Our growth aspirations are huge, and we are making all the right investments to ensure that we further cement our leadership position in the chosen chemistries, while leveraging our expertise in some of the high-potential newer chemical value chains where the addressable opportunity is humongous. The coming two years will see maximum gains arising from various CAPEX projects announced in the past. Overall, we remain confident of delivering what is expected out of us through a combination of our expertise in manufacturing and process enhancements, blended with strength in R&D and innovation. Our objective is to increase shareholder value by capitalizing on the positive sector tailwinds. – Rajendra Gogri, Chairman & MD at Aarti Industries Limited

Stock Data:

| Ticker | NSE: AARTIIND & BSE: 524208 |

| Exchange | NSE & BSE |

| Industry | CHEMICALS & PETROCHEMICALS |

Price Performance:

| Last 5 Days | +4.88% |

| YTD | -10.58% |

| Last 12 Months | -42.68% |

Company Description:

Aarti Industries Ltd is an Indian company engaged in the manufacturing of specialty chemicals, pharmaceuticals, and home and personal care intermediates. The company operates through three segments: Speciality Chemicals, Pharmaceuticals, and Home & Personal Care Chemicals. Aarti Industries has a strong focus on research and development, which has enabled it to develop new products and expand its product portfolio. The company exports its products to over 60 countries worldwide, and it has a global presence with manufacturing facilities in India, the Netherlands, the UK, and the USA. Aarti Industries is one of the leading specialty chemical companies in India.

Critical Success Factors:

