Anuh Pharma Ltd. is a prominent bulk drugs manufacturing company known for its expertise in producing Macrolides and Anti-TB products, making it one of the largest manufacturers in India. The company also holds a significant market position in the manufacturing of Anti-Bacterial, Anti-Malarial, and Corticosteroid products. Anuh Pharma Ltd. is a member of the INR 8.5 billion SK Group of Companies, which operates across various sectors. With a workforce exceeding 2000 employees, the SK Group is involved in manufacturing active pharmaceutical ingredients (APIs), medicinal chemicals and botanical products, pharmaceutical formulations, and distribution and logistics services, primarily for leading multinational brands.

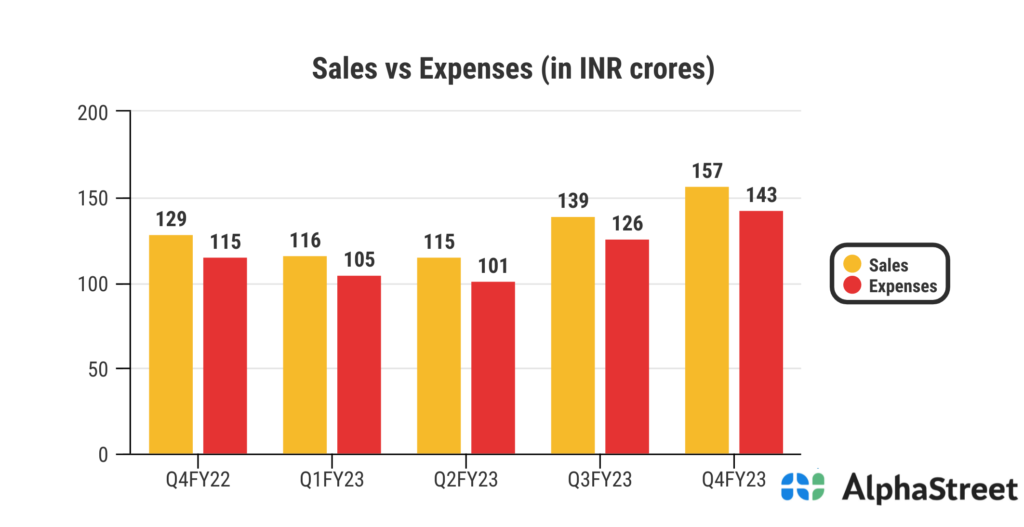

• Anuh Pharma Ltd. reported Total Income for Q4 FY23 of ₹158 Crore up from ₹130 Crore year on year, a growth of 21%.

• Total Expenses for Q4 FY23 of ₹145 Crore up from ₹118 Crore year on year, a growth of 23%.

• Consolidated Net Profit of ₹9.6 Crore, up 8% from ₹8.9 Crore in the same quarter of the previous year.

• The Earnings per Share is ₹1.92, up 8% from ₹1.78 in the same quarter of the previous year.