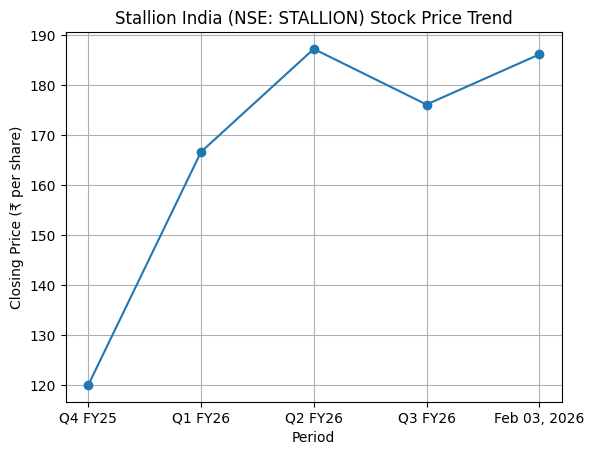

Stallion India Fluorochemicals Limited (NSE: STALLION) shares traded higher on Tuesday after the company disclosed its third quarter and nine-month FY26 financial results, showing year-on-year increases in revenue and profit, according to official exchange filings.

Quarterly Financial Summary

Stallion India Fluorochemicals Limited reported total revenue of ₹10,487.90 lakhs for the quarter ended December 31, 2025, up from ₹8,515.09 lakhs in Q3 FY25, representing a 23.17% increase, according to the company’s clarification filing to the NSE and BSE. EBITDA for the quarter was ₹1,356.20 lakhs, slightly lower than ₹1,430.80 lakhs in the prior year period. Profit after tax (PAT) for Q3 FY26 was ₹1,112.69 lakhs, compared with ₹977.54 lakhs in the year-ago quarter.

For the nine months ended December 31, 2025, total revenue stood at ₹32,118.21 lakhs, up from ₹22,668.25 lakhs in 9M FY25, while PAT rose to ₹3,290.68 lakhs from ₹1,904.25 lakhs in the corresponding period of the previous fiscal year. EBITDA for 9M FY26 was ₹4,369.91 lakhs compared with ₹2,941.33 lakhs in 9M FY25.

Management Commentary

In the clarification filing, Managing Director and CEO Shazad Rustomji addressed errors in earlier market communications, reiterating the accuracy of officially disclosed figures. “While our operational and financial performance remains robust, we acknowledge that certain market communications did not reflect the company’s verified disclosures,” he said and emphasized that stakeholders should rely on exchange filings for accurate information.

Operational Review

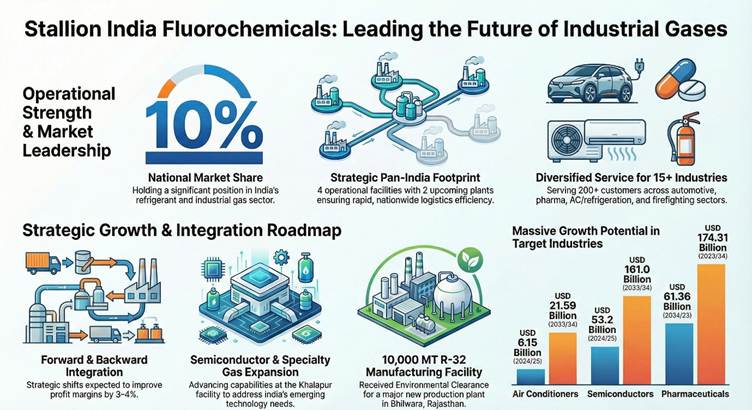

The investor presentation filed with the exchanges detailed Stallion India’s business and manufacturing footprint. The company operates four strategic manufacturing facilities located at Khalapur (Maharashtra), Ghiloth (Rajasthan), Manesar (Haryana), and Panvel (Maharashtra), specializing in debulking, blending, and processing of refrigerants and industrial gases.

The presentation noted ongoing investments to expand capabilities, including enhancements in specialty and semiconductor gas processing, liquid helium handling capacity of 1,200 MT per annum, and the construction of a 10,000 MT per annum R-32 manufacturing facility at Bhilwara, for which the company has received environmental clearance. These steps are part of the company’s forward and backward integration roadmap.

Business Segments and Product Mix

Stallion India’s product portfolio encompasses refrigerant gases such as HFCs, HFOs, and hydrocarbons, as well as specialty industrial gases. The presentation emphasized an expanding presence across multiple end-use industries, including automotive, air-conditioning and refrigeration, fire safety, pharmaceuticals, electronics, and glass manufacturing.

Outlook & Guidance

Management reaffirmed its FY26 guidance in the filings and investor presentation, targeting revenue of ₹43,000 lakhs and PAT of ₹4,000 lakhs for the full year ending March 31, 2026, consistent with previously stated targets, and projecting a compound annual growth rate of 30–35% over the next three years.

Next Reporting Timeline

Stallion India Fluorochemicals is scheduled to report its financial results for the quarter ending March 31, 2026, in accordance with regulatory timelines. Ongoing operational developments include commencement of construction at the Bhilwara R-32 facility and progress on specialty gas and helium processing capacity enhancements.