Allied Blenders and Distillers Limited (NSE: ABDL) shares closed at approximately ₹486.15 on 30 January 2026, reflecting a 6.6% rise in trading value at today’s market close compared with the previous session’s close.

Financial Summary

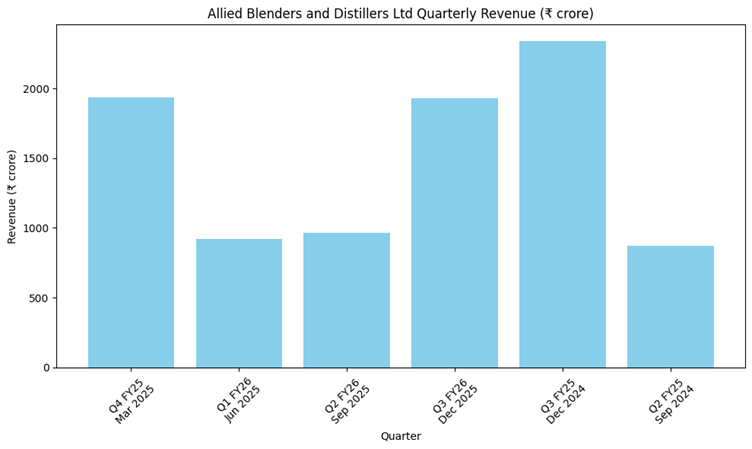

Allied Blenders and Distillers Limited recorded a consolidated net profit of ₹63.74 crore in Q3 FY26, up 11% from ₹57.47 crore in Q3 FY25. Consolidated revenue from operations was ₹1,933.61 crore for the quarter, versus ₹2,342.38 crore in the year-ago period. Total expenses in the quarter declined to ₹1,797.89 crore from ₹2,225.6 crore in Q3 FY25.

Other published figures show net sales of ₹1,002.98 crore in Q3 FY26, an increase of 2.98% year-on-year, and EBITDA of ₹137 crore, up 14.1% from ₹120.05 crore in the year-ago quarter. The EBITDA margin was 13.6%, compared with 12.3% in Q3 FY25.

Standalone results indicated net sales of ₹984.79 crore, up 1.13% year-on-year, and EBITDA of ₹149.65 crore, up 24.12%, with net profit at ₹78.17 crore.

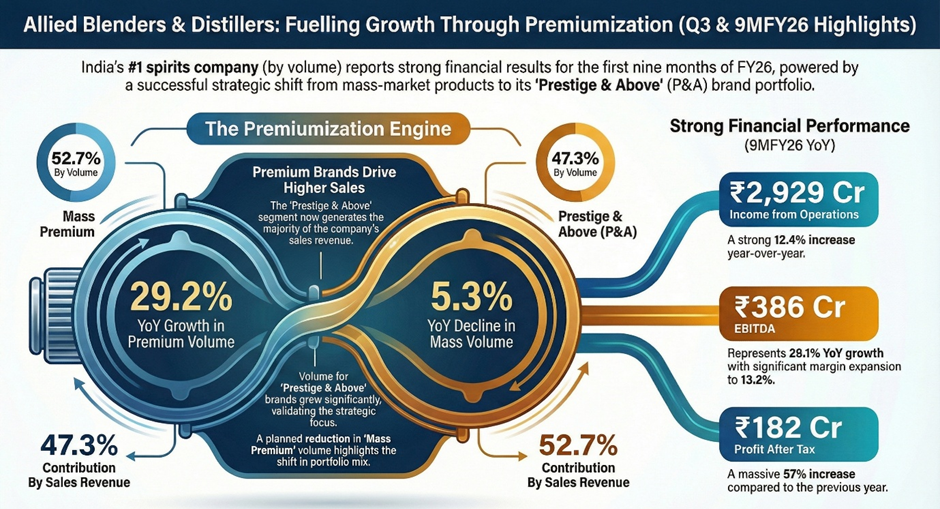

Operational Highlights

The company reported a total volume of 9.0 million cases in Q3 FY26, representing a 1.3% year-on-year increase, with the Prestige & Above (P&A) segment showing a 16.9% rise in volumes. The P&A portfolio continued to contribute a larger share of total sales.

Allied Blenders also expanded its international presence to 31 countries during the quarter, compared with 23 countries in the prior fiscal year, with a target to operate in 35 countries by March 2026.

Management Commentary

Management stated that the quarter’s results were supported by portfolio premiumization and improved margin performance. The company said enhancements in cost management and a favorable sales mix contributed to higher operating margins.

The filing also noted a leadership transition in the finance function. Jayant Manmadkar, the outgoing Chief Financial Officer, will assume the role of Group Finance Director, while Ramakrishnan Ramaswamy will return as CFO, reporting to Managing Director Alok Gupta. This change was described as part of strategic planning to align financial oversight with growth objectives.

Outlook and Guidance

The company said it expects strong top-line growth in the fourth quarter, supported by recovery in key markets and disciplined cost management. Management indicated that focus on consumer-centric growth remains a priority going into the next quarter.

Other Relevant Disclosures

In the regulatory filing, the Board approved the Q3 and nine-month results. The company also confirmed an ongoing strategic realignment of senior finance leadership to support its expansion into the luxury segment and value-accretive capacity enhancements.

Separately, earlier disclosures show the company’s board approved the acquisition of distillery and bottling assets in Moradabad, Uttar Pradesh, with total consideration up to ₹110 crore, expected to enhance bottling capacity and support backward integration.