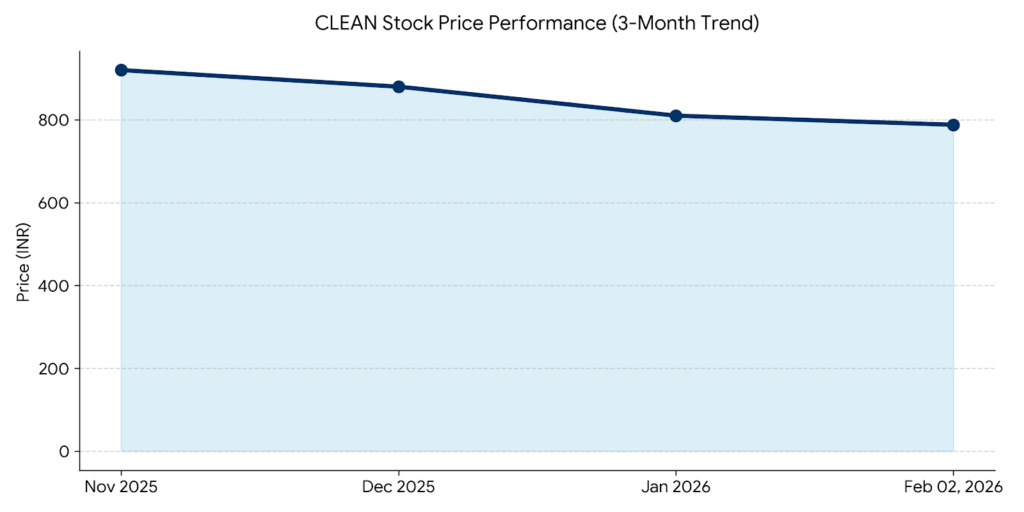

Clean Science and Technology Limited (NSE: CLEAN, BSE: 543318) shares closed at INR 788.00 on Monday, marking a 2.72% decline from the previous session. The specialty chemical manufacturer’s market capitalization was valued at approximately INR 83.70 billion (USD 1.00 billion) as of the market close on February 2, 2026.

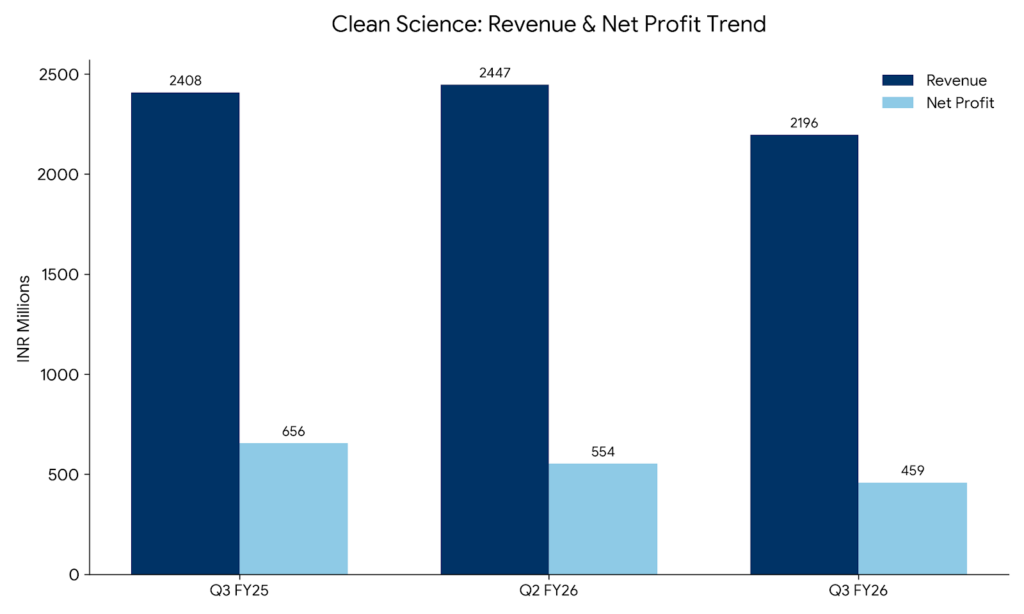

Latest Quarterly Results

For the third quarter of fiscal year 2026, Clean Science reported consolidated revenue from operations of INR 2.20 billion, representing an 8.8% decline year-on-year. Consolidated net profit for the quarter fell by 30.0% to INR 459 million, down from INR 656 million in the corresponding period last year.

The company’s profitability was impacted by significant margin compression, with EBITDA margins dropping to 33.0% from 40.8% in Q3 FY25. Segment revenue contributions for the quarter were:

- Performance Chemicals: 76% of total revenue; impacted by pricing pressure in key products like MEHQ and Guaiacol.

- Pharma & Agro Intermediates: 17% of total revenue.

- FMCG Chemicals: 7% of total revenue.

FINANCIAL TRENDS

Nine-Month Analysis

For the nine-month period (9M FY26), the company reported consolidated revenue of INR 6.18 billion, an 8.7% decrease from the previous year. Net profit for the same period stood at INR 1.93 billion, reflecting a 9.6% contraction. The overall directional trend for the fiscal year indicates a contraction in earnings and operational margins.

Business & Operations Update

Clean Science successfully commenced commercial production of Hydroquinone and Catechol during Q3 FY26. The company incurred a capital expenditure of INR 1.65 billion during the first nine months of the fiscal year, primarily directed toward its wholly-owned subsidiary, Clean Fino Chem Limited (CFCL). Construction for the “Performance Chemical 2” facility remains on schedule.

Q&A Focal Points: Q3 FY26

In the post-earnings conference call held on January 31, 2026, the management of Clean Science and Technology Limited addressed several critical themes related to the company’s recent performance and expansion strategy:

- Margin Contraction and Chinese Competition: The central theme of the discussion was the 810 basis point drop in consolidated operating margins. Management clarified that aggressive pricing by Chinese manufacturers in the MEHQ and Hydroquinone (HQ) markets has forced domestic price corrections to maintain market share. Analysts questioned the floor for these prices, to which management noted that while current realizations are at “all-time lows,” the company’s catalytic processes keep it cost-competitive relative to traditional manufacturing methods.

- HALS Ramp-up and Import Substitution: Investors sought clarity on the utilization levels of the Clean Fino Chem Limited (CFCL) subsidiary. Management confirmed that the ramp-up of the Hindered Amine Light Stabilizers (HALS) series is ongoing, with a focus on capturing the Indian domestic market—estimated at 10,000 MTPA—currently dominated by imports. They highlighted that newer grades like HALS 2020 have already been commercialized to broaden the product basket.

- Capex and Revenue Guidance: Following the INR 1.65 billion capex incurred in the first nine months, management indicated that the current heavy investment cycle is nearing completion. They projected that the newly commissioned HQ and Catechol facilities could potentially contribute an additional INR 3 billion to the top line over a three-year ramp-up period, assuming a recovery in global specialty chemical demand.

Guidance & Outlook

Management indicated that while the HALS (Hindered Amine Light Stabilizers) product line is gaining traction—contributing significantly to domestic sales—the overall outlook remains cautious. Investors are advised to monitor the ramp-up of the CFCL plant and global raw material price volatility, which remain the primary variables for margin recovery in FY27.