Executive Summary

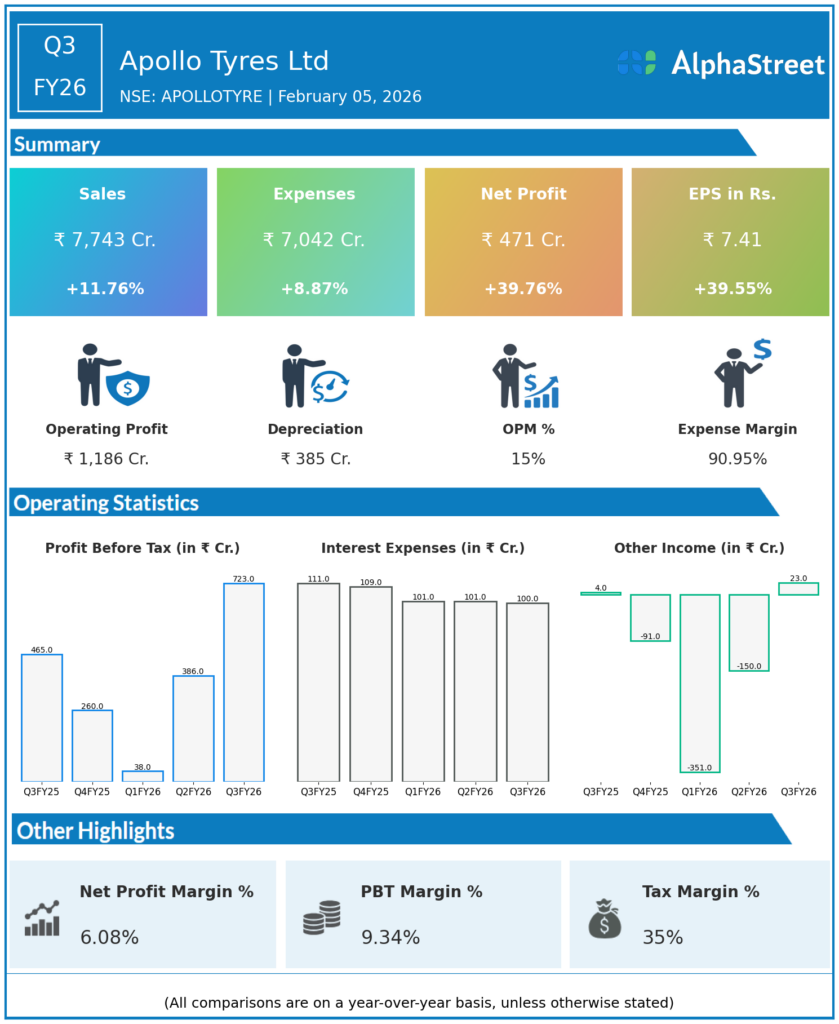

Apollo Tyres Ltd reported Q3FY26 revenues of ₹7,743 crore, up 11.76% YoY, with consolidated net profit surging 39.76% to ₹471 crore. Strong replacement market demand across passenger car, truck/bus, and farm segments drove volume growth, supported by moderated raw material costs and operational efficiencies.

Revenue & Growth

Revenues expanded to ₹7,743 crore from ₹6,928 crore YoY, reflecting 12% growth led by robust replacement sales and steady OEM contributions. Total expenses rose 8.87% YoY to ₹7,042 crore, growing slower than topline through effective cost management and scale benefits.

Profitability & Margins

Consolidated net profit jumped 39.76% YoY to ₹471 crore from ₹337 crore, with EBITDA increasing 25% to ₹1,186 crore at expanded 15.32% margins (up 165 bps). Basic EPS rose 39.55% to ₹7.41 from ₹5.31, highlighting tyre sector resilience.

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

India and European operations delivered balanced growth; passenger radial volumes strong in replacement market. 9M trajectory positions Apollo for sustained tyre demand amid replacement cycle upturn.