Indoco Remedies Limited (NSE:INDOCO) closed at ₹235.00 on February 3, 2026, up 10.88% from the previous close of ₹211.94, surging after Q3 FY26 results announced on February 2 showed consolidated revenue of ₹389.6 crore (up 7% YoY) and EBITDA growth of 29% to ₹25.9 crore despite a net loss of ₹29.45 crore amid ongoing USFDA remediation at the Goa facility.

Third Quarter Performance

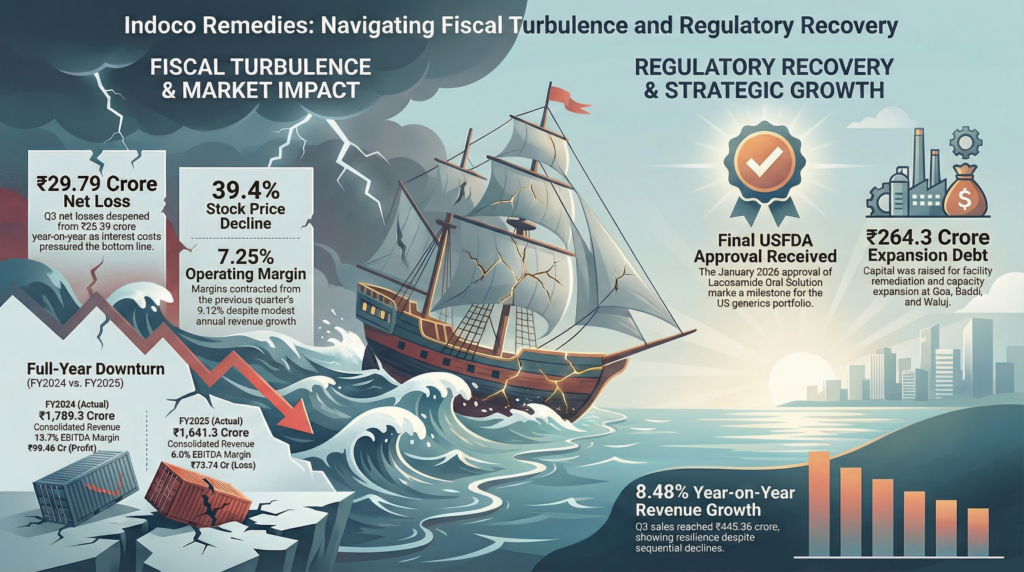

Consolidated net sales for Q3 FY2026 (December 2025 quarter) reached ₹445.36 crore, down 8.11% quarter-on-quarter from ₹484.67 crore in Q2, but up 8.48% year-on-year from ₹410.55 crore in Q3 FY2025. Operating profit before depreciation and interest stood at ₹31.51 crore with a margin of 7.25%, contracting from Q2’s 9.12% despite the modest revenue growth. Net loss widened to ₹29.79 crore from ₹26.39 crore year-on-year, translating to a negative PAT margin of 6.78%.

Earnings before interest, tax, depreciation and amortization expanded significantly to ₹315 million from ₹120 million year-on-year, representing 162.5% growth, though EBITDA margin remained compressed at 7.1% versus 2.93% previously. Depreciation charges of ₹32.01 crore and elevated interest costs continued to pressure bottom-line profitability.

Full-Year Context

For fiscal year 2025, consolidated revenues totaled ₹1,641.3 crore, reflecting an 8.4% year-on-year decline from ₹1,789.3 crore. EBITDA contracted to ₹99.3 crore with a margin of 6%, compared to ₹244.3 crore and 13.7% margin in FY2024. Full-year net loss reached ₹73.74 crore, versus a profit of ₹98.46 crore in FY2024.

Regulatory and Operations Updates

The company’s international formulation business remained under pressure due to ongoing remediation efforts at its Goa sterile manufacturing facility following a US Food and Drug Administration warning letter in December 2024. The FDA-inspected facility from July 16-26, 2024, had been classified with Official Action Indicated status, restricting shipments to regulated markets. Revenue from US and UK markets declined significantly throughout FY2025 due to facility disruptions.

Positively, Indoco received final USFDA approval on January 30, 2026, for Lacosamide Oral Solution USP for epilepsy treatment, expanding its US generics portfolio in neurology. The product will be manufactured at the Verna facility in Goa, marking continued regulatory progress despite compliance challenges.

Capital and Strategic Initiatives

The company incurred ₹264.3 crore in additional debt during FY2025 for capacity expansion and remediation. Capex focused on refurbishing manufacturing plants in Goa, Baddi, and Waluj, plus accelerated investment in wholly-owned subsidiary Warren Remedies for toothpaste and API manufacturing facilities. ICRA projects maintenance capex of ₹50 crore in FY2026 and ₹50-60 crore in FY2027 for Goa Plant II expansions.

Performance Summary

Indoco Remedies faced significant financial pressure in fiscal year 2025, reporting a net loss of ₹73.74 crore as annual revenue declined by 8.4% to ₹1,641.3 crore. While Q3 FY2026 saw a modest 8.48% year-on-year increase in consolidated net sales, net losses widened to ₹29.79 crore amid high depreciation and interest charges. Strategically, the company incurred ₹264.3 crore in additional debt to fund capacity expansions at plants in Goa, Baddi, and Waluj, alongside investments in its subsidiary, Warren Remedies. Regulatory challenges persist with the Goa sterile facility under Official Action Indicated status, though the recent USFDA approval for Lacosamide Oral Solution marks a positive step for the generics portfolio. These factors contributed to a 39.4% decline in stock price from its July 2025 peak, as the market remains cautious about the pace of operational recovery and debt management.