Executive Summary

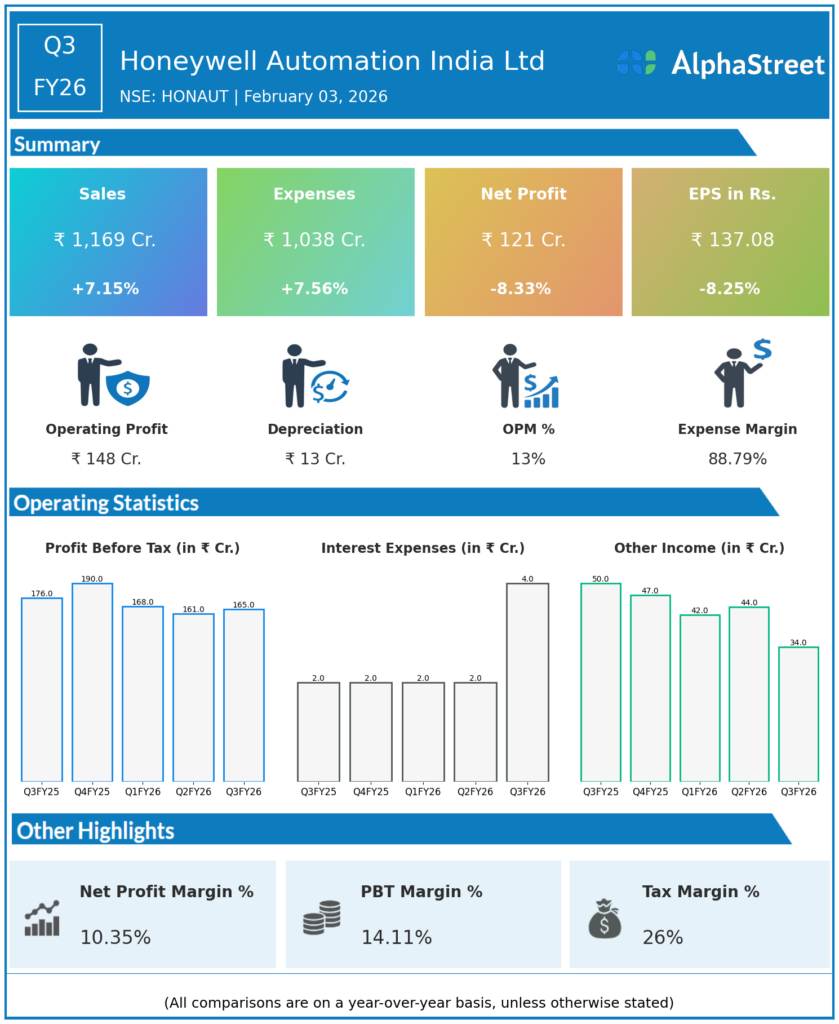

Honeywell Automation India Ltd reported Q3FY26 revenues of ₹1,169 crore, up 7.15% YoY, but consolidated net profit declined 8.33% to ₹121 crore amid rising costs. Revenue growth from process control solutions was offset by margin compression and exceptional labor code provisions.

Revenue & Growth

Revenues rose to ₹1,169 crore from ₹1,091 crore YoY, reflecting 7.15% expansion in advanced materials and automation systems. Total expenses increased 7.56% YoY to ₹1,038 crore, tracking topline growth but eroding profitability.

Profitability & Margins

Consolidated net profit fell 8.33% YoY to ₹121 crore from ₹132 crore, with EBITDA growing modestly to ₹148 crore at 12.63% margins (down 39 bps YoY). Basic EPS declined 8.25% to ₹137.08 from ₹149.41.

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

EBITDA margins contracted to 12.63%; 9M revenue up to ₹3,501 crore but PAT down to ₹365 crore. Exceptional items of ₹11.4 crore from gratuity and compensated absences impacted results.