Executive Summary

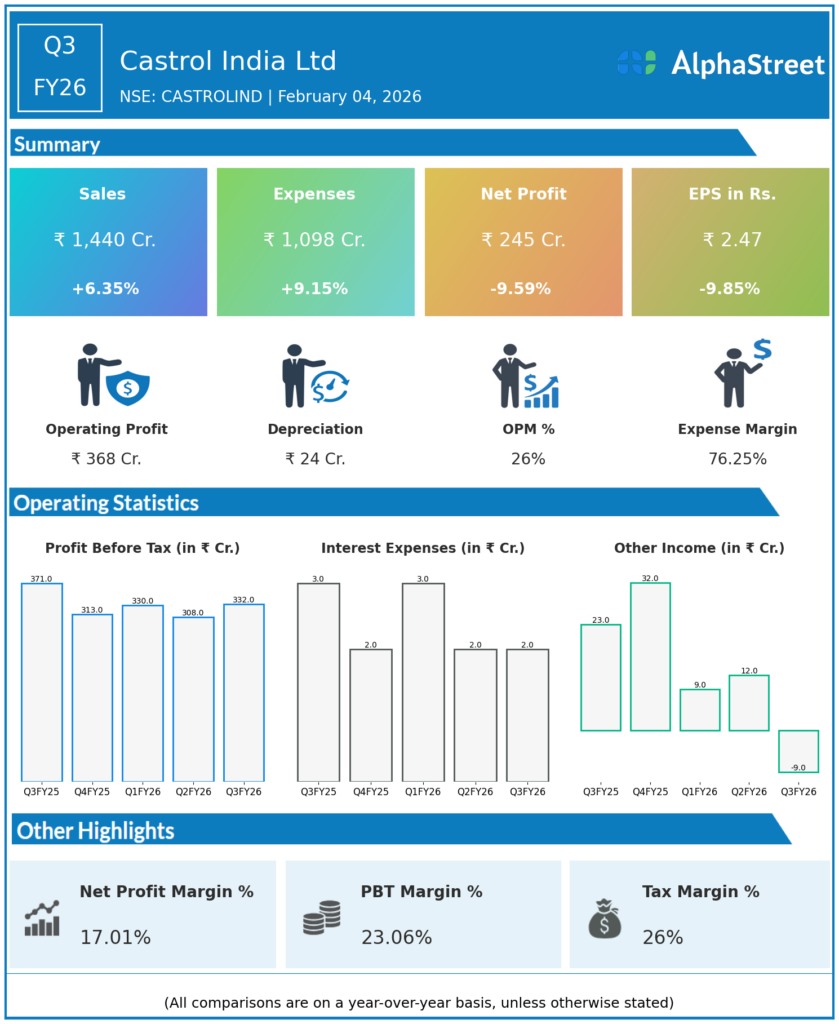

Castrol India Ltd reported Q3FY26 revenues of ₹1,440 crore, up 6.35% YoY, but consolidated net profit declined 9.59% to ₹245 crore amid higher expense growth. Automotive and industrial lubricants demand supported topline while competitive pressures and raw material costs compressed margins.

Revenue & Growth

Revenues grew to ₹1,440 crore from ₹1,354 crore YoY, reflecting steady volume expansion across automotive and industrial segments. Total expenses increased 9.15% YoY to ₹1,098 crore, outpacing revenue growth due to elevated input costs and marketing investments.

Profitability & Margins

Consolidated net profit fell 9.59% YoY to ₹245 crore from ₹271 crore, with EBITDA margins contracting amid pricing challenges in a competitive lubricants market. Basic EPS declined 9.85% to ₹2.47 from ₹2.74.

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

EBITDA margins compressed to 25.58% from 27.67% YoY, reflecting sector headwinds. Sequential revenue contraction of 8.96% signals moderating demand momentum despite sustained market leadership in automotive lubricants.