Executive Summary

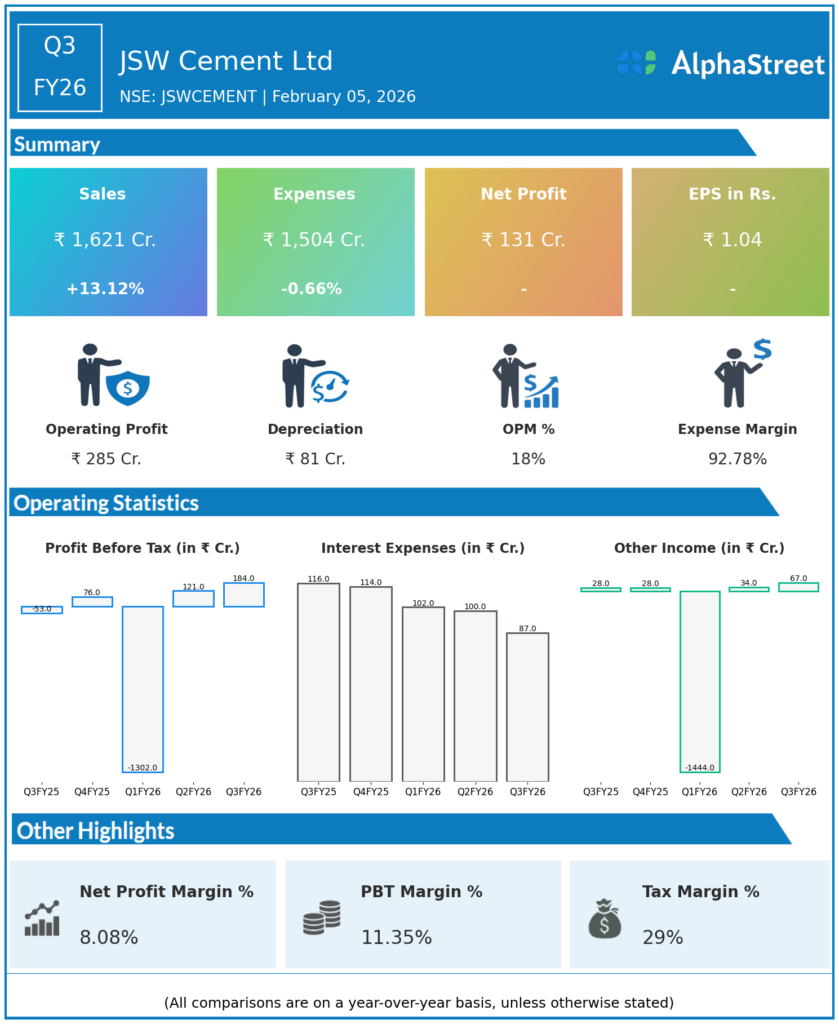

JSW Cement Ltd reported Q3FY26 revenues of ₹1,621 crore, up 13.12% YoY, swinging from a ₹80 crore loss to ₹131 crore profit driven by 14% volume growth to 3.56 MT and 31.5% EBITDA surge to ₹285 crore. Expense reduction and operational leverage marked strong green cement execution.

Revenue & Growth

Revenues grew to ₹1,621 crore from ₹1,433 crore YoY, fueled by cement volumes up 6.8% to 1.89 MT and GGBS up 17% to 1.53 MT totaling 3.56 MT sales. Total expenses fell 0.66% YoY to ₹1,504 crore despite higher blended fuel costs, showcasing cost discipline.

Profitability & Margins

Consolidated net profit achieved ₹130.6 crore versus ₹80.2 crore loss YoY, with EBITDA at ₹285.1 crore (17.6% margins, up from prior trough). Basic EPS turned positive at ₹1.04 from negative ₹0.68; PBT before ₹33.7 crore Labour Code exceptional loss reached ₹218 crore.

Balance-Sheet Highlights

Net debt stood at ₹3,557 crore with Net Debt/EBITDA at 2.90x, reflecting improved leverage post-profitability inflection. Vadraj Energy Gujarat Ltd sale completed for ₹192 crore cash inflow.

Cash Flow / Liquidity

Q3 capex at ₹491 crore supports capacity expansion; 9M EBITDA conversion demonstrates operational cash generation amid growth investments.

Key Ratios / Metrics

EBITDA/tonne reached ₹802 reflecting pricing power; 9M revenue up 14.1% to ₹4,617 crore. CRISIL rating upgraded to AA-/Stable with UAE grinding unit (USD 39M capex) and 41.85 MTPA target by 2028.