 / NSE: SEQUENT) reported higher revenue and profitability in the quarter ended December 31, 2025, reflecting growth in its formulations, APIs and CDMO businesses in the first quarter reported on a combined post-merger basis.

For Q3 FY26, consolidated revenue rose 10.9% year-on-year to ₹8,584 million, while EBITDA (excluding ESOP costs) increased 64.4% to ₹1,854 million. Profit after tax rose 15.5% to ₹485 million, including merger-related exceptional costs.

Business overview

Sequent Scientific (renamed Viyash Scientific Limited) operates across Formulations, Active Pharmaceutical Ingredients (APIs), and CDMO services for both human and animal health. The company has manufacturing, R&D and distribution operations in India, Spain, Brazil, Turkey and the United States, serving customers in over 100 countries.

The company is positioned among the top 25 animal health companies globally, with approvals from international regulators including USFDA, EU-GMP, WHO and TGA.

Financial performance — Q3 FY26

Revenue in Q3 FY26 increased to ₹8,584 million from ₹7,740 million in Q3 FY25. EBITDA (excluding ESOP costs) rose to ₹1,854 million from ₹1,127 million, lifting the EBITDA margin to 21.6% from 14.6% a year earlier.

Profit after tax stood at ₹485 million, compared with ₹420 million in Q3 FY25, after accounting for ₹413 million of merger-related exceptional costs and a one-time MAT credit reversal of ₹77 million.

Nine-month performance (9M FY26)

For the nine months ended December 2025, revenue increased 11.9% to ₹25,004 million from ₹22,345 million in 9M FY25. EBITDA (excluding ESOP costs) rose 58% to ₹5,024 million, with margin improving to 20.1% from 14.2%.

Profit after tax for 9M FY26 increased sharply to ₹1,583 million, compared with ₹480 million in the prior year period.

Merger and strategic developments

Q3 FY26 marked the first quarter in which results of the merged entity were presented on a combined basis. Management stated that the merger is beginning to generate benefits across R&D, manufacturing and front-end operations.

The company indicated plans to strengthen its Companion Animal portfolio and expand its CDMO services offering.

Balance sheet and debt position

The company reported pre-closure of high-cost debt during the period, with net debt to EBITDA at 0.38x, reflecting an improvement in leverage metrics.

Risks and constraints

The press release notes that forward-looking statements are subject to risks including government actions, economic conditions, technological risks and other factors that could cause actual results to differ materially from expectations.

Management commentary

The Managing Director and Group CEO stated that revenue, margins and profitability continued to show growth due to new product introductions, cost improvements and synergies across business units, and that the company is positioned to capture market opportunities over the next three to five years.