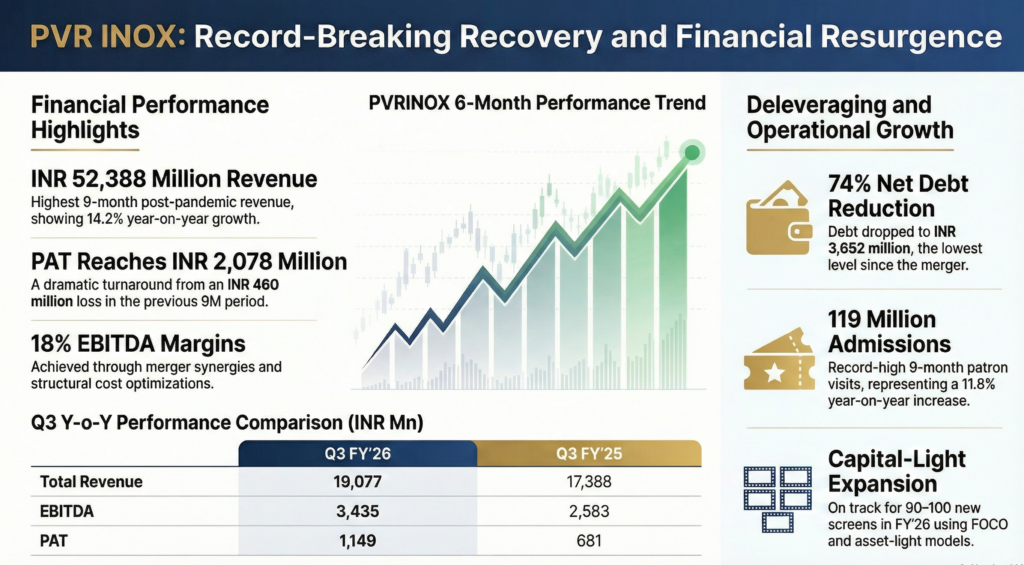

PVR INOX Ltd (NSE: PVRINOX) recorded a 9.7% year-over-year increase in quarterly revenue and a significant reduction in net debt. Investors are focusing on structural margin expansion and the transition to a capital-light growth model.

PVR INOX Ltd reported total revenue of INR 19,077 million for the third quarter of FY’26. This represents a 9.7% increase compared to the same period in the previous year. The company achieved its lowest net debt level since the merger, standing at INR 3,652 million, a reduction of 74%.

Company Profile and Market Situation

PVR INOX Ltd is the leading cinema exhibition company in India, formed after the merger of PVR Limited and INOX Leisure Limited. As of the reporting date, the company operates a diversified network of 358 cinemas with 1,791 screens across 112 cities. The industry witnessed a record-breaking 2025, with the highest-ever India box office collection of INR 13,395 crore, a 32% increase over pre-pandemic levels.

Latest Quarterly Results and Highlights

For the quarter ended December 31, 2025, the company reported an EBITDA of INR 3,435 million (excluding Ind-AS 116 impact), yielding an 18.0% margin. Profit After Tax (PAT) stood at INR 1,149 million. Operating highlights included 40.5 million admits, an 8.6% year-over-year growth. The Average Ticket Price (ATP) rose 4.1% to INR 293, while the Average F&B Spend per Head (SPH) increased 4.2% to INR 146.

Full Year Context and Growth Trajectory

On a nine-month basis, PVR INOX recorded its highest post-pandemic revenue of INR 52,388 million, up 14.2% year-over-year. Nine-month EBITDA reached INR 7,849 million, and PAT was INR 2,078 million. Total admits for the nine-month period grew 11.8% to 119 million.

Performance by Business Vertical and Segment Updates

• Sale of Movie Tickets: Revenue reached INR 10,056 million for the quarter, up 14.4% YoY.

• Food & Beverages (F&B): Revenue was INR 5,938 million, a 14.0% increase. The company is on track to achieve over INR 2,000 crore in F&B revenue for FY’26 through initiatives like PVR CAFÉ and new in-house brands.

• Advertisement Income: Revenue was INR 1,180 million, a 20.6% decline for the quarter.

Core Growth Strategies and Strategic Expansion

PVR INOX is transitioning to a capital-light growth strategy, focusing on FOCO (Franchise Owned Company Operated) and Asset-light models. The company currently has 149 screens signed under this model. During Q3 FY’26, the company opened 20 new screens and remains on track to add 90–100 new screens for the full fiscal year.

Strategic Analysis and Capital Strength

The company has demonstrated structural margin expansion, achieving 18% EBITDA margins at lower occupancy levels (28.5%) compared to the pre-COVID era. Robust operating cash flows and reduced capex allowed for the generation of INR 5,870 million in free cash flow during the first nine months of FY’26. The divestment of the 4700BC premium snacking brand for INR 226.8 crore in January 2026 will further move the company toward negligible net debt levels.

Regulatory Milestones and Management Commentary

The company recorded a one-time exceptional provision of INR 446 million for the implementation of New Labour Codes. Management noted that the company is entering its next phase of sustainable growth supported by a significantly strengthened balance sheet.

Future Outlook and Broader Industry Trends

The outlook for 2026 is supported by a robust content pipeline including large-scale titles such as Dhurandhar 2, Jailer 2, and Hollywood marquee releases like Avengers: Doomsday and Spider-Man: Brand New Day. Hindi original films dominated recent growth with a 59% YoY increase. Regional cinema also reached an all-time high, with Gujarati cinema growing 188% and Malayalam cinema crossing the INR 1,000 crore mark for the second year in a row.