Executive Summary

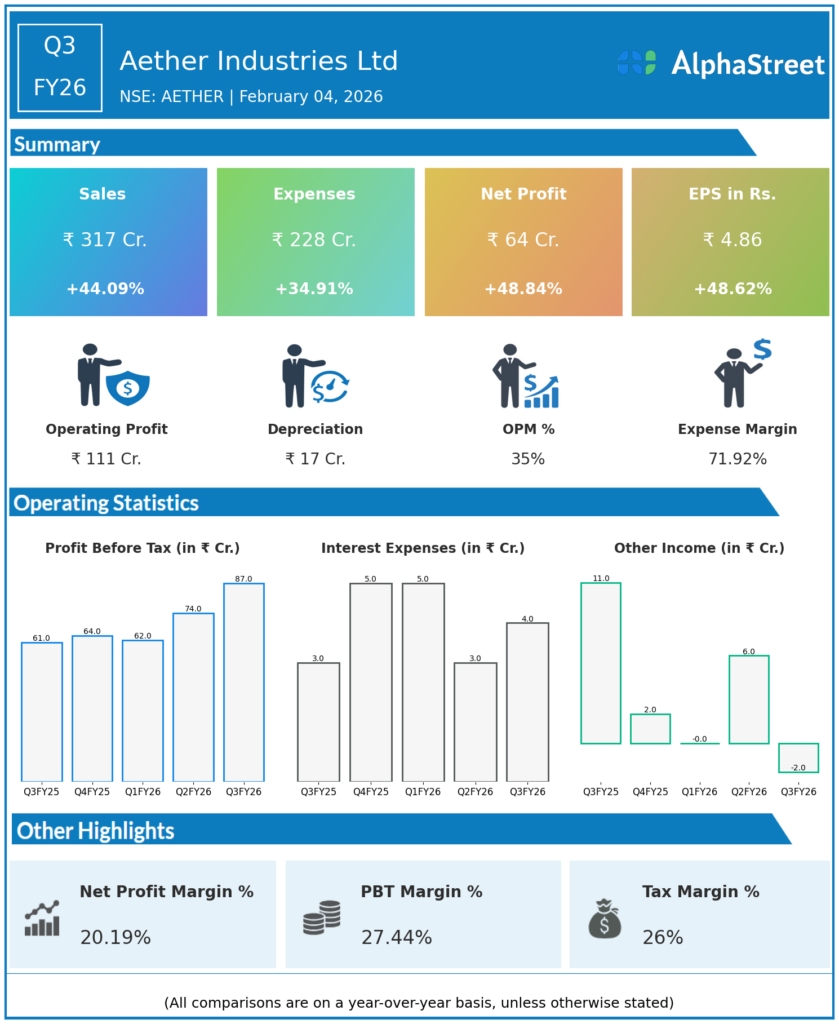

Aether Industries Ltd reported Q3FY26 revenues of ₹317 crore, up 44.09% YoY, with consolidated net profit increasing 48.84% to ₹64 crore. Specialty chemicals demand, particularly CEM and CRAMS segments exceeding 50% revenue mix, drove strong volume growth and margin expansion.

Revenue & Growth

Revenues surged to ₹317.12 crore from ₹220 crore YoY, reflecting robust 44% expansion led by higher-margin contract manufacturing and custom synthesis. Total expenses rose 34.91% YoY to ₹228 crore but grew slower than topline, delivering significant operating leverage.

Profitability & Margins

Consolidated net profit jumped 49% YoY to ₹64.48 crore from ₹43 crore, with EBITDA margins expanding 393 bps to 34.15% and PAT margins reaching 20.34%. Basic EPS rose 48.62% to ₹4.86 from ₹3.27; standalone PAT at ₹51.96 crore.

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26. Capacity utilization improvements and 15 new customer onboardings strengthened strategic positioning.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

9M consolidated revenue reached ₹864.7 crore with PAT at ₹165.5 crore; ROCE hit 11.33% reflecting capital efficiency gains. Strategic 70% CRAMS/CEM revenue target supports sustained specialty chemicals growth trajectory.