GPT Healthcare Ltd (BSE: 544131 / NSE: GPTHEALTH) reported higher revenue but lower profitability in the quarter ended December 31, 2025, reflecting rising costs and a still-ramping Raipur facility, while nine-month revenue grew at a double-digit rate on the back of higher patient volumes and improved ARPOB.

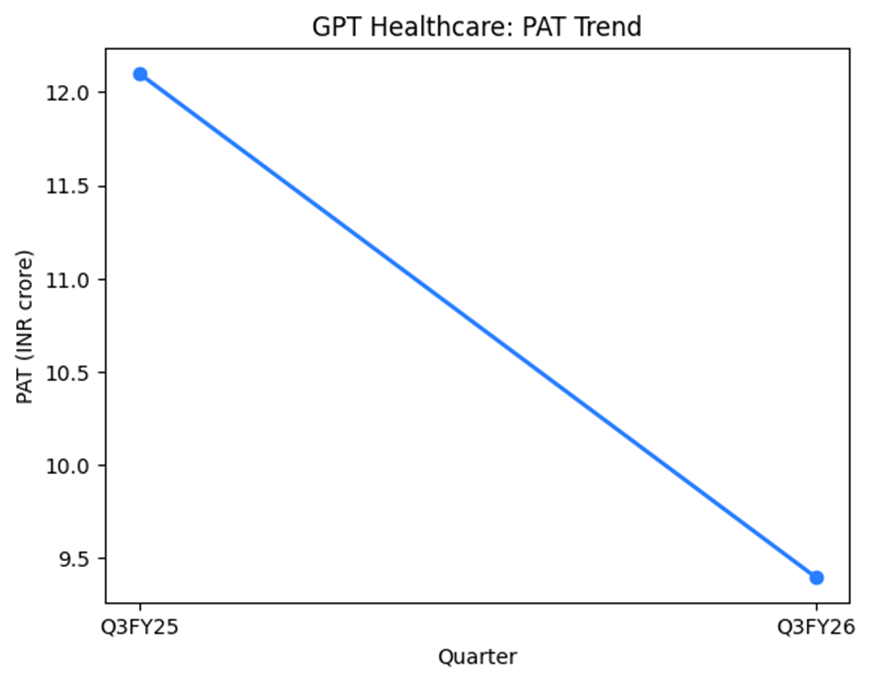

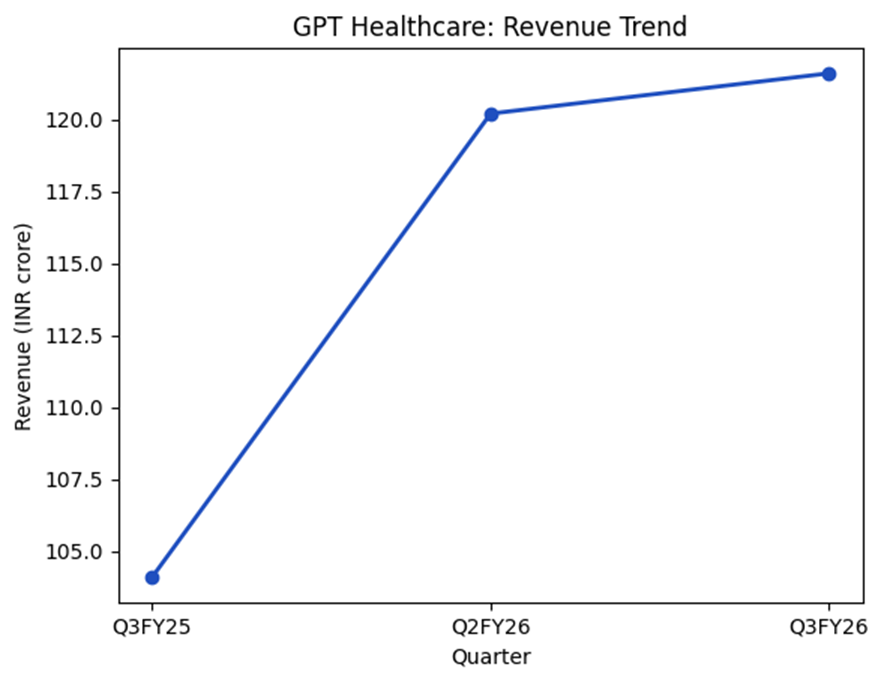

For Q3 FY26, total revenue rose 16.8% year-on-year to ₹121.6 crore, but profit after tax declined 23.5% to ₹9.4 crore. For the nine months ended December 2025, revenue increased 12.1% to ₹350.5 crore, while PAT fell 25.3% to ₹27.6 crore.

Business overview

GPT Healthcare operates the ILS Hospitals brand, a neighbourhood tertiary-care hospital platform in Eastern India. As of December 2025, the company operated five multi-specialty hospitals at Salt Lake, Agartala, Dum Dum, Howrah and Raipur, with a combined capacity of 719 beds.

The company follows a proximity-based, capital-efficient model focused on dense residential catchments, with clinical capabilities across oncology, cardiology, renal transplants and robotic surgery.

Financial performance — Q3 FY26

Total revenue in Q3 FY26 was ₹121.6 crore, compared with ₹104.1 crore in Q3 FY25 and ₹120.2 crore in Q2 FY26. EBITDA declined 4.4% year-on-year to ₹22.2 crore, with EBITDA margin contracting to 18.2% from 22.2%.

Profit before tax fell 27.6% to ₹12.8 crore, while PAT declined to ₹9.4 crore from ₹12.1 crore a year earlier. Employee benefits and other expenses rose, contributing to margin compression.

Nine-month performance (9M FY26)

For 9M FY26, revenue increased to ₹350.5 crore from ₹312.6 crore in 9M FY25. EBITDA fell 6.4% to ₹65.1 crore, with margin easing to 18.6%. PAT declined to ₹27.6 crore from ₹37.0 crore. Average Revenue Per Occupied Bed (ARPOB) for 9M FY26 rose 6% year-on-year to ₹38,797.

Operating metrics

Overall network occupancy in 9M FY26 was 45%. Excluding the newly commissioned Raipur hospital, occupancy improved marginally to 55% from 54% a year earlier.

Total patient volumes for 9M FY26 were broadly stable, with 25,608 inpatients and 1,59,894 outpatients. Average length of stay declined to 3.48 days.

Hospital-wise performance showed higher ARPOB across Salt Lake, Dum Dum and Raipur, while occupancy remained below mature-asset levels at Raipur as the facility continued to scale.

Key developments

GPT Healthcare commissioned CTVS (Cardiothoracic and Vascular Surgery) at ILS Dum Dum, enabling end-to-end cardiac care under one roof. The Raipur facility, which began operations in May 2025, continued to ramp up, with occupancy rising sequentially.

The company progressed its 150-bed Jamshedpur project under a MoU, targeting commissioning by end-FY27, with land and building to be funded by developers under fixed rental arrangements.

Capital and expansion

Management outlined plans to scale to a 1,000-bed network by 2027 through expansion in Tier-I and Tier-II cities in Eastern India, with a focus on asset-light models and disciplined capital allocation.

Risks and constraints

Disclosures indicate that profitability remains sensitive to occupancy levels, cost inflation in manpower and consumables, the pace of ramp-up at new facilities, competitive intensity in key catchments, and execution risks in expansion projects.

Outlook and commentary

Management said higher ARPOB, improved specialty mix and better clinical throughput supported revenue growth, while near-term margins were affected by investments in newer facilities and higher operating costs.