Tata Power Company Ltd is primarily involved in the business of the generation, transmission and distribution of electricity. It aims to produce electricity completely through renewable sources. It also manufactures solar roofs and plans to build 1 lakh ev charging stations by 2025. The company is India’s largest vertically-integrated power company.

Q3 FY26 Earnings Results

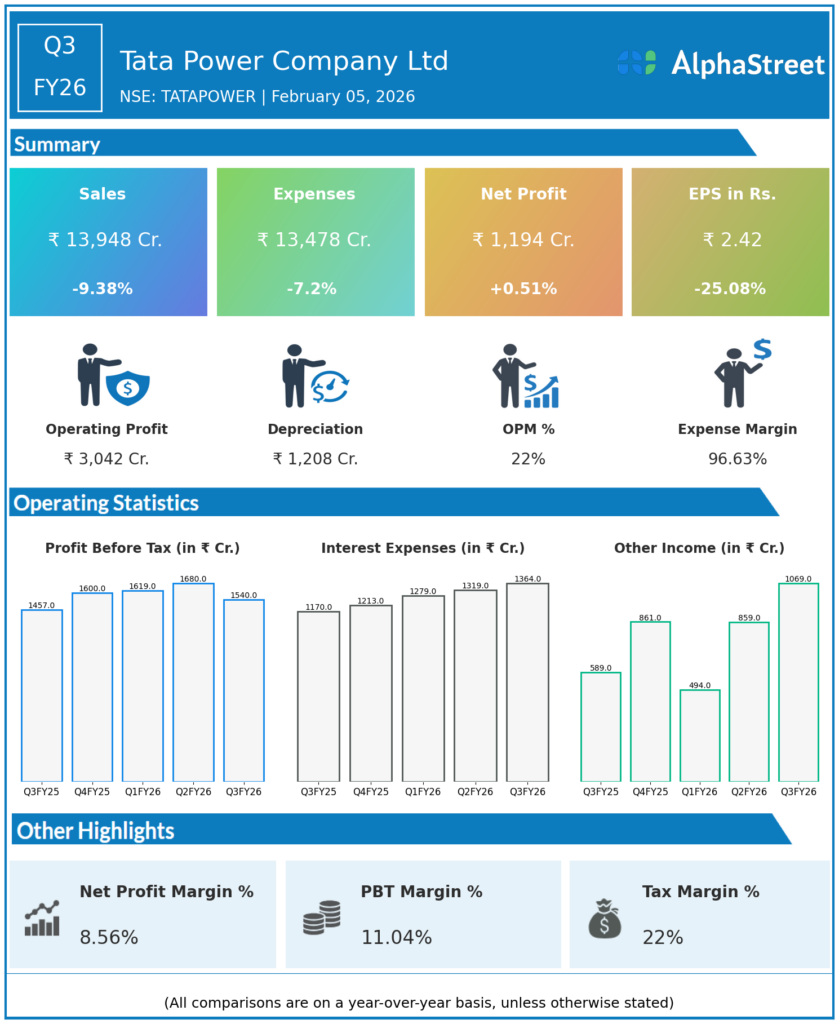

- Revenue from Operations: ₹14,485 cr, -4% YoY vs ₹15,118 cr in Q3 FY25.

- EBITDA: ₹3,913 cr, +12% YoY, indicating resilient operating performance despite lower sales.

- PAT: ₹1,194 cr, +1% YoY (vs ₹1,188 cr last year); profits were supported by diversification in segments.

- Other key metrics:

- 9M FY26 Revenue: ₹47,719 cr, +1% YoY;

- 9M FY26 EBITDA: ₹11,874 cr, +12% YoY;

- 9M FY26 PAT: ₹3,702 cr, +7% YoY reflecting cumulative performance resilience.

Management Commentary & Strategic Decisions

- Diversified growth drivers: Management highlighted that the Q3 FY26 performance was driven by strong execution across generation, transmission, distribution and renewables, with record renewable EPC execution (>10 GW) and expanded clean capacity contributing materially to results.

- Renewables focus: The renewable energy segment saw high growth, with revenue and PAT expanding strongly as the company scales solar manufacturing (cells/modules output near full capacity) and rooftop installations.

- Distribution & transmission strength: Distribution delivered substantial profit growth (+167% YoY), reflecting operational effectiveness and expanding customer base; transmission PAT also grew ~80% YoY.

- Strategic priorities: Leadership reaffirmed investments in clean energy infrastructure, rooftop solar scale-up, smart metering roll-outs, and pumped storage projects, aligning with medium/long-term energy transition goals.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹15,769 cr, -3% YoY (mild decline).

- EBITDA: ₹4,032 cr, +6% YoY (operating margin relatively stable).

- PAT: ₹1,245 cr, +14% YoY (distribution and renewables bolstered bottom line).

- Other key metrics: Transmission and distribution segments reported strong YoY PAT growth; renewable segment showed robust performance with higher output and order book expansion.

Management Commentary Q2

- Management described a “robust performance” through the first half of FY26 supported by a diversified portfolio spanning conventional generation, clean energy and distribution, despite a slight revenue dip and Mundra plant outages.

- Focus was on strengthening renewable footprint, scaling rooftop solar, and expanding distribution reach, positioning Tata Power well for long-term structural growth driven by energy transition themes.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.