Bluspring Enterprises Ltd (NSE:BLUSPRING), an integrated infrastructure management company providing facility management, food services, security, and telecom and industrial operations support to enterprises and public institutions across India, reported a 10% year-on-year rise in revenue for the December quarter, supported by steady growth in its facilities management, food services and security businesses, while margin improvement reflected operating efficiencies and cost optimization.

Key Financial Highlights – Q3 & 9M FY26

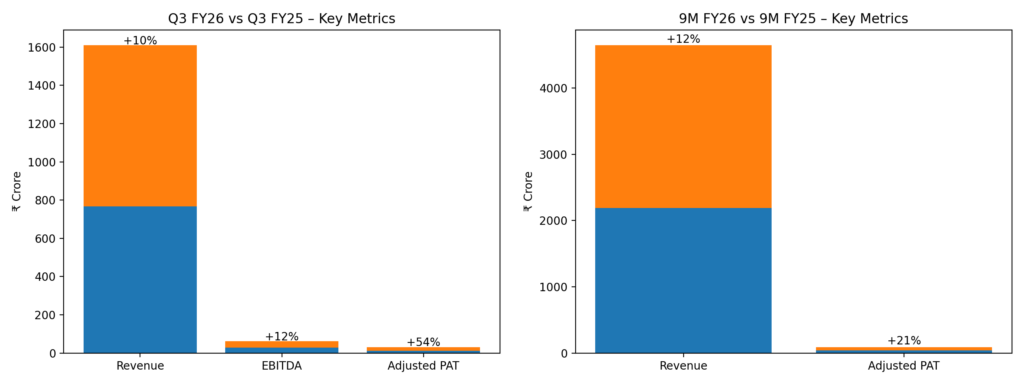

- Revenue for Q3 FY26 rose to ₹844 crore, compared with ₹766 crore a year earlier, while EBITDA increased 15% year-on-year to ₹32 crore.

- EBITDA margin expanded to 3.8%, up 37 basis points sequentially.

- Adjusted profit after tax, excluding one-time exceptional items, surged 54% year-on-year to ₹19 crore, with adjusted EPS rising to ₹1.2 .

Nine-month performance shows steady scale-up:

- For the first nine months of FY26, revenue grew 12% year-on-year to ₹2,458 crore, driven by new contract wins and expansion across core service lines.

- Adjusted PAT for the period rose 21% to ₹48 crore, though EBITDA margin declined to 3.5% from 3.9% a year ago, reflecting investments in leadership, new business ramp-ups and changes in client mix

- Headcount stood at over 91,000 employees as of December, up 4% year-on-year, underlining the labour-intensive nature of the company’s operations.

Segment Performance

Facility & Food leads growth: remained the largest contributor, accounting for over 60% of nine-month revenue.

- Segment revenue rose 11% year-on-year in Q3 to ₹521 crore, supported by new contract mobilizations with an annual contract value of ₹79 crore.

- Segment EBITDA grew 8% year-on-year, aided by improved performance in education-linked food services.

Telecom & Industrials: segment posted modest revenue growth of 2% year-on-year in Q3, impacted by a slowdown in new telecom network roll-outs.

- EBITDA from the segment rose 36% year-on-year, reflecting margin expansion, cost optimization and improved credit loss reversals.

Security services: delivered a 15% year-on-year increase in quarterly revenue to ₹173 crore, driven by a 12% rise in headcount additions.

- Segment EBITDA declined sequentially due to one-off provisioning related to receivables.

Business & Operational Updates

- Bluspring continues to operate as an integrated infrastructure management platform with services spanning facility management, food services, security, telecom and industrial operations.

- The company manages over 366 million square feet of space, serves more than 182,000 meals per day and maintains over 237,000 telecom network nodes monthly. Its revenue base remains diversified, with no single client accounting for more than 5% of consolidated revenue and the top 30 clients contributing less than half of nine-month turnover.

Market Perspective & Outlook

Management highlighted favourable long-term demand drivers, including rising urbanization, infrastructure investment and increased outsourcing of facility management services. The total addressable market for Bluspring’s core segments is estimated at about ₹1.7 trillion in FY25, with a projected CAGR of 13% over the next three years.

Looking ahead, the company said it will focus on higher-margin contracts, deeper penetration in healthcare, education, manufacturing and GCCs, and operational efficiencies to sustain growth while improving profitability.