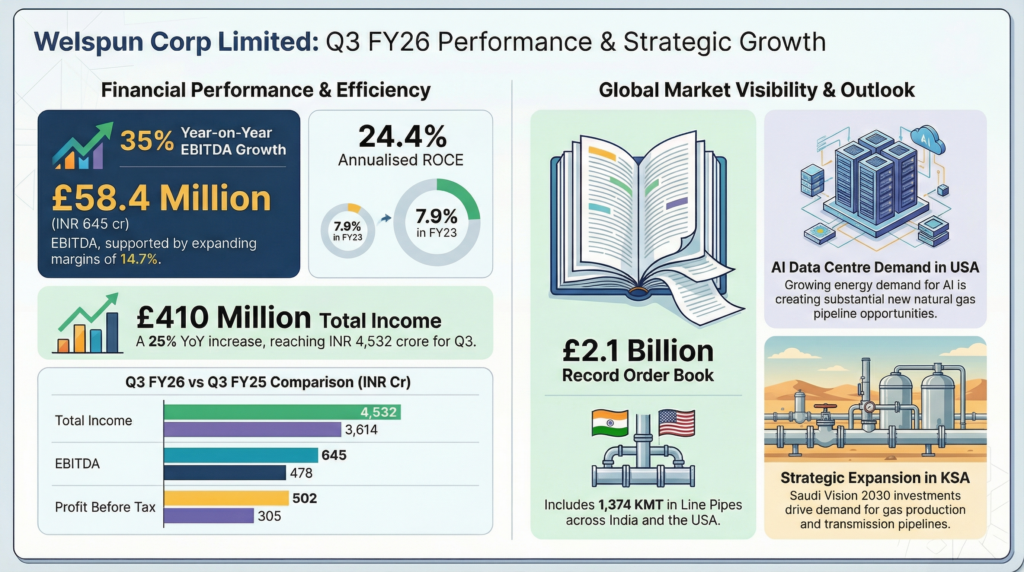

Welspun Corp Ltd (WELCORP:NSE) share price gained 3.27% intraday to ₹756.75 by 3:19 PM IST on 2 February 2026 following the 30 January Q3 FY26 results release, with market cap at ₹19,389 crore. At market close, the stock settled at ₹737.05, up from the prior close of ₹729.70, reflecting positive response to consolidated total income of ₹4,532 crore (up 25% YoY) and EBITDA of ₹645 crore (up 35% YoY), backed by a ₹23,600 crore order book.

Quarterly Results

Consolidated total income for Q3 FY26 reached ₹4,532 crore, representing a 25% year-over-year increase from ₹3,614 crore and a 4% sequential rise from ₹4,374 crore. EBITDA grew to ₹645 crore from ₹478 crore a year earlier, despite the quarter reflecting a one-time cost of ₹25.2 crore associated with gratuity and leave encashment provisions under the new labor code. Profit before tax and share of joint ventures increased to ₹502 crore, up from ₹305 crore in Q3 FY25.

Profit after tax attributable to shareholders was reported at ₹453 crore, compared with ₹675 crore in the prior-year period. The year-over-year decline in net profit is attributed to a one-time gain of ₹378 crore recorded in Q3 FY25 from the sale of shares in an associate company, East Pipes Integrated Company for Industry. Finance costs for the quarter declined to ₹51 crore from ₹82 crore.

Annual Performance Context

For the nine months ended December 31, 2025 (9M FY26), Welspun Corp reported a consolidated EBITDA of ₹1,831 crore with an EBITDA margin of 14.7%, reflecting a multi-year trend of margin expansion. The company reiterated its full-year guidance of ₹17,500 crore in revenue and ₹2,200 crore in EBITDA.

Current 9M FY26 performance shows progress with revenue at ₹12,458 crore and an annualized return on capital employed (ROCE) of 24%, which exceeds the company’s 20% target. Net debt stood at ₹132 crore following capital expenditures of ₹1,722 crore, resulting in a net debt-to-EBITDA ratio of negative 0.06 times on a trailing basis, down from 1.41 times in FY23.

Business and Operations Update

The consolidated order book as of January 21, 2026, totaled ₹23,600 crore, covering line pipes in India and the US, ductile iron pipes, and stainless steel products. Line pipe sales volumes in India and the US rose to 265 thousand metric tonnes (KMT) in Q3 FY26 from 235 KMT year-over-year.

Ductile iron pipe volumes increased 39% to 92 KMT, while stainless steel bars and pipes recorded volume growth of 22% and 50% respectively. Welspun Specialty Solutions reported improved performance due to higher volumes and operational initiatives. The Sintex building materials business expanded its market visibility across seven Indian states through dealer additions and new product launches.

Forward Outlook

Demand for line pipes in the US is supported by energy infrastructure, LNG exports, and data center pipeline requirements, with the Little Rock mill booked through FY28. In Saudi Arabia, increased capital expenditure by Saudi Aramco and the development of hydrogen infrastructure are expected to support the company’s new LSAW pipe facility.

In India, demand for line pipes and ductile iron pipes is anticipated to be driven by government-led gas transmission and water supply projects. Management indicated it is on track to meet or exceed FY26 guidance while maintaining a focus on carbon and water neutrality goals.

Performance Summary

Welspun Corp achieved year-over-year growth in revenue and EBITDA for Q3 FY26, supported by lower finance costs and a robust order book. Net debt remained minimal despite substantial capital expenditure, contributing to a 24% annualized ROCE. Operational growth was observed across line pipes, ductile iron, and stainless steel segments, while the company maintains its original FY26 financial guidance metrics.