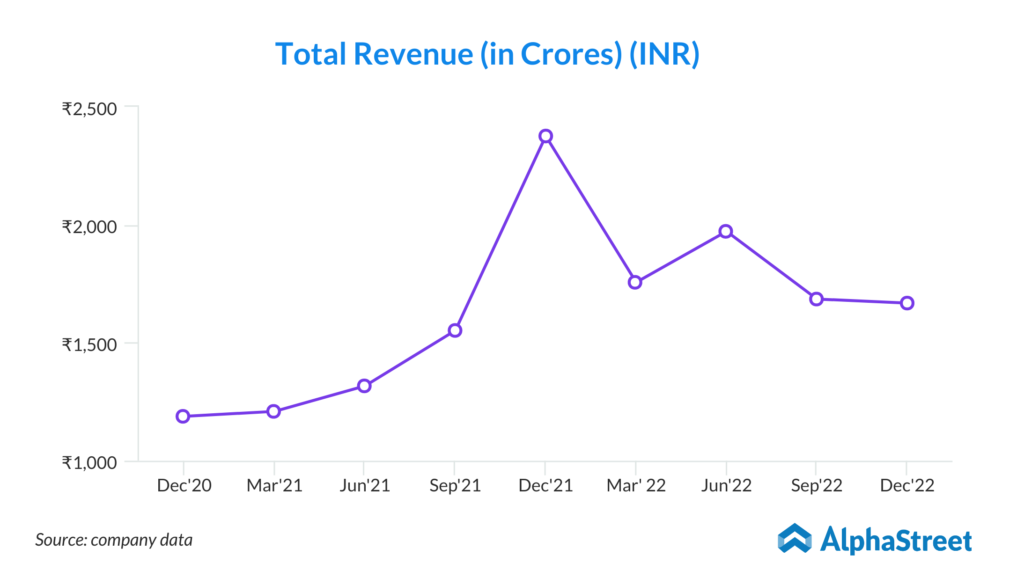

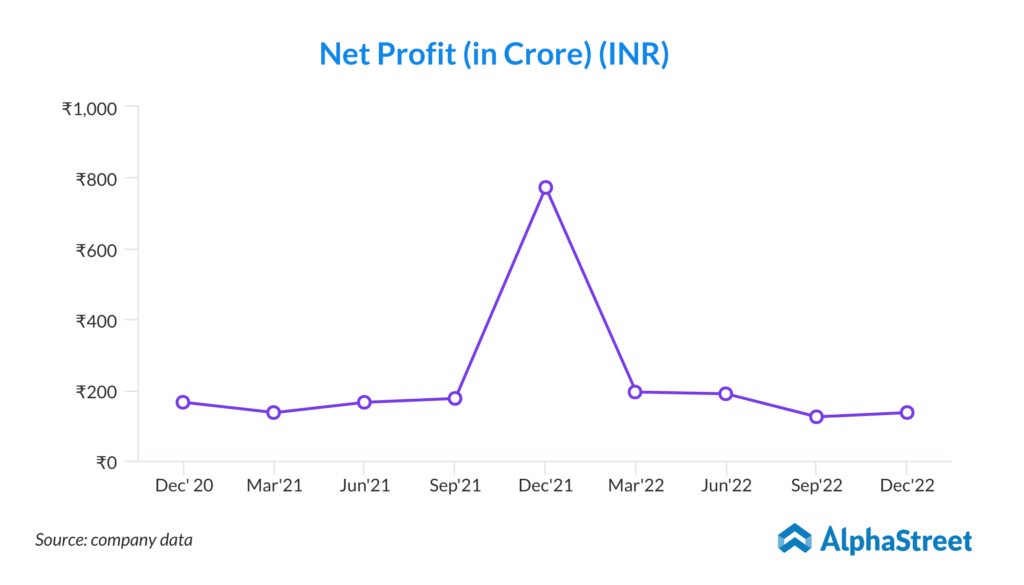

- Aarti Industries has demonstrated a strong performance in 3QFY23, with its share of value-added products standing at 81%. The company’s revenue increased by 12% YoY to Rs 18.54 billion, driven by growth from value-added products and LT-2. Despite the challenging demand environment witnessed in the textiles and automotive sectors, Aarti Industries has managed to achieve an EBITDA of Rs 8.4 billion so far in 9MFY23, as against its guided EBITDA of Rs 11 billion for FY23. The company has also set a guidance of Rs 17 billion EBITDA by FY25, indicating strong growth prospects. Moreover, the decline in raw material prices over 3QFY23 is likely to aid margins in 4QFY23.

- Aarti Industries has made significant developments during the quarter, including a binding 20-year contract with Deepak Fertilizers for the supply of Nitric Acid amounting to more than Rs 80 billion. This move has eliminated the need to invest in a captive Nitric Acid Facility, freeing up capital for other initiatives. The demerger of the pharma business into Aarti Pharma Labs Ltd has also provided the company with more focus and flexibility to drive growth. Additionally, the company has made progress in its capex plans, including the expansion of the Ethylation capacity by 3x at Dahej SEZ and debottlenecking of Nitrotoluene capacity to cater to high-growth applications in agrochemicals. Overall, Aarti Industries has demonstrated strength in its product portfolio, innovation, and strategic partnerships, which are likely to drive growth going forward.

- Aarti Industries has a strong strategic focus on expanding into new value chains and introducing high-value products. The company has outlined its plans to invest Rs 30bn collectively over the next two years to develop a new chemical value chain and introduce new products. Aarti Industries is leveraging its expertise to venture into new value chains, and the initiatives are expected to bear fruit over and beyond the next two years. The company has allocated additional capex to cater to the demand from the Agro and Pharma segments. The new product line in Chlorotoluene and Multipurpose plant is expected to start generating revenue from FY25, which would be a significant contributor to the company’s earnings.

- Aarti Industries has a strong focus on reducing its debt, and the reduction in commodity prices and working capital has led to some moderation in debt. The company’s tax rates might continue to remain soft due to the commissioning of new capacities. While there is a global demand slowdown impacting demand for textile chemicals and some Agrochemical products, Aarti Industries is evaluating downstream products and repurposing its product lines to optimize them. The company is optimistic about its long-term growth prospects, and it expects a 25% CAGR (FY24-25) driven by volume growth from existing products and new products to contribute from FY26 onwards.

- In conclusion, Aarti Industries has a strong focus on expanding into new value chains and introducing high-value products, which would be a significant contributor to its earnings in the long run. The company is also reducing its debt and has a strong strategic focus on optimizing its product lines to mitigate the impact of the global demand slowdown. The long-term growth prospects of Aarti Industries remain strong, and it expects to achieve a 25% CAGR (FY24-25) driven by volume growth from existing products and new products to contribute from FY26 onwards. The company’s tax rates are likely to remain soft, and the reduction in debt and working capital is expected to improve its cash flow.

Key Challenges:

- One major risk for Aarti Industries is the global slowdown affecting demand for their products. Inflation is leading to decreased demand for textile chemicals and the automotive industry is also experiencing reduced demand. Agrochemical products are also seeing a slowdown. This could lead to the selling of products in non-regular markets at lower margins, which would impact Aarti Industries’ profitability. Additionally, the situation could last for the next 2-3 quarters, further affecting their bottom line. The company must carefully manage costs during this challenging period to mitigate the impact on earnings.

- Another risk for Aarti Industries is the slower-than-anticipated utilization of their LT-1 plant. Despite the company’s guidance of 30-40% utilization in FY23, the current rate is only around 20%, and there may be no improvement in 4QFY23. This lower utilization rate, combined with margins under pressure, could impact earnings. The company is evaluating downstream products and repurposing product lines to improve utilization. Still, it is uncertain if they will be able to achieve their 70% utilization target in FY24.

- A final concern for Aarti Industries is the slow progress in establishing a Europe plus one strategy, which involves identifying product areas and setting up new capacities. This may take 2-3 years to materialize reasonably. This delay could affect the company’s ability to expand into new markets and generate revenue from new product lines. Aarti Industries must be vigilant in monitoring progress and adjusting their strategy accordingly to ensure they are well-positioned to take advantage of opportunities as they arise.