Executive Summary

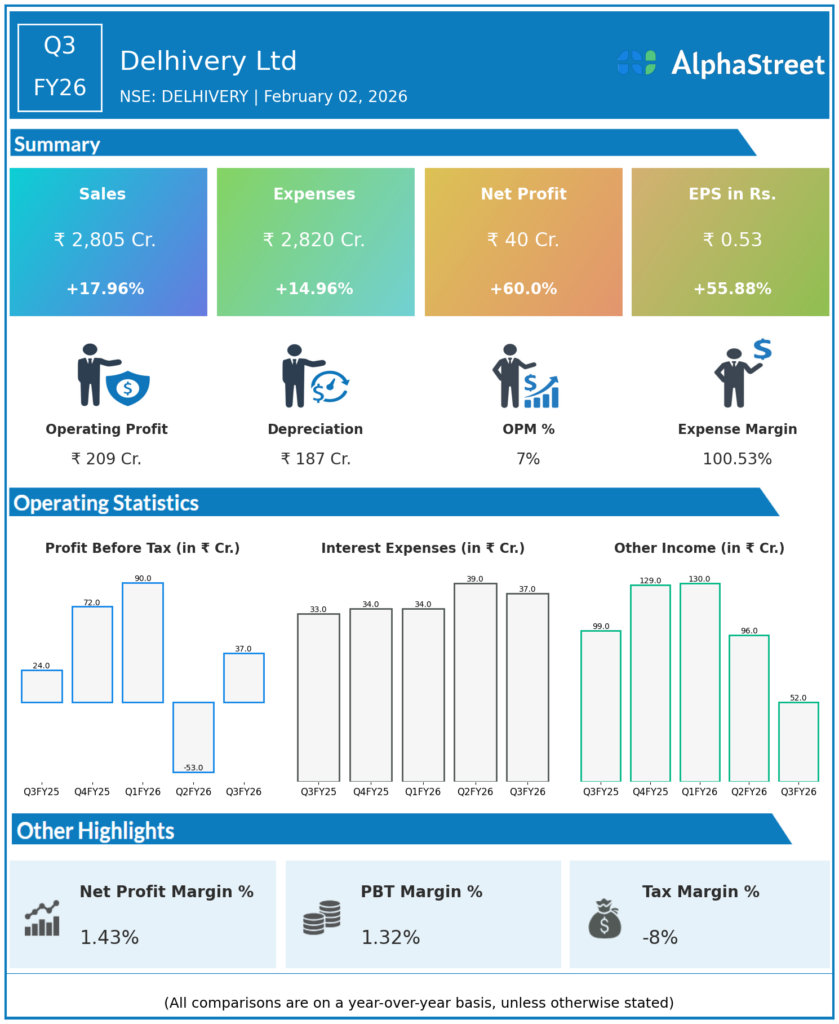

Delhivery Ltd reported Q3FY26 revenues of ₹2,805 crore, up 17.96% YoY, with consolidated net profit rising 60.0% to ₹40 crore from ₹25 crore. Total expenses increased 14.96% YoY to ₹2,820 crore, reflecting strong volume growth and operating leverage in express parcels and PTL freight.

Revenue & Growth

Revenues grew to ₹2,805.00 crore in Q3FY26 from ₹2,378.00 crore YoY, marking 17.96% expansion driven by record 295 million express shipments. Total expenses rose 14.96% YoY to ₹2,820.00 crore, lagging revenue growth for improved margins.

Profitability & Margins

Consolidated net profit increased 60.0% YoY to ₹40.00 crore. Basic EPS rose 55.88% to ₹0.53 from ₹0.34, with adjusted EBITDA hitting record ₹147 crore (5.3% margin).

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

Gross, EBITDA, and PAT margins show improvement; service EBITDA reached 16.4% in transport segment. Net debt/EBITDA and QoQ changes unavailable without additional data